Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $3.6 billion 0.18% |

| TRADE | |

| Exports | $7.3 billion |

| Imports | $4.8 billion |

| Foreign Trade Balance | +$2.5 billion |

| EMPLOYMENT | |

Total Employment (2023) 10-year change | 29,400 -8.8% |

| Average hourly wage | $30.04/hr |

10-year real wage change | +14.1% |

| Average Work Hours/Week | 43.4 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 1,143kt +42.7% 0.18% |

| LABOUR | |

| Union Coverage Rate | 16.7% |

| Unifor Members in the Industry | 10,000 |

| Share of Total Unifor Membership | 3.1%

|

| Number of Unifor Bargaining Units | 17 |

Unifor in the Fisheries Industry

Unifor’s presence in the fisheries industry is primarily through its affiliated unions: the Fish, Food and Allied Workers Union (FFAW) and the United Fishermen and Allied Workers’ Union (UFAWU). Together, these affiliates represent just over 10,000 members engaged mainly in fishing, harvesting, and sales activities. Additionally, Unifor directly represents workers in various processing and packaging facilities across Canada.

The majority of Unifor members in the fisheries sector are concentrated in Newfoundland and Labrador, British Columbia, and Quebec. While many FFAW and UFAWU members are self-employed or not tied to a single employer, some of the key companies employing Unifor members include Beothic Fish Processors, Highliner Foods, Icewater Seafoods, Unipêche MDM and Highland Fisheries.

| Select Unifor Units | Approx. # Members |

| Independent FFAW/UFAWU harvesters | 10,000 |

| Unipêche MDM | 125 |

Current Conditions

Canada’s fisheries comprise commercial fish harvesters, aquaculture workers and workers involved in seafood processing and packaging for retail distribution. The Canadian fishing industry is one of the largest in the world, contributing $3.6 billion to Canada’s gross domestic product (GDP) while sending $7.3 billion in fishing exports around the world. These exports significantly surpass the value of fishing products Canadians import from overseas, with the industry reporting a robust $2.5 billion trade surplus in 2024. However, Canadian fisheries exports have come under fire during the recent trade war with the United States, as well as the imposition of Chinese tariffs on Canadian aquatic products alongside other products such as canola oil and pork in March 2025. Of the nearly $3 billion in Canadian exports that are impacted by China’s tariffs, seafood is expected to account for close to a third of the total.

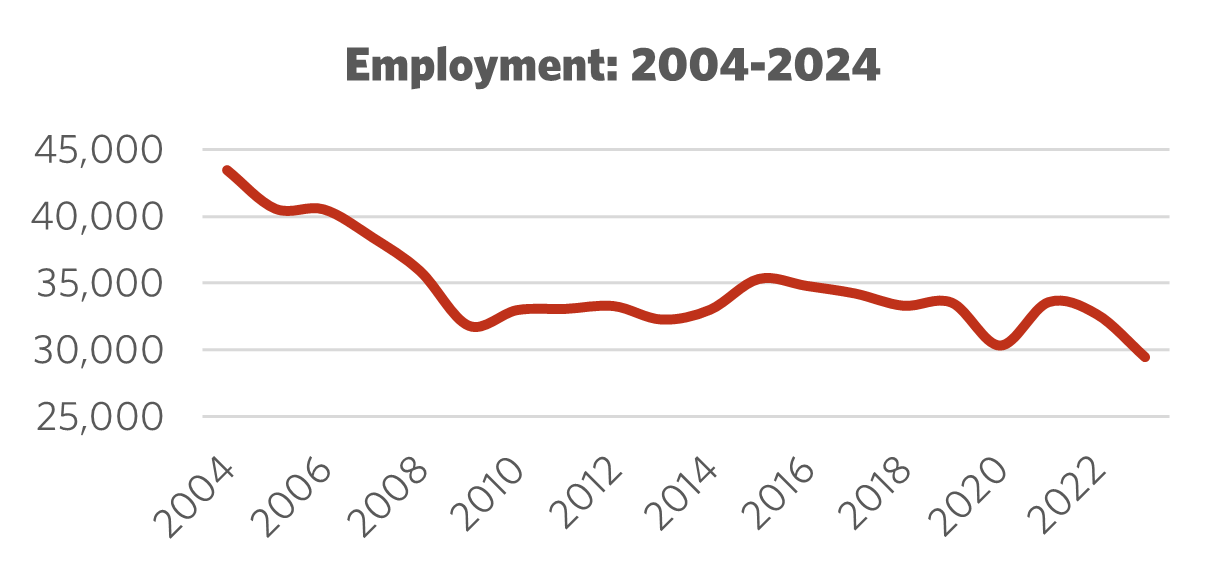

The industry has also faced notable employment challenges over the past two decades, with the number of jobs in the industry declining precipitously by more than a quarter of the total workforce from 2004 to 2009, falling from 43,500 to 32,000. Employment experienced a slight revival during the early 2010s before declining again. The post-COVID rebound also appears to have ended, with the industry hitting a low of 29,500 workers in 2023. Vertical integration, technological advances and the consolidation of fish harvesting operations in some regions have had negative impacts on the industry’s employment overall.

