Rising prices are affecting working people and families around the world.

In April 2022, Canada’s year-over-year inflation hit a 31-year high of 6.8%i. A recent survey found that, in adjusting to the higher costs of goods, 1 in 5 Canadians are eating less than they should in order to make ends meetii. The price of housing has accelerated – for both renters and buyers – and the cost of filling up at the pump reached record highs in May, only to continue climbing with no signs of dropping.

Calls for government to address the affordability crisis are growing louder. Implementing effective and durable solutions requires careful analysis of what is driving inflation, a recognition of lessons learned in past crises, as well as a willingness and fearlessness to challenge conventional economic wisdom and standard policy prescriptions.

There is no question that rising prices are affecting Canada’s workers. What governments and policy-makers must do is ensure the right policies are in place to moderate the current inflation situation while avoiding the job loss and bankruptcies of the 1970’s and 1980’s.

Inflation is the result of rising prices in three specific categories

There is a tendency to treat inflation as a singular phenomenon. In fact, inflation reflects the costs of hundreds of everyday goods and services people buy. Costs of goods tend to rise and fall over time based on external forces. Smart and targeted responses require policy-makers to identify the core elements that are causing price inflation, and develop solutions to ease those price pressures wherever possible.

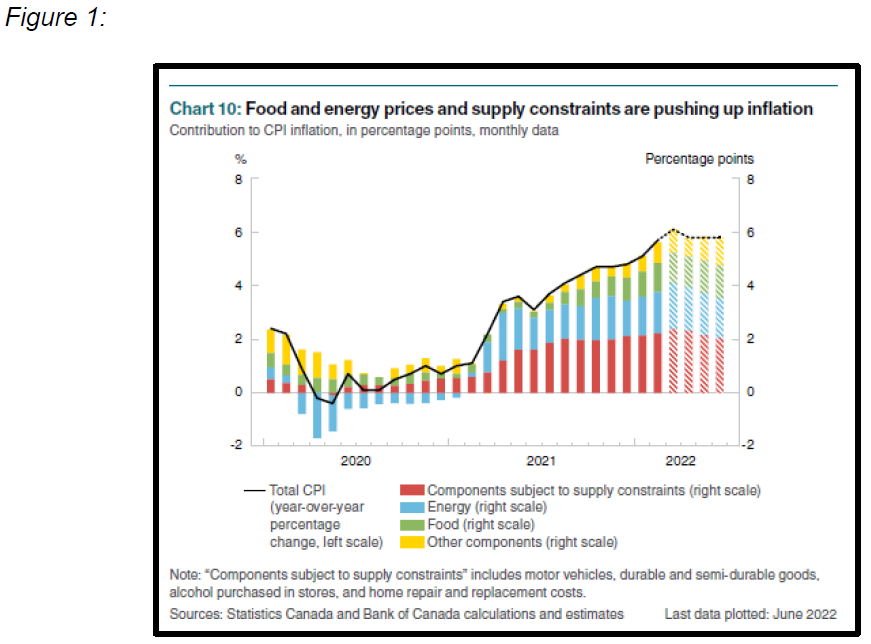

As it happens, current inflation is a result of rising prices in three specific categories: food, energy and consumer goods affected by supply chain constraints including motor vehicles as well as other durable and semi-durable goods, along with alcohol, and home repair suppliesiii.

According to the Bank of Canada’s April Monetary Policy Report (see Figure 1), one-third of current inflation is the result of fragile supply chains, one-quarter is from rising energy prices, including gasoline and home heating, and about one-fifth is the result of the increase in food costs. The remainder is due to other components.

It is also important to acknowledge that current inflation concerns reflect the extraordinary rise in consumer prices, over a relatively short period of time (e.g. prices today compared to the previous year). What this does not reflect is the many exorbitant costs affecting the cost of living for workers that have not risen, extraordinarily, in the past year, but were stubbornly high before the pandemic, including child care, housing and prescription drugs. These high costs do not show up in current inflation data but they are still as high and prohibitive as they ever were. Stagnating wages, a steady rise in precarious jobs and limited upward mobility, exacerbate these affordability challenges.

