Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $37.1 billion 1.9% |

| TRADE | |

| Exports | $59.8 billion |

| Imports | $51.2 billion |

| Export reliance | 34.5% |

| U.S. dependence | 27.6% |

| Foreign Trade Balance | +$8.6 billion |

| EMPLOYMENT | |

Total Employment 10-year change | 317,400 24.9% |

| Percentage of part-time workers | 8.9% |

| Average hourly wage | $32.25/hr |

10-year real wage change | -8.3% |

| Average Work Hours/Week | 35.3 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 6,574kt +9.5% 1.04% |

| LABOUR | |

| Union Coverage Rate | 27.0% |

| Unifor Members in the Industry | 13,000 |

| Share of Total Unifor Membership | 4.1%

|

| Number of Unifor Bargaining Units | 89 |

Unifor in the Food and Beverage Industry

Unifor represents 13,000 members across 89 bargaining units in the food and beverage manufacturing and processing industry. Geographically, over 60% of these members are located in Ontario, 21% in the Prairies and British Columbia, and 11% in the Atlantic region, with the remainder working in Quebec.

The five largest employers represented by Unifor in the food and beverage industry—Coca Cola Canada Bottling Ltd., The Original Cakerie, Saputo, PepsiCo, and Lactalis—account for approximately 30% of Unifor's total membership in this sector.

| Select Unifor Employers | Approx. # Members |

| Coca Cola Canada Bottling | 1,200 |

| The Original Cakerie | 820 |

| Saputo | 725 |

| PepsiCo | 620 |

| Lactalis | 530 |

Current Conditions

The food and beverage manufacturing and processing industry continues to grow at a rapid pace, with total shipments reaching nearly $170 billion in 2024 – an increase of 44% since 2019. Taken together, food and beverage shipments accounted for one-fifth of all manufacturing sales in 2024, making it the largest manufacturing sub-sector. Booming sales helped the industry contribute $37 billion to national gross domestic product (GDP), amounting to just under 2% of Canada’s total economic output, while driving exports to nearly $60 billion and maintaining a substantially positive trade surplus of $8.6 billion. Meat product manufacturing accounted for over 25% of total food and beverage manufacturing sales in 2024, with grain and oilseed milling, dairy product manufacturing, and bakeries each accounting for approximately 11%, followed by beverage manufacturing at 9% of total sales.

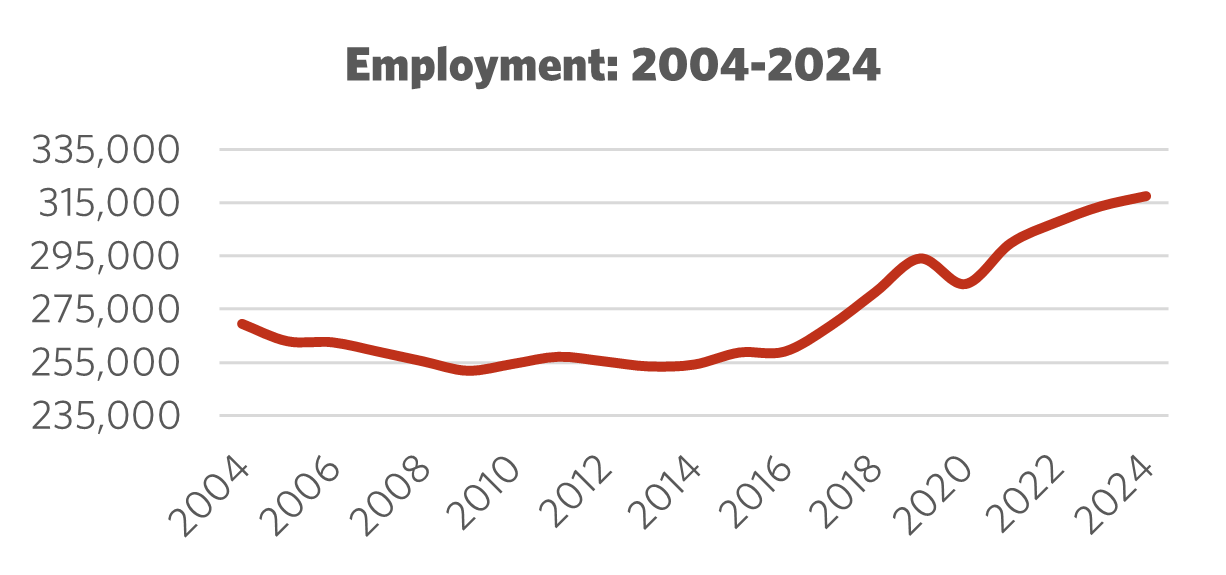

Employment in food and beverage manufacturing has surged over the past decade, which constitutes a stunning turnaround for an industry that saw a number of high profile plant closures during the 2000s. Since 2014, the number of jobs in the industry has grown by 25%, with only a brief decline recorded during the height of the COVID-19 pandemic. Although the pace of employment gains has slowed somewhat in the post-pandemic era, the industry is expected to continue to drive manufacturing job growth across the country.

