Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $5.8 billion 0.3% |

| EMPLOYMENT | |

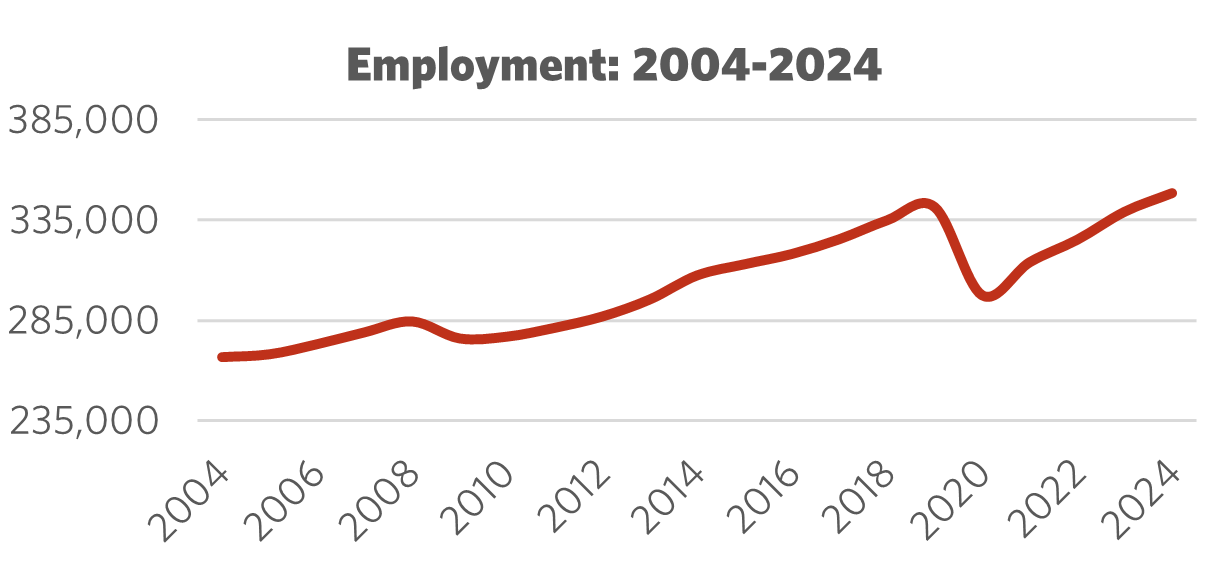

Total Employment 10-year change | 348,300 +13.3% |

| Percentage of part-time workers | 9.3% |

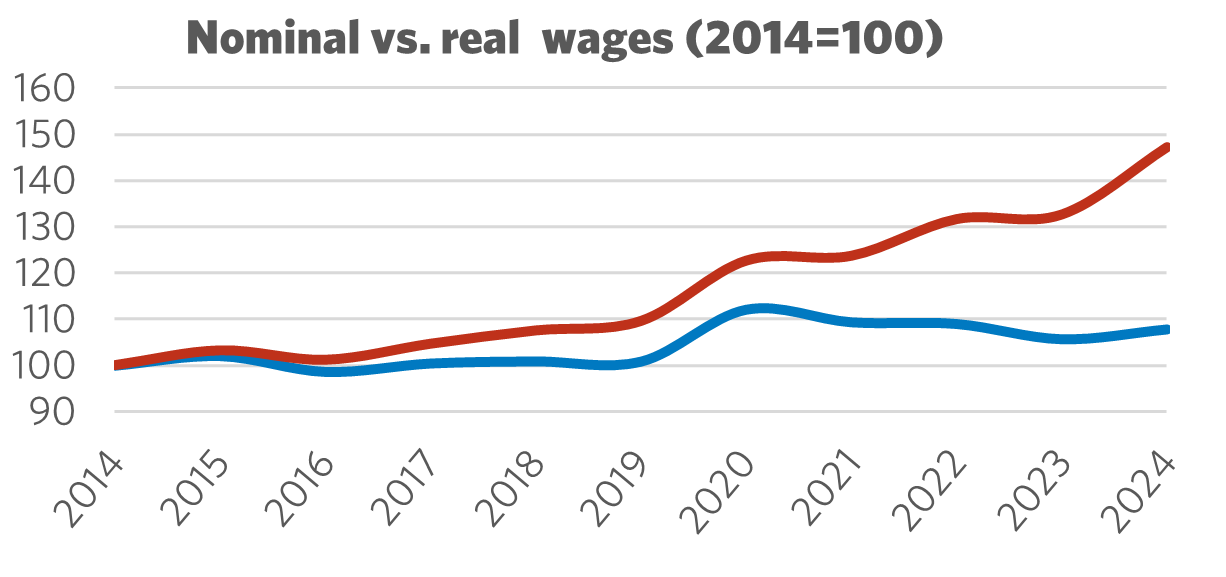

| Average hourly wage | $34.77/hr |

10-year real wage change | +7.8% |

| Average Work Hours/Week | 36.3 |

| LABOUR | |

| Union Coverage Rate | 5.9% |

| Unifor Members in the Industry | 5,000 |

| Share of Total Unifor Membership | 1.6%

|

| Number of Unifor Bargaining Units | 176 |

Unifor in the Vehicle Dealerships and Services Industry

Unifor’s 5,000 vehicle dealership and service members make up 2% of overall union membership spreading out among 176 bargaining units. The average bargaining unit membership is quite small at an average of 28 members. Union membership in this industry is scattered throughout the country, with larger numbers in Quebec and Ontario.

| Select Unifor Employers | Approx. # Members |

| Greater Montreal Automobile Dealers Assn. | 1,400 |

| Greater Montreal Automobile Dealers Assn. | 150 |

| Cummins Canada | 100 |

| BMW-Toronto | 80 |

Current Conditions

The vehicle dealerships and automotive services sector in Canada continues to be an important part of the national economy with close to 350,000 workers active in sales of new and used vehicles, automotive parts, and the provision of repair and maintenance services.

Following a strong rebound from the COVID-19 pandemic, the sector has largely stabilized, although it continues to face headwinds related to vehicle affordability, labour shortages, and electrification pressures. Pent-up demand from supply shortages during the pandemic years helped to fuel sales but aggressive U.S. tariffs (and Canadian counter-tariffs) among other inflationary pressures could prove detrimental to new vehicle purchases, especially in the context of a Canada-U.S. trade war. At the same time, used vehicle sales and repair services remain robust, supported by extended vehicle lifespans.

By 2024, sector revenues in Canada reached $191 billion – a full 25% higher than pre-pandemic sales levels – driven by higher sticker prices for both new and used vehicles. Rising vehicle costs also spurred higher demand for aftermarket and repair services among cost-conscious consumers. Dealers that diversified early into electric vehicle (EV) servicing, fleet sales, and digital platforms outperformed traditional operators, although EV sales growth has slowed considerably in the first quarter of 2025 compared to prior periods.

Labour market conditions have improved since the lows of the pandemic. Employment in the sector is growing, though recruitment and retention remain a challenge, particularly in skilled trades like auto mechanics. The average hourly wage in the sector reached approximately $34.77 in 2024, with unionized workers continuing to earn above the sector average.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Vehicle Dealerships and Services Industry

