The COVID-19 pandemic has gone on longer than many of us expected, or hoped. The toll on many of has been great as we were separated from loved ones, and possibly struggled with declining income or added pressures at work.

This page is your guide to the resources and information you need to navigate these times over the long haul - whether than means continuing to rely on government COVID relief programs, work from home, ease your way back into work or your workplace was never shut down.

This site is divided into several tabs to help you find the information you need:

- Resources, where you will find resources for applying for government aid, webinars and more

- Updates, where you will find press releases, statements, new resources, releases and more, listed in chronological order

- Health & Safety, which includes the resources you need for safely returning to work and ensuring a safe workplace, including mental health supports

- Local Resources, which contains resources for Local union leadership and Health & Safety reps as they work with employers on COVID-19 protocols in their workplaces

- Sector Updates. Each industry has specific needs during the pandemic, and this tab is meant to provide sector-specific information

- Regional Information. The further we get into the pandemic, the more regional differences are emerging in our responses. Find out what the situation is in your province or territory.

One thing we have learned since the pandemic began is that things are constantly changing as we learn more about the virus, so be sure to check back regularly to this page as we update the resources under each of the tabs.

If you have any questions that have not been answered on this page, feel free to reach out via the contact information to the right on your screen.

We all look forward to a stronger and healthier future. Until we get there, it is important that we all work to support one another.

Unifor Events and Offices

Unifor National has adopted a Comprehensive COVID-19 prevention policy for all offices, events, meetings, courses and actions.

Any event organized by Unifor National adheres to a set of health and safety protocols to ensure the health and well-being of members and staff. These protocols include a requirement to show proof of vaccination prior to participating in any Unifor event.

National Executive Board Statement on Comprehensive COVID-19 policy for events

National Executive Board Statement on Proof of immunization for Unifor events, offices and meetings

The main contact for Unifor National's Comprehensive COVID-19 prevention policy is Unifor's National Secretary-Treasurer Lana Payne.

Health & Safety

Your safe return to work is a top priority at Unifor. Your union is committed to ensuring safe workplaces for all it members, and the COVID-19 pandemic has added an entirely new level to this commitment.

This page is for COVID-19 related health and safety issues only, for other health and safety issues, please see our Health and Safety page here.

On this page you will find the information you need to return to work safely. Be sure to check back regularly for updated information and new documents.

Local leadership and health and safety reps are also encouraged to check out the Resources for Locals tab to help you fulfil your responsibilities.

Health & Safety resources

- Ventilation - The Vital Engineering Control to Protect Workers, December 2021 - Read the guide

- Returning to the Workplace With COVID-19 All Around, Fall 2021 - Read the guide

- COVID-19 Mental Health Resource Guide - Download the guide

- Unifor statement on aerosol transmission of COVID-19 - Read the statement

- Worker Safety Rep Checklist - Read the guide

- Checklist for return to work post COVID-19 closure - Read the guide

- Protecting Workers from the COVID-19 Virus - Get the health and safety factsheet