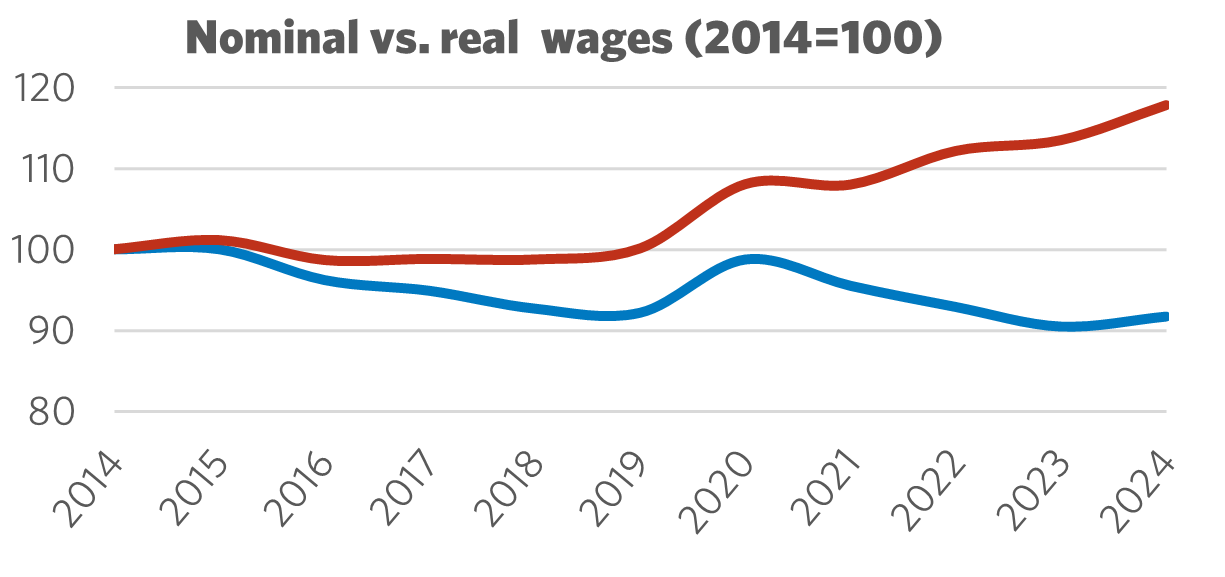

Wage growth, however, remains a concern in the industry, with real wages declining by more than 8% over the past decade. Until the pandemic, flat nominal wages kept real wage growth in negative territory. However, despite nominal wages increasing again after 2020, higher levels of inflation have continued to erode the purchasing power of food and beverage manufacturing workers. The relatively high percentage of part-timers (9%) and temporary foreign workers compared to other manufacturing sub-sectors suggests that precarious working conditions may be playing a part in suppressing wage growth.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Food and Beverage Industry

Ongoing challenges to developing the food and beverage industry include calls by industry employers to address job vacancies through increased use of temporary foreign workers (TFWs), rather than attracting workers through increased wages/benefits and addressing poor working conditions. Notably, however, industry claims about an impending worker shortage have quietened since the average vacancy rates for food manufacturing and beverage manufacturing fell to 2.4% and 1.7%, respectively, in the third quarter of 2024. These levels were substantially below the average of 3.2% for all industries during the same period of time.

Low wages, particularly for new workers in the industry, also continue to play a role in lagging real wages and high turnover, with the average offered wage rate sitting at just $24.35/hour for food manufacturing and $22.40/hour for beverage manufacturing in Q3 2024, compared to an economy-wide average of $27.55/hour. While a union coverage rate of 27% compares favourably with many private sector industries, organizing additional workplaces within the sector is one of the primary means to ensure that wages keep up with inflation and to improve working conditions within food and beverage manufacturing workplaces.

Successfully developing the sector into a generator of quality jobs will also hinge on overcoming ongoing trade tensions with Canada’s trading partners, especially in light of the fact that exports account for 34% of all food and beverage manufacturing shipments. Trade challenges include the recent imposition of tariffs by China on Canadian canola, pork and seafood products, and continuing threats by the Trump administration to expand its tariff assault on the Canadian economy. Canadian dairy processing is particularly vulnerable given attempts by the United States to target Canada’s dairy supply management system for dismantling through trade negotiations, despite the fact that U.S. dairy exporters have failed to make full use of their tariff-free quotas under the Canada-United States-Mexico Agreement (CUSMA).

Sector Development Recommendations

- Government must resist calls to expand the use of temporary foreign workers (TFWs) to contend with supposed labour shortages in the food and beverage industry. Instead, employers should raise wages/benefits and improve poor working conditions to attract workers.

- Increase union density in the sector to ensure robust real wage growth and better working conditions.

- The federal government must negotiate an end to tariffs and tariff threats, including those imposed by China and ongoing threats by the U.S., both of which impact the sector given its relatively high reliance on exports.

- Governments at all levels must vigorously defend Canada’s supply management system, which plays a vital role in delivering safe, quality dairy and poultry products to Canadians while generating jobs in food manufacturing and processing.