Wages are rising at half the rate of inflation, and are not to blame

n most periods of high inflation, prevailing economic logic attempts to lay at least part of the blame on workers’ demands for higher wages. As prices rise, workers will demand higher wages, thus creating an upward spiral on costs – as employers pass through higher wages to consumers in the form of more expensive goods. In today’s circumstances, nothing can be further from the truth.

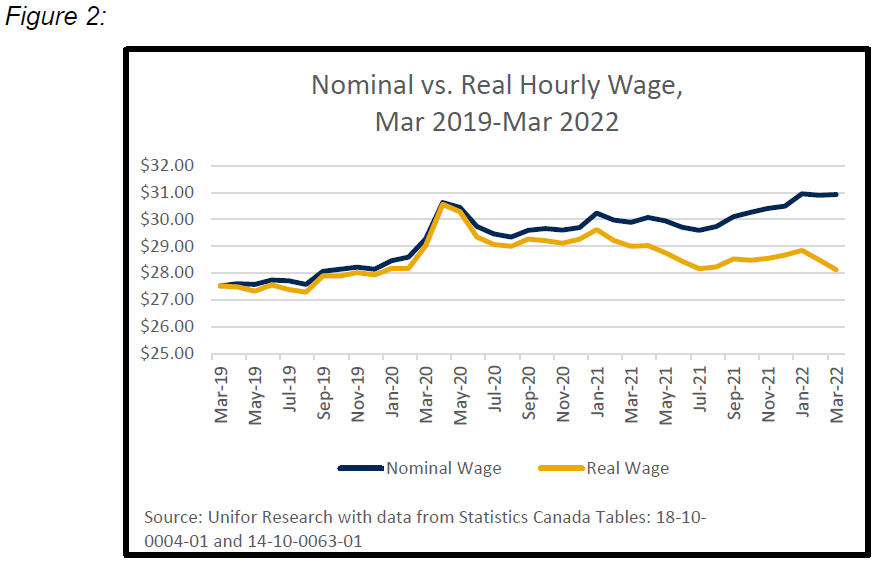

As of March 2022, average wages are increasing at half the rate of inflation. What this means is that, after adjusting for inflation, the purchasing power of wages is in decline. In fact, ‘real’ average wages for workers in Canada declined by 3% between March 2021 and 2022. If we look back even further, and take March 2019 as our starting point, inflation has consumed $2.80/hour of wage growth, leaving workers with a pay increase over this period of just 60 cents.

It is abundantly clear that wages are not driving inflation and workers did not cause this crisis in affordability.

Price gouging, profiteering a leading cause of rising prices in 2021 and 2022

Researchers have sliced and diced consumer price data in multiple ways trying to find out exactly what actions are driving inflation. Corporate price gouging has become a common finding in both Canada and the United States.