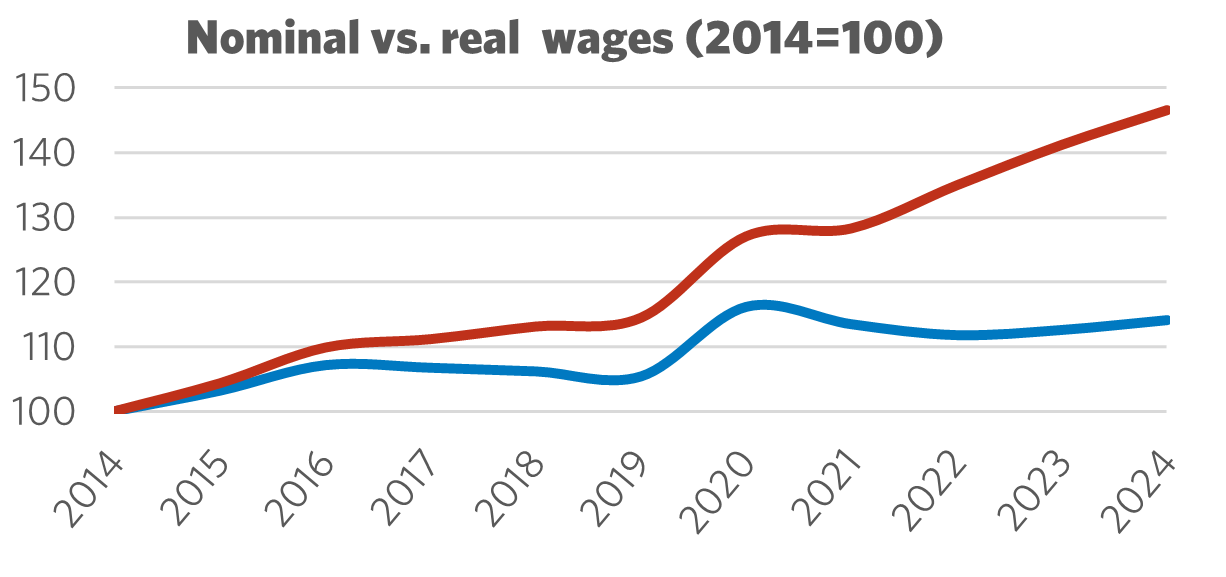

Average wages, meanwhile, have seen robust growth throughout the last ten years, but real wage growth (adjusted for inflation) has been relatively stagnant since the COVID-19 pandemic, owing to historically high inflation during the intervening years. Wage growth is also highly uneven across regions, with wages on the west coast lagging behind.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Fisheries Industry

The fisheries industry is highly export-dependent, with Canada among the top ten global exporters of seafood. These exports, however, are under threat from Chinese tariffs and continued threats by the U.S. to expand its list of Canadian trade targets. Continued development of the fisheries industry will be dependent on Canada’s ability to diversify its trading partnerships and successfully promote Canadian seafood in alternative markets, particularly in Asia and Europe, along with campaigns to increase domestic consumption. Workers in the industry will require comprehensive financial supports to weather any negative impacts from current trade tensions, while governments should commit to investing in coastal communities, to drive employment and expand economic opportunities. Where possible, governments should adopt measures to reduce the cost of exports to make Canadian seafood even more competitive in global markets and ensure that seafood caught in Canada is processed in Canada.

Development of the fisheries industry also faces challenges from foreign ownership and corporate concentration, particularly on the West Coast where British Columbia lacks an owner-operator licensing model. Fish harvesters on Pacific waters are often forced to lease licenses at exorbitant and unregulated rates from wealthy licenseholders, operating on razor thin and often absent margins while performing all of the work of harvesting. The federal government should commit to harmonizing licensing models across the country and ensure that harvesters can bargain common standards across their region through broader-based bargaining and mandatory union membership.

Sector Development Recommendations

- Canada's highly export-dependent fisheries industry faces severe threats from Chinese tariffs and potential U.S. trade actions. Diversifying trade partnerships and promoting Canadian seafood in new markets will be crucial in the next few years.

- Workers require comprehensive financial supports to weather these trade tensions. Governments should invest in coastal communities to drive employment and expand economic opportunities, while reducing export costs and increasing processing requirements.

- The fisheries industry also faces challenges from foreign ownership and corporate concentration. Commercial licensing regimes across the country should be harmonized in favour of the owner-operator model and harvesters’ bargaining power enhanced through mandatory unionization and sectoral bargaining.