Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $118.6 billion 6.0% |

| EMPLOYMENT | |

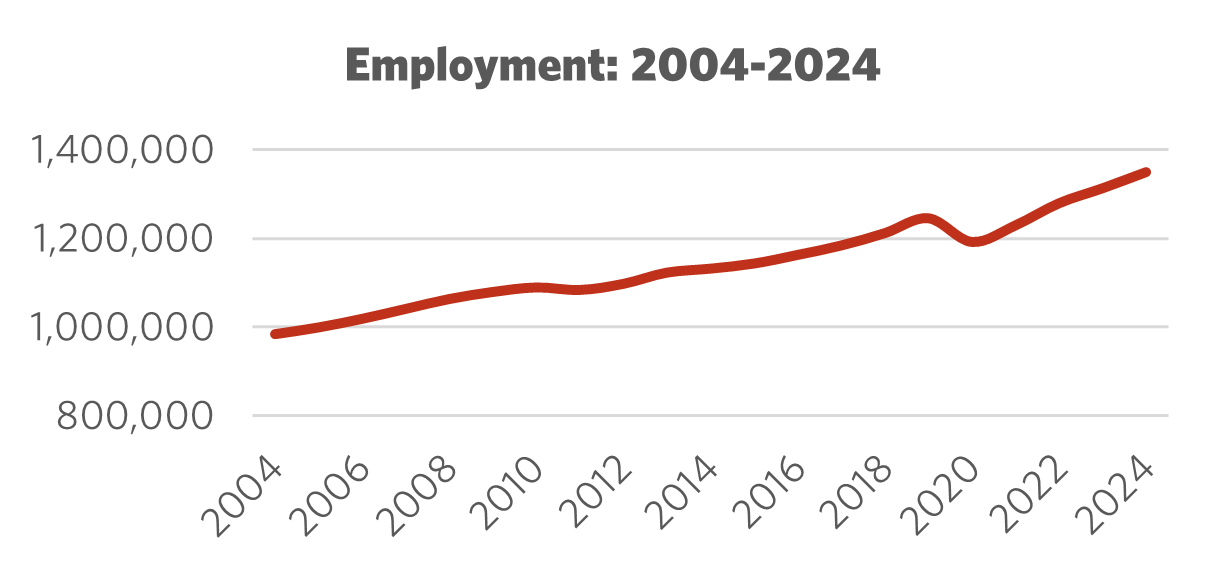

Total Employment 10-year change | 1,348,491 +19.3% |

| Percentage of part-time workers | 19.1% |

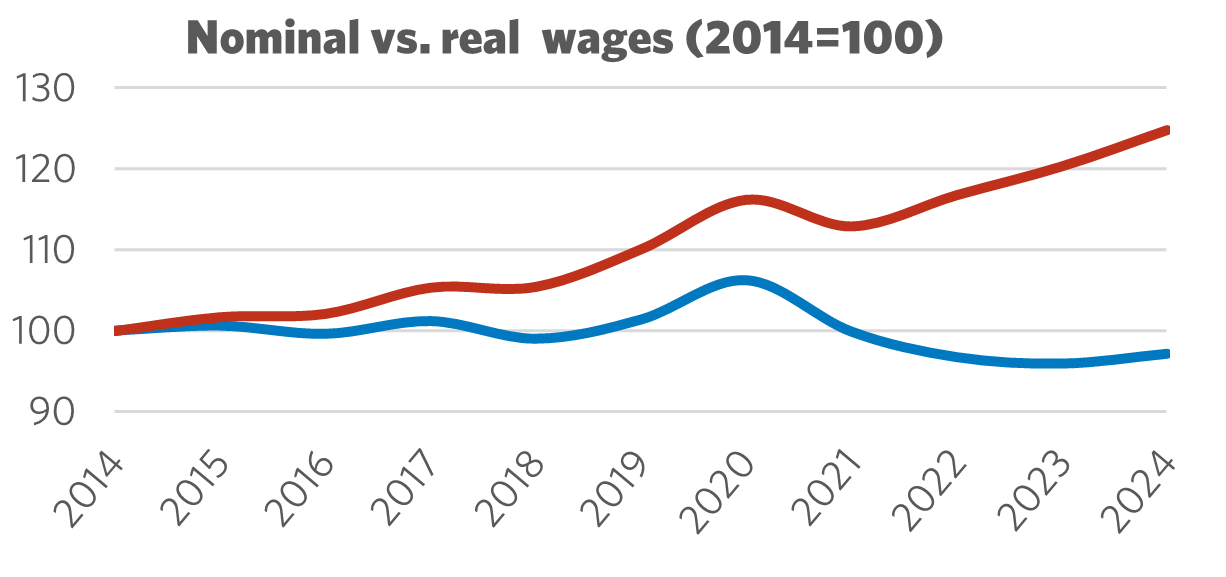

| Average hourly wage | $44.79/hr |

10-year real wage change | -2.9% |

| Average Work Hours/Week | 29.1 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 4,662kt +7.6% 0.74% |

| LABOUR | |

| Union Coverage Rate | 76.5% |

| Unifor Members in the Industry | 8,500 |

| Share of Total Unifor Membership | 2.7% |

| Number of Unifor Bargaining Units | 36 |

Unifor in the Education Industry

Unifor represents approximately 8,500 members in the education sector. Unifor members are primarily concentrated in Alberta (school boards) and Ontario (school boards, universities, and contracted services in colleges). Within school boards, Unifor members typically work as educational assistants, maintenance personnel, clerical staff, and in other school support roles. In universities, Unifor members work in maintenance, skilled trades, clerical positions, special constables, engineering and in food services, among others. In colleges, most members are employed in food services for contractors.

Two-thirds of the members in this sector work for the three largest employers. McMaster University is the single largest employer, accounting for roughly 38% of sector membership, while another 37% work in various Alberta school boards. The remaining members are distributed among Ontario school boards, Ontario universities and colleges, as well as universities in Manitoba and the Atlantic region.

| SELECT UNIFOR EMPLOYER | APPROX. # MEMBERS |

| McMaster University | 3,500 |

| Calgary Roman Catholic Separate School Board Division | 1,600 |

| Edmonton Catholic Separate School Board Division | 1,100 |

| University of Windsor | 460 |

| University of Manitoba | 380 |

| University of New Brunswick | 320 |

Current Conditions

Unifor’s education sector encompasses various types of workplaces, including school boards, universities, and colleges that are either government-owned or partially government-funded. Collectively, this sector employs more than 1.3 million people and contributes $118.6 billion to Canada’s GDP. However, because the sector is primarily public (e.g., school boards) or partially public (e.g., universities and colleges), the fiscal position and political orientation of governments significantly influence funding and employee compensation trends.

The COVID-19 pandemic had a negative impact on school boards and post-secondary institutions, particularly during the initial lockdowns. Workers in the sector experienced varying changes to working conditions depending on their roles within the institutions. Classes transitioned to virtual platforms, a shift that continues to occur to varying degrees.

Despite the sector's relative stability, consistently high demand for education services and the crucial role of schools in communities across the country, financial challenges persist. Educational