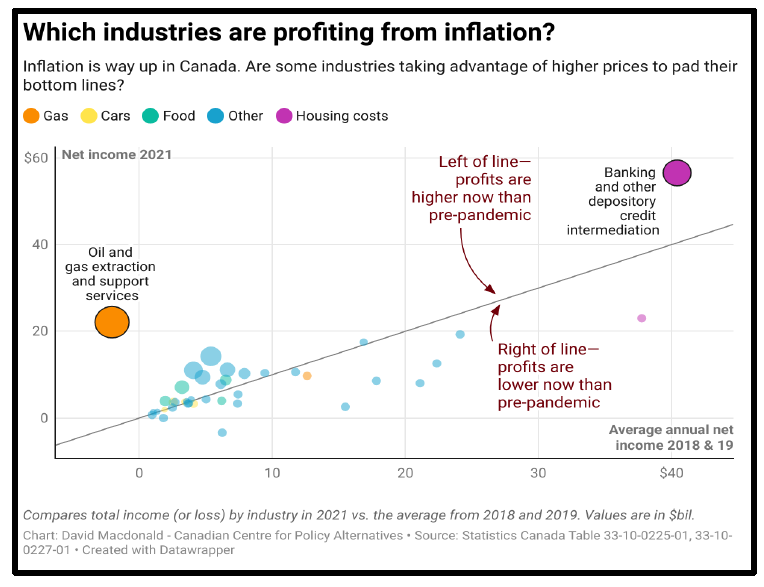

Recent analysis from David MacDonald at the Canadian Centre for Policy Alternatives found that 25% of the excess inflation experienced in Canada is the result of price gouging leading to higher corporate profits, particularly in oil and gas extraction, banking and wood product manufacturingiv.

Figure 3

According to the Bank of Canada’s April Monetary Policy Report (see Figure 1), one-third of current inflation is the result of fragile supply chains, one-quarter is from rising energy prices, including gasoline and home heating, and about one-fifth is the result of the increase in food costs. The remainder is due to other components.

It is also important to acknowledge that current inflation concerns reflect the extraordinary rise in consumer prices, over a relatively short period of time (e.g. prices today compared to the previous year). What this does not reflect is the many exorbitant costs affecting the cost of living for workers that have not risen, extraordinarily, in the past year, but were stubbornly high before the pandemic, including child care, housing and prescription drugs. These high costs do not show up in current inflation data but they are still as high and prohibitive as they ever were. Stagnating wages, a steady rise in precarious jobs and limited upward mobility, exacerbate these affordability challenges.

Wages are rising at half the rate of inflation, and are not to blame

In most periods of high inflation, prevailing economic logic attempts to lay at least part of the blame on workers’ demands for higher wages. As prices rise, workers will demand higher wages, thus creating an upward spiral on costs – as employers pass through higher wages to consumers in the form of more expensive goods. In today’s circumstances, nothing can be further from the truth.

As of March 2022, average wages are increasing at half the rate of inflation. What this means is that, after adjusting for inflation, the purchasing power of wages is in decline. In fact, ‘real’ average wages for workers in Canada declined by 3% between March 2021 and 2022. If we look back even further, and take March 2019 as our starting point, inflation has consumed $2.80/hour of wage growth, leaving workers with a pay increase over this period of just 60 cents.

It is abundantly clear that wages are not driving inflation and workers did not cause this crisis in affordability.

Price gouging, profiteering a leading cause of rising prices in 2021 and 2022

Researchers have sliced and diced consumer price data in multiple ways trying to find out exactly what actions are driving inflation. Corporate price gouging has become a common finding in both Canada and the United States.

Recent analysis from David MacDonald at the Canadian Centre for Policy Alternatives found that 25% of the excess inflation experienced in Canada is the result of price gouging leading to higher corporate profits, particularly in oil and gas extraction, banking and wood product manufacturingiv.

Figure 3 highlights the industries extracting the highest profits in 2021. Banks and other financial institutions, as well as oil and gas firms, are the two largest profiteers. Wood products and food industry firms are on the list as well. Recent reports from the first months of 2022 show that the world’s largest oil and gas producers made nearly $100 billion in profits in just the first quarter of 2022. Shell alone made 3 times the profits it did in the first quarter of 2021v.

Even at a time of significant labour market tightness, and wild claims of labour

“shortages” (despite overall the job participation rates in pre-and-post pandemic periods remaining relatively unchanged) incomes are rising at a fraction of the pace of corporate profits.