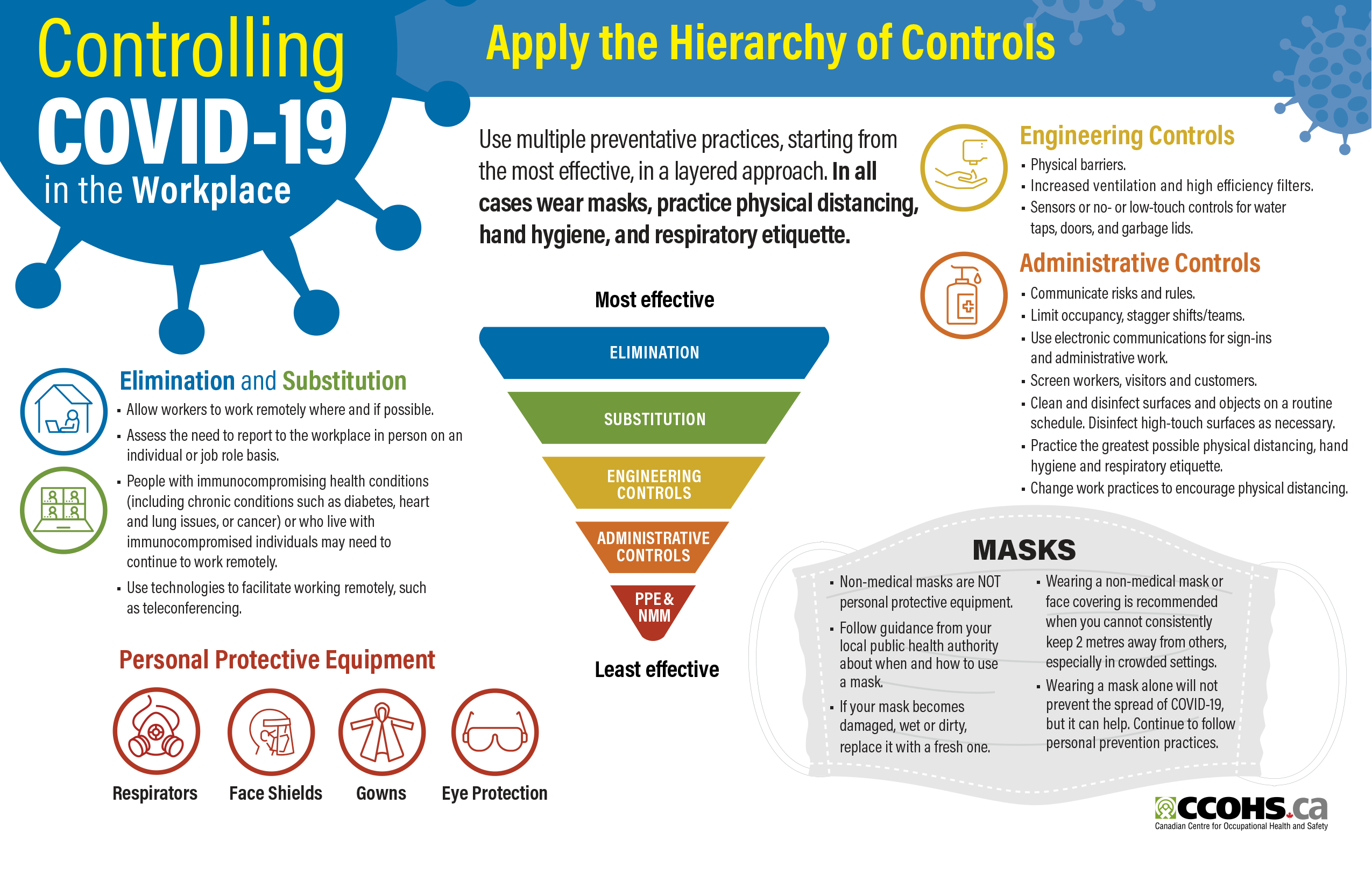

- COVID-19 and the Hierarchy of Controls to Protect Lives - Get the factsheet

- Unifor's demands to protect workers as we restart the economy - Download the guide

- Health & Safety: The "New Normal" is not the old normal - Get the factsheet

Income Supports

Unifor has developed a number of fact sheets to help workers navigate the many new federal government programs to help Canadians struggling during the pandemic. These programs are being updated regularly, and Unifor is monitoring all these changes to keep these fact sheets and links up to date, so check back regularly.

Unifor FAQs: Income Assistance, Wage Subsidies, and Other Benefits

- FAQ on EI Temporary Measures Read the FAQ

- Applying for employment insurance: a how-to guide for Unifor members. Read the guide.

- Canada Worker Lockdown Benefit (CWLB) Get more info.

- Canada Recovery Sickness Benefit (CRSB) Get more info.

- Canada Recovery Caregiving Benefit (CRCB) Get more info.

- Canada Recovery Hiring Program (CRHP) Get more info.