Total road motor vehicle registrations in Canada rose to 25.7 million in 2023, reflecting slow growth since the 25 million mark was first reached back in 2018. An escalating trade war, initiated by the United States, has new motor vehicle sales in the crosshairs. Tariffs on Canadian-made cars and parts, as well as Canadian steel and aluminum – in addition to necessary counter-tariffs imposed by Canada – are dampening auto sales forecasts for North America. Developing the vehicle dealership and service industry in this context means navigating a volatile economy.

Amid trade tensions, forward momentum on the electric transition appears to be stalling. Since 2020, zero emission vehicle (ZEV) adoption advanced steadily, albeit with uneven sales across Canadian provinces (i.e., sales concentrated in Quebec and British Columbia). In 2024, ZEVs accounted for 271,000 new motor vehicle registrations, representing almost 15% of the total – triple the 5% share recorded in 2021.

However, in the first quarter of 2025, the pace of Canadian ZEV sales has slowed, largely as a result of governments turning away from consumer rebate programs. In the U.S., Donald Trump was elected on a promise to end ZEV sales mandates and reverse course on corporate average fuel economy standards that are mirrored by Canadian regulators. Trump’s upending of the EV industry not only undermines planned investments in domestic assembly plants, but also dealer investments in EV infrastructure and training. A pull-back on EV production in North America will pave the way for Chinese automakers, like BYD, to corner the market on future vehicle sales.

In this context, vehicle dealers and service providers must remain nimble. A coordinated national strategy to accelerate EV and fuel-efficient vehicle adoption remains essential. This includes consistent incentive policies, a nationwide charging infrastructure, workforce training, and targeted support measures.

Sector Development Recommendations

- Negotiate a permanent end to U.S. tariffs.

- Re-introduce federal and provincial incentives to spur consumer demand for new vehicle purchases, including rebates for zero emission vehicles, as well as older vehicle trade-in/scrappage programs.

- Regularly update worker training programs and health and safety measures tailored to an increasingly electrified work environment with high voltage batteries and components.

- Restrict foreign-based online vehicles sales platforms from operating in Canada.

- Monitor vehicle sales and service dealership consolidation, with targeted capital funding supports provided to independently-owned companies.