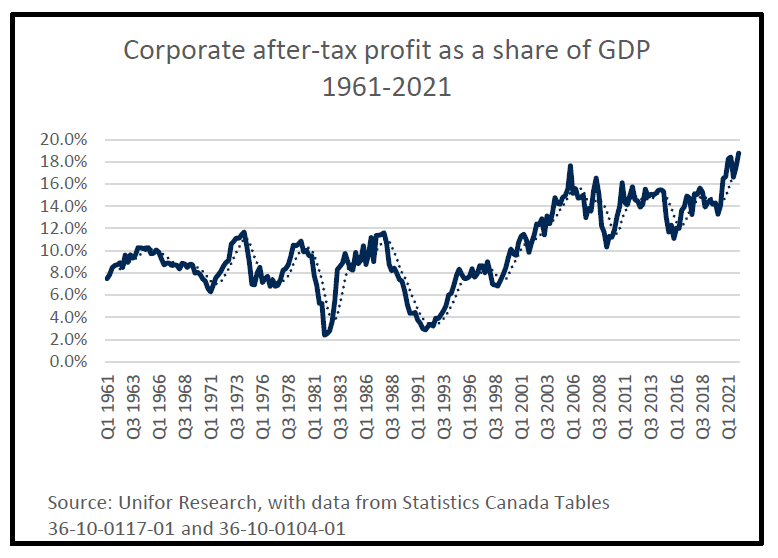

In fact, corporate profits have risen so fast in recent months that they are shattering records. Today, corporate after-tax profits, measured as a share of total economic activity in Canada, are the highest ever recorded (see Figure 4, as well as commentary by Jim Stanford, Centre for Future Workvi).

Figure 4

The conditions giving rise to massive upswings in profits and high inflation result from policies set in place over the past 30 years that misunderstood the mechanisms that drive prosperity - policies intended to increase profits, suppress workers incomes and drive inequality.

These include:

- Free trade - constraining government policy-making, globalizing supply chains and expanding competition for jobs creates significant economic vulnerabilities;

- Farcical competition policy - enabling corporate consolidation and an abuse of market power; while pitting workers against each other to fight for the scraps large corporations are willing to share;

- Privatization of public goods – subjecting essential goods and services to market forces and price volatility;

- An imbalanced tax system - benefiting corporations and the rich while leaving workers to pay more than our fair share;

- Unfair treatment of workers - rising job precarity and instability leads to unstable incomes, weak labour standards and anti-union animus.

Many of the conventional solutions being peddled will not solve the problem

Economists and researchers have learned a lot in the last 50 years about measuring the causes and consequences of inflation and the actions that build a strong economy that delivers broad based benefits.

he most commonly used measure to beat-back rising prices is monetary policy – raising the cost of borrowing money (i.e. spending), lowering demand, forcing economies to contract. The problem is that hiking interest rates is a blunt tool, affecting all of the economy when only certain segments are causing the problem. Fast-rising interest rates threatens to plunge Canada’s economy into recession – throwing millions out of work.

Corporations and their lobbyists are peddling short-term, self-serving solutions such as tax cuts on goods, like gasoline and food. This is a back-door subsidy to keep profits flowing, doing nothing about the causes of inflation. Reducing prices on staple goods is a key objective, but the last thing Canada needs right now is to subsidize even greater corporate profits.

Blaming government, which many conservative politicians seem eager to do (including the much-needed pandemic spending that carried Canadians through the pandemic), as a primary cause for inflation is irresponsible. Without income and business support programs such as CERB, CEWS and CEBA, Canada’s economy would be in much worse shape.

Criticizing Canada’s fiat currency while promoting new, unregulated digital/crypto currencies is dangerous and disingenuous, and reflects a new frontier capitalism in the digital age. As is evident from the last few weeks in the crypto-currency market, crypto-currency is volatile and unstable and is subject to the whims of the market in a way that fiat currency is not.

There is broad consensus that the primary drivers of inflation are supply constraints and sector specific issues, not broad based excess demand. Utilizing the interest rate as the only tool to solve the problem may lower inflation eventually, but will do so by slowing business growth, dampening consumer spending and killing jobs. It is trading one pain for another instead of dealing with the root causes of the problem.

Finding durable solutions to the affordability crisis

Tackling the affordability crisis requires strategic, long-term investments that help address the systemic challenges that existed before the pandemic and the new challenges that have arisen.