- Hardest-Hit Business Recovery Program (HHBRP) Get more info.

- Tourism and Hospitality Recovery Program (THRP) Get more info.

- E.I. Work Sharing Get more info.

Be sure also to check the Regional Information tab on this website for information related to your province or territory.

As well, on the Resources tab, you will find additional information about caregiver benefits, sickness benefits and the Canada Recovery Benefit.

Local and Sector Tools

Unifor’s Locals are on the front lines as we work to ensure the safety of our members throughout this pandemic. This page is meant to help Local leadership and health and safety reps as they navigate this new and fast-changing environment.

On the page, you will find the resources you need to work with your employers to ensure safe working places for your members, as well as information specific to your sector.

As always, your National union is year to provide the supports you need. Your National Representative can help you access any additional resources you may need.

Be sure to check back regularly for new documents and updates, and the check out the Health and Safety tab on the website.

RESOURCES FOR LOCAL UNIONS

Local unions play an important role to ensure all workplaces represented by Unifor are as safe as possible.

To achieve a higher level of health and safety protections during this pandemic, Unifor local unions should:

- Keep in touch with workplace representatives, unit chair people, stewards and your national representative.

- Keep track of new confirmed or suspected COVID-19 cases and report them to your national representative as soon as possible.

- Ensure all workplaces have active joint health and safety committees.

- Stay informed on Unifor's information, guidelines and campaigns relating to COVID-19.

During the pandemic, Unifor has supported local unions in maintaining the business of the union, holding virtual meetings and votes, and prioritizing health and safety. Local unions can rely on the help of their national representative and Unifor's departments to work through difficult challenges relating to this pandemic.

Unifor has adopted a Comprehensive COVID-19 prevention protocol that includes a vaccine requirement for all Unifor National events, meetings, courses and actions. Local unions who want to develop a similar policy can request a template from the National Union by email.

For specific requests and support, contact @email.

NEB Statement on Vaccine Certificates and Considerations to Guide the Re-Opening of Canada’s Economy

NEB Statement on Comprehensive Workplace Immunization Programs and Mandatory Vaccinations

NEB Statement on Proof of immunization for Unifor events, offices and meetings

Union Activist’s Guide to Online Meetings

Proof of vaccine requirement poster

SECTOR RESOURCES

The COVID-19 pandemic is having an impact on every workplace across this country – but the nature of that impact changes from sector to sector.

Below are resources you need to address specific needs in your sector.

AIR TRANSPORTATION UPDATES

- What the Coronavirus (COVID-19) means for air transportation workers

- Government Support for the Air Transportation Industry: Virtual Meeting Request

- Restarting the Economy: What Air Transportation Workers Need to Know

- Letter to Deputy Prime Minister Freeland Re: Strong, enforceable conditions on corporate support packages

AUTO AND IPS UPDATES

- Auto and IPS COVID-19 Memo

ENERGY UPDATES

FORESTRY UPDATES

- What the Coronavirus (COVID-19) means for forestry workers

- Forestry Letter to Minister Qualtrough

- Restarting the Economy: What forestry workers need to know

HEALTH CARE UPDATES

- Memo to Unifor long-term care members in Ontario related to testing - March 17, 2021

- Ontario Directive 5 Access to N-95 - February 2021

- Urgent memo to health care members regarding COVID-19

- Memo for Unifor health care members regarding Personal Protective Equipment (PPE)

- Letter to Chief Medical Officer regarding Directive Number 5 for Public Hospitals

- Unifor calls on the federal government for emergency drug coverage for all

- Letter to Premier Ford regarding ineligibility of Pandemic Pay to many healthcare workers

- Letter to Ombudsman Dubé regarding Investigation into the Oversight of Long-Term Care Homes

- Restarting the Economy: What workers in the long-term care sector need to know

- New Directive #5 Rules - October 6, 2020

- Memo to Unifor long-term care members in Ontario related to government directives and announcements - October 19, 2020

