Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $9.0 billion 0.5% |

| TRADE | |

| Exports | $21.8 billion |

| Imports | $43.5 billion |

| Export reliance | 64.1% |

| U.S. dependence | 57.8% |

| Foreign Trade Balance | -$21.7 billion |

| EMPLOYMENT | |

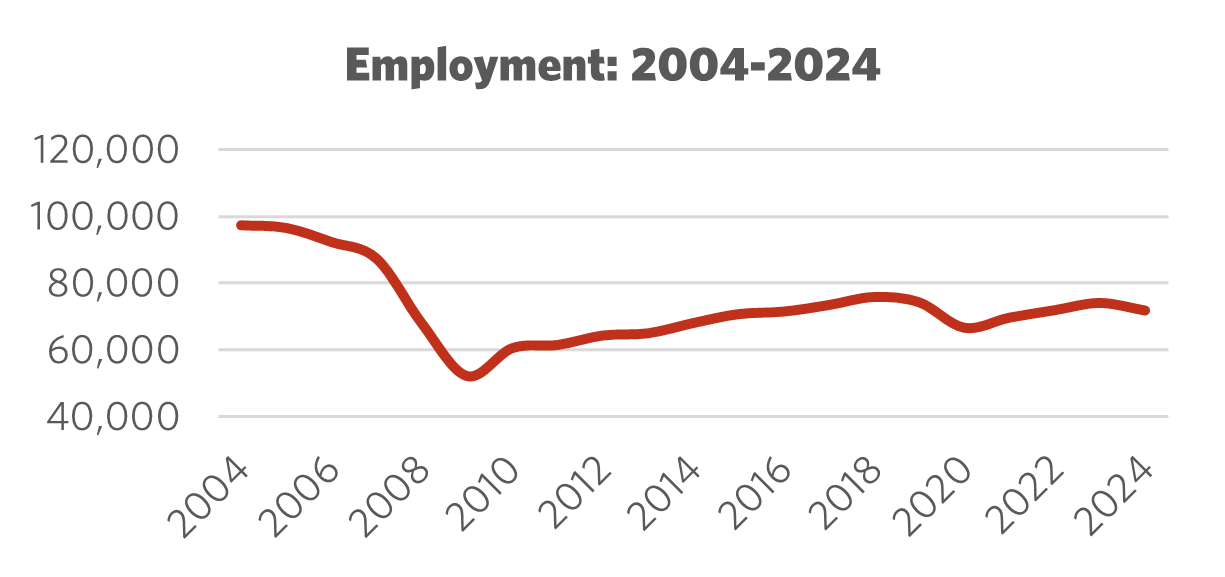

Total Employment 10-year change | 71,850 +5.5% |

| Percentage of part-time workers | 2.6% |

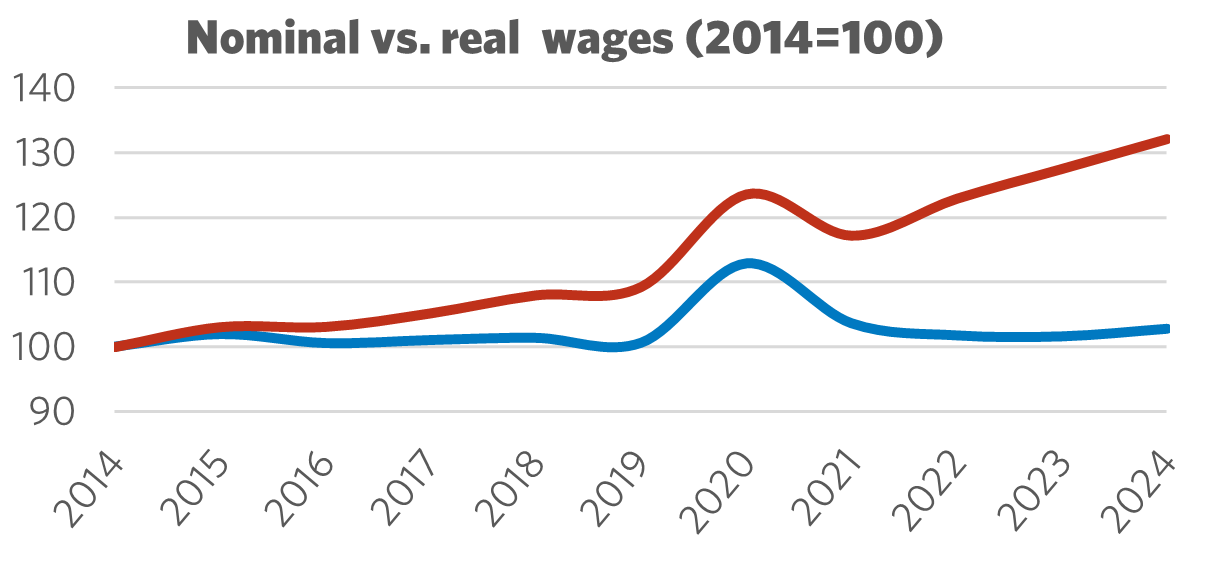

| Average hourly wage | $39.05/hr |

10-year real wage change | +2.8% |

| Average Work Hours/Week | 37.4 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 351kt -3.8% 0.06% |

| LABOUR | |

| Union Coverage Rate | 20.8% |

| Unifor Members in the Industry | 16,000 |

| Share of Total Unifor Membership | 5%

|

| Number of Unifor Bargaining Units | 99 |

Unifor in the Independent Auto Parts Industry

Unifor’s 16,000 members in the independent auto parts sector make up 5% of total union membership spread across nearly 100 bargaining units of all sizes. Union density in Canada’s auto parts sector is currently less than half that found in auto assembly. This may partially help to explain the fact that both wage levels and wage growth in this industry tend to trail auto assembly plants – although Unifor’s strategic pattern bargaining efforts in this sector are showing positive results.