The policies that are finally implemented have to focus on smoothing the burden of a high-cost, high-inflation environment – not sheltering the rich, leaving working people to suffer.

Inflation targeting, at the expense of other important economic goals, is a dismal objective in building modern, inclusive and sustainable economies. Canada needs to manage inflation, not in the context of maintaining the status quo, but rather in the spirit of setting imaginative, economically and socially transformative priorities.

There is no silver bullet to solving the affordability crisis. A range of government supports, presented as Canada’s Affordability Plan in June 2022, include immediate reprieve for low-income workers through increases to the Canada Workers Benefit, Old Age Security payments, and rent supports are helpful and encouraging. Expanding these credits to a broader range of working families in need, at least temporarily, can help alleviate added pressures of short-term price increases. However, governments must set clear priorities over many years to address the multiple avenues through which affordability is diminished.

The following is a list of near, medium and long-term recommendations that federal or provincial governments can implement as a means to grow wages, reduce prices and reduce the incentive to profiteer at the expense of working people in Canada.

Near-term

- Introduce caps on profit margins in industries where price gouging and profiteering has become obvious or is a feature of the business model, lowering prices by deflating profits;

- Expand the excess profits tax introduced in the 2022 federal budget and make it permanent;

-

Provide immediate financial relief in the form of credits to a broad range of working families, including those in low-income;

- Vigorously enforce Canada’s Competition Act to reduce price gouging;

- Improve labour laws to bolster unionization and collective bargaining;

- Implement a 1% tax on wealth over $20 million on an annual basis;

- Require government agencies and crown corporations to negotiate with unions to ensure ‘cost of living adjustment’ (COLA) mechanisms in collective agreements.

Medium-term

- Reinvest government revenue in promised social programs to lower consumer costs on critical goods, including pharmacare and dental care, and work to accelerate implementation;

- Make Employment Insurance universally accessible and improve benefits, buffering against a possible recession. Reintroduce the EI temporary measures implemented during the pandemic, if required;

- Adjust Canada’s housing policy to build more affordable housing units and limit financial speculation in the housing market.

Long-term

- Invest heavily in public transit, electric vehicle infrastructure and clean power systems;

- Localize supply chains for critical goods, thus lowering risk of supply chain disruption and rising transportation costs.

- Reform Canada’s Competition Act to better analyze and deal with impacts of corporate concentration on workers and consumer prices.

i Statistics Canada, May 2022. The Daily: Consumer Price Index, April 2022. Available at:

https://www150.statcan.gc.ca/n1/daily-quotidien/220518/dq220518a-eng.ht…

ii Food Banks Canada, June 2022. Press Release: New Food Banks Canada Research Shows 7 Million Canadians Report Going Hungry. Available at: https://drive.google.com/drive/folders/1ir-rXlEUPjG1uam9hWjeiHBkhCv6fAiQ

iii Bank of Canada, April 2022. Monetary Policy Report: April 2022. Available at:

https://www.bankofcanada.ca/2022/04/mpr-2022-04-13/#:~:text=April%2013%…-

,Canadian%20economic%20activity%20remains%20strong%2C%20and%20employment%20is%20robus t.,easing%20to%203%C2%BC%25%20in%202023.

iv David MacDonald, April 2022. Profit squeeze: Excess corporate profits are making inflation tougher for Canadians: Twenty-six per cent of higher inflation for Canadian households is being driven by excess profits. Available at: https://monitormag.ca/articles/profit-squeeze-the-case-for-an-excess-pr…

v Oliver Milman, May 2022. Largest oil and gas producers made close to $100bn in first quarter of 2022. Available at: https://www.theguardian.com/business/2022/may/13/oil-gas-producers-firs…

vi Jim Stanford, June 2022, Business Profits from Inflation, but Workers Will Pay to Bring it Down. Available at: https://centreforfuturework.ca/2022/06/01/business-profits-from-inflati…