- Memo to Unifor healthcare care members in Ontario related to workplace rights and staff redeployment - October 19, 2020

- Memo to Unifor health care members in Nova Scotia to government directives and announcements - November 2, 2020

- Combatting Compassion Fatigue Memo - November 12, 2020

HOSPITALITY AND GAMING UPDATES

- Hospitality and Gaming COVID-19 Memo

- What the Coronavirus (COVID-19) means for hospitality workers

- What the Coronavirus (COVID-19) means for gaming workers

- Restarting the Economy: What hospitality workers need to know

- Restarting the Economy: What gaming workers need to know

- British Columbia Letter: WorkSafeBC Presumptive Coverage for COVID-19 Infections June 16 2020

- British Columbia Submission: Unifor Submission to BC government Hospitality and Gaming Sector August 10 2020

- British Columbia Submission: Unifor Submission to the BC Tourism Task Force October 8 2020

- British Columbia Submission: Unifor Submission tothe BC Tourism Task Force October 21 2020

- Letter to Deputy Prime Minister Freeland Re: Strong, enforceable conditions on corporate support packages

MANUFACTURING UPDATES

- What the Coronavirus (COVID-19) means for manufacturing workers

- Restarting the Economy: What manufacturing workers need to know

- Restarting the Economy: What food and beverage processing workers need to know

MEDIA UPDATES

- What the Coronavirus (COVID-19) means for media workers

- Restarting the Economy: What media workers need to know

POST-SECONDARY EDUCATION UPDATES

RAIL UPDATES

- RailLine COVID-19

RETAIL SECTOR UPDATES

- Retail COVID-19 Memo

- What the Coronavirus (COVID-19) means for retail workers

- Restarting the Economy: What Retail workers need to know

TELECOMMUNICATIONS UPDATES

- Letter to telecommunications members - COVID-19

- Restarting the Economy: What workers in the telecommunications sector need to know

TRANSIT UPDATES

- Transit COVID-19 Memo to Staff

- What the Coronavirus (COVID-19) means for the transit and passenger rail workers?

- What the Coronavirus (COVID-19) means for student transportation workers?

- Restarting the Economy: What road passenger transport and urban transit workers need to know

TRANSPORTATION

MINES, METALS AND MINERALS

- Mines, Metals and Minerals Workplaces and COVID-19

- Restarting the Economy: What mines, metals and minerals workers need to know

WAREHOUSING AND LOGISTICS

Regional Information

As we move further into the COVID-19 pandemic, provinces, territories and regions across Canada have implemented their own pandemic response plans to address to local needs and to keep their resident safe.

This page is meant to help you find the information you need for your part of Canada, or to help you if you are considering a move to another part of Canada for work or to visit family.

REGIONAL HEALTH SERVICES FOR COVID-19

- British Columbia Centre for Disease Control

- Alberta Health Services

- Saskatchewan Health Authority

- Manitoba Health, Seniors and Active Living

- Public Health Ontario

- Quebec Health

- New Brunswick

- Nova Scotia Government

- Prince Edward Island

- Newfoundland and Labrador

- Yukon Health and Wellness

- Northwest Territories

- Nunavut

Resources

Unifor has developed a number of documents and online tools to help address your needs during the COVID-19 pandemic, including how to apply for income supports, how to return to work safely, dealing with associated stresses and mental health issues, staying safe in your own home and more.

For information specifically on income supports during the pandemic, including Employment Insurance and special pandemic income programs, please see the Income Supports tab of this website.

As vaccines begin to roll out across the country, Unifor is also examining the legal and ethical issues surrounding the roll out – including your rights and making sure vaccines go first to those who need them most. Check out the Vaccines tab on this page for more information.

Be sure, as well, to check out the other tabs on this website for more information on resources for Locals, Health and Safety, Regional and sector-specific information.

