Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $4.0 billion 0.2% |

| TRADE | |

| Exports | $5.7 billion |

| Imports | $8.3 billion |

| Export reliance | 54.4% |

| U.S. dependence | 37.0% |

| Foreign Trade Balance | -$2.5 billion |

| EMPLOYMENT | |

Total Employment 10-year change | 35,800 +54.6% |

| Percentage of part-time workers | N/A |

| Average hourly wage | $39.61/hr |

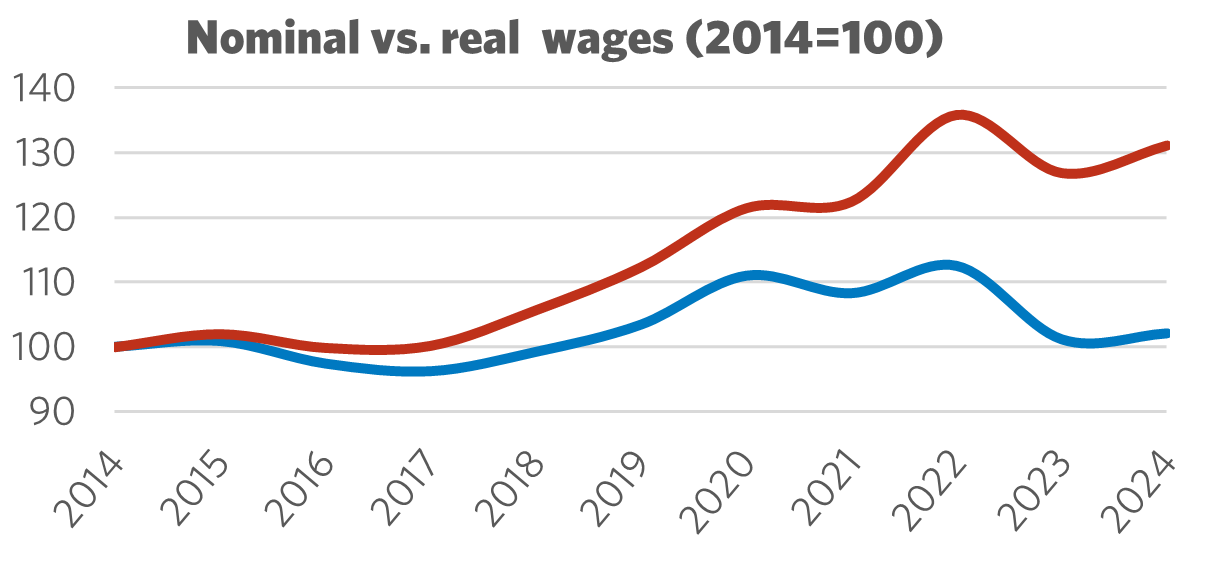

10-year real wage change | +2.1% |

| Average Work Hours/Week | 36.8 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 157kt -17.4% 0.02% |

| LABOUR | |

| Union Coverage Rate | 21.4% |

| Unifor Members in the Industry | 5,500 |

| Share of Total Unifor Membership | 1.7%

|

| Number of Unifor Bargaining Units | 15 |

Unifor in the Specialty Vehicles Industry

Unifor represents 5,500 members who build and maintain specialty vehicles in Canada. They manufacture a wide variety of specialty and transport vehicles, including subway cars, commuter trains and buses, streetcars, custom food trucks, long-haul trucks, defense vehicles, as well as some of the highest-rated public transit buses in the world.

The largest segment of Unifor’s membership in this sector produces buses and rolling stock for public transit agencies in Canada and around the globe. Much of the equipment in this sub-segment is procured by local transit agencies and funded by local, provincial, and federal governments.

Unifor’s members in the sector are highly skilled welders, assemblers, fabricators, logistics specialists, materials handlers, and quality controllers.

Unifor members in this sector are organized into 15 bargaining units, spanning from Alberta to Quebec, with sizes ranging from 15 to 1,400 members.

| Select Unifor Employers | Approx. # Members |

| Paccar Inc. | 1,400 |

| Prevost | 1,100 |

| New Flyer | 750 |

| Nova Bus | 650 |

Current Conditions

The specialty vehicle manufacturing industry encompasses a wide range of vehicles, including buses, streetcars, and subways, as well as commuter buses and trains, defense vehicles, custom food trucks, fire trucks, ambulances, semi-trucks, and more.