Recent historic wage settlements across many Unifor parts facilities have followed gains made in the historic 2023 settlement with the Detroit 3 automakers. Rising wages, and strong settlements throughout the parts sector, have led to a wave of new members organizing in the supply base.

Approximately 95% of Unifor’s auto parts members live and work in Ontario, with the remaining members located in Quebec.

| Select Unifor Employers | Approx. # Members |

| Magna | 1,800 |

| Flex-N-Gate | 1,100 |

| Ventra | 900 |

| TFT | 900 |

| F&P | 850 |

Current Conditions

Canada boasts a highly sophisticated and diverse automotive parts industry, with hundreds of firms operating in clusters throughout mostly Southwestern Ontario, as well as Quebec and other parts of the country. The automotive parts industry employs more than 70,000 workers across various nodes of the supply chain, including tier 1 suppliers who make advanced parts that directly supply final assembly plants, and tier 2 suppliers manufacturing sub-assembled parts installed in more advanced components.

The auto parts industry is intrinsically tied to vehicle production cycles. The ‘just-in-time’ delivery of components to vehicle assembly plants (limiting stockpiles, reducing costs) has created a counter-reliance between vehicle assembly and parts manufacturing. This hyper-efficient model of production often means that if assembly plants are not in operation because of plant retooling or a slowdown in vehicle sales, neither are parts plants – and vice versa. The COVID-19 pandemic illustrated how vulnerable ‘just-in-time’ automaking is to global supply disruptions and parts shortages.

Auto parts workers in Canada face twin challenges. The shift toward zero emission vehicles – while creating opportunities for Canada in burgeoning battery, e-motor and related supplier jobs – also comes at a cost. EVs render many traditional component parts obsolete, which threatens to eliminate jobs in the process. Transition policies that protect good, union jobs and help parts workers ply their trade in new fields of automaking are sorely absent in Canada and require significant attention. The recent pullback on EV investments in North America – driven by retrograde Trump policies – makes transition planning even harder.

Exacerbating the challenges of this complex industry transition is a needless, U.S.-provoked trade war that is damaging Canada’s industrial economy. President Trump’s trade policy is designed to throttle Canadian auto and parts production, while stealing jobs and vehicle programs, undoing decades of cross-border collaboration in vehicle and parts production.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Independent Auto Parts Industry

Canada’s automotive industry is gripped in a period of economic uncertainty. U.S. tariffs on Canadian-made vehicles and the Canadian parts content within those vehicles threaten to rupture a decades-long supply chain integration, which began with the 1965 Canada-US Auto Pact. Workers in the Canadian parts sector have, for years, pushed back against employer efforts to offshore work to low-cost jurisdictions and protect good jobs and collective bargaining – no different than the fight parts workers have taken on in the United States. Yet, today, Canada is treated like the enemy, targeted by U.S. trade aggression. Building a strong auto parts sector means eliminating unjust U.S. tariffs in the auto sector, full stop.

Amid the turmoil, Canada still has distinct global advantages in auto parts. Canada is one of only a handful of high-skilled tool-and-die and mold-making clusters in the world, which is worth investing in and expanding on. Canada boasts a fully-formed supply chain for advanced, next-generation, zero emission vehicles from critical minerals to manufacturing, most recently demonstrated by the APMA’s all-Canadian Project Arrow concept car. Targeted federal investments in the electric and autonomous vehicle space can further broaden Canada’s ambitions as a next-generation auto industry leader – a position that the U.S. is willingly ceding to China. Specific investments in worker development, skills retention, labour adjustment programs and the creation of good, union jobs are key for workforce stability and growth.

Canada is more than an automotive branch plant economy. Our auto parts industry, although reliant on U.S. exports, has much more to offer the world and the future of automobility. Three of the biggest global parts makers (Magna, Linamar, Martinrea) are headquartered in Canada, and Canada is regarded as a top destination for investment in automotive batteries, battery materials and precursor chemicals. Navigating troubling U.S. headwinds while strategically incubating homegrown technologies, local ownership, and leveraging our natural advantages, puts Canada on a path for success.

Sector Development Recommendations

- Negotiate a permanent end of U.S. tariffs.

- Establish a comprehensive auto industry strategy that, in part, focuses investment attraction on advanced component parts, in addition to vehicle assembly mandates.

- Leverage existing government funding through the Strategic Response Fund and Strategic Innovation Fund.

- Develop a comprehensive national skills inventory and enhanced labour market adjustment supports to protect jobs for auto parts workers.

- Build on recent organizing successes and continue to organize more auto parts workers. Achieving a critical mass of union shops in the sector can enable more innovative broad-based bargaining models to expand union coverage and raise work standards.

- Address persistent auto parts trade imbalances with the United States, Mexico and offshore producers.