As we address the on-the-ground needs or our members, Unifor is also campaigning to ensure governments and industry are doing their part to ensure a speedy and equitable recovery, including:

- Build Back Better

- Fair Pay for Health Care workers

- Fair Pay Forever for Retail workers

- Fix Employment Insurance

- Race-based COVID data

- Extend the Canada Recovery Benefit and Fix EI

Keep checking back regularly. The documents throughout this page are updated regularly as programs change and new ones are announced.

Education Department webinars

Sign up for Unifor’s Education Department webinar sessions here http://onlineeducation.unifor.org/

Special Recovery Benefits

The federal government has set up several special programs to provide income support to Canadians impacted by the ongoing COVID-19 pandemic:

- Canada Worker Lockdown Benefit

The Canada Worker Lockdown Benefit (CWLB) gives income support ($270 after taxes, for each 1-week period an eligible region is in lockdown) to employed and self-employed individuals who are unable to work due to a COVID-19 lockdown. Note that specific regions are considered to be in lockdown if they have been subject to capacity-limiting restrictions of 50% or more for more than 7 consecutive days. Click here for more information and to find out if you are in an eligible region.

- Canada Recovery Caregiver Benefit

The Canada Recovery Caregiving Benefit (CRCB) gives income support ($450 after taxes each week, for up to 44 weeks) to employed and self-employed individuals who are unable to work because they must care for their child under 12 years old or a family member who needs supervised care. Click here for more information.

- Canada Recovery Sickness Benefit

The Canada Recovery Sickness Benefit (CRSB) gives income support ($500 $450 after taxes each week, for up to 6 weeks) to employed and self-employed individuals who are unable to work because they're sick or need to self-isolate due to COVID-19, or have an underlying health condition that puts them at greater risk of getting COVID-19. Click here for more information.

Women

Domestic violence and the workplace during the pandemic

Safe at home. Safe at work. End domestic violence. Shareable.

Public Health Canada is your most reliable source for medical information about COVID-19 prevention measures, symptoms, and preparedness plans. You will find a complete list of resources including updates on the government's responses on their website.

General Information About the COVID-19 Pandemic

Public Health Canada is your most reliable source for medical information about COVID-19 prevention measures, symptoms, and preparedness plans. You will find a complete list of resources including updates on the government's responses on their website.

Vaccines

Vaccines are an important part of ensuring our workplaces are safe for everyone, and Unifor has always placed a priority on our members’ health and safety. Vaccine policies are not a replacement for personal protective equipment, proper ventilation, and thorough cleaning and disinfecting regimes.

As vaccines rolled out across the country, Unifor examined the legal and ethical issues surrounding the roll out – including your rights and making sure vaccines went first to those who needed them most.

Unifor National President Jerry Dias sent letters to every provincial premier in Canada calling for time off for workers to be vaccinated, and for paid time off if they have COVID-19 symptoms, to help stop the spread of the virus.

| Leave for COVID-19 Vaccination | Paid Sick Leave | |

| British Columbia | Up to 3 hours paid leave | 5 days paid annually |

| Alberta | Up to 3 consecutive hours paid leave | |

| Saskatchewan | 3 consecutive hours paid leave | |

| Manitoba | Up to 3 hours paid leave | up to $600 per employee for up to five full days |

| Ontario | (use Up to 3 days paid leave) | Up to 3 days of paid leave |

| Quebec | Up to 4 consecutive hours paid leave | |

| New Brunswick | ||

| Nova Scotia | Up to 4 days of paid sick leave | |

| PEI | Up to maximum of $20 per hour or $160 per day | |

| Newfoundland and Labrador | ||

| Federal | 10 days paid leave |

Unifor will continue to post new materials as they are developed and to act on your behalf to ensure a smooth and equitable rollout. For now, please see these documents:

- Draft model COVID-19 vaccination language

- Vaccine workplace Q&A

- Doctors answer questions about vaccines

NEB Statement on Vaccine Certificates and Considerations to Guide the Re-Opening of Canada’s Economy

NEB Statement on Comprehensive Workplace Immunization Programs and Mandatory Vaccinations