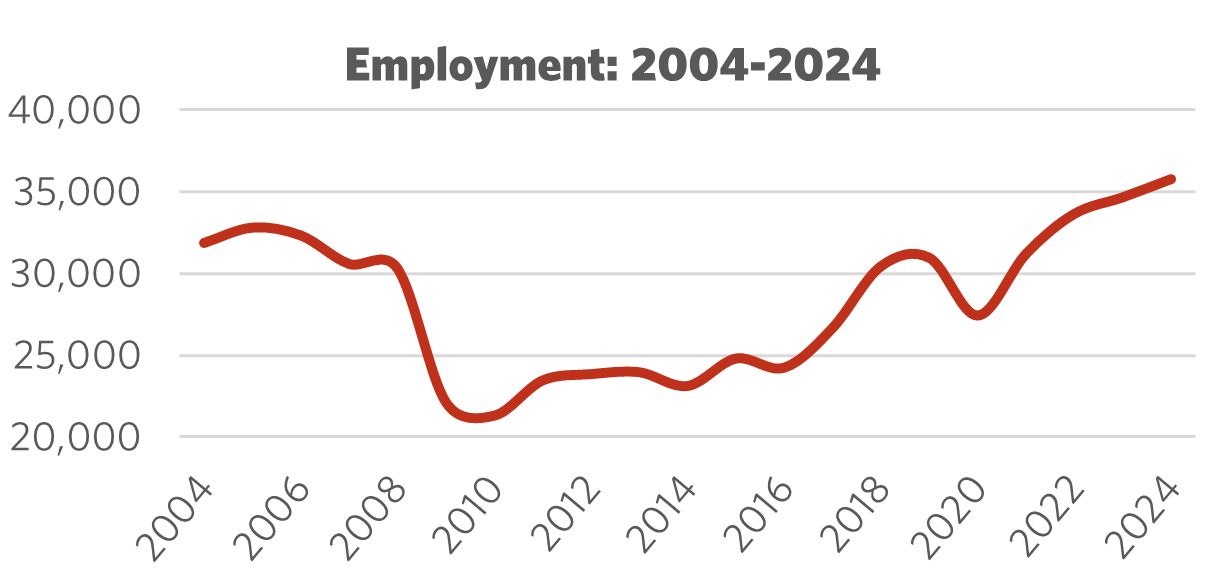

Although employment in the sector declined during the pandemic, it has rebounded significantly, reaching nearly 36,000 jobs and experiencing a 15% growth since the pre-pandemic peak in 2019.

The surge in online shopping during the COVID-19 pandemic has persisted, leading to increased demand for specialty vehicles that transport goods and services across the country.

The federal government’s Zero Emissions Transit Fund, combined with strong Canadian content requirements, has spurred a rise in electric transit bus manufacturing, creating more jobs at Unifor-represented facilities in Manitoba and Quebec.

Additionally, the federal government recently announced a substantial increase in funding for defense-related equipment, including specialty vehicles for transporting military personnel and goods. This commitment comes with a promise to maximize economic benefits for Canadians, creating and sustaining jobs at home.

However, the industry faces challenges. Buy America rules continue to divert work from Canada to the United States, while the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) restricts the amount of Canadian content that governments can require in certain procurements. Ongoing threats of U.S. tariffs, including on heavy trucks, will continue to hurt Canadian specialty vehicle export sales.

The potential for growth in the industry is significant. To ensure this potential is realized in Canada, strong government leadership and a commitment to purchasing high-quality Canadian-made innovations are essential.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Specialty Vehicles Industry

The specialty vehicle industry is poised for growth. Globally, local, provincial, and national governments will be renewing and expanding public transit fleets over the coming decades. There is a renewed emphasis on procuring equipment that can help Canada and governments worldwide protect their sovereignty, meet NATO spending targets, and reduce dependence on the United States, particularly in areas such as emergency vehicles, troop transportation, and Arctic overland operations.

Both of these trends will lead to a renewed focus on Canadian capacity and innovation in the sector. Workers need to advocate for this opportunity by ensuring that government procurement processes are designed to maximize Canadian content, both through purchasing off-the-shelf equipment and by empowering companies to develop solutions that meet the needs of Canada’s public transit, emergency, and defense fleets.

Additionally, workers must ensure that funding is available to grow the fleets required by governments and transit agencies. The federal government should expand the Public Transit Fund and incorporate maximum Canadian content requirements. There must also be a concerted effort to maintain a skilled workforce, including hiring apprentices and training and certifying journeypersons.

Sector Development Recommendations

- Negotiate a permanent end to U.S. tariffs.

- To support the specialty vehicles industry, governments should maximize Canadian content in government procurement contracts for transit, fleet and defence vehicles.

- The industry should capitalize on Canadian expertise in zero-emissions buses and trains.

- Governments should heed Unifor’s call to expand the Public Transit Fund.

- Given the demand for skilled workers, unions and governments alike should secure more apprenticeship positions through bargaining and public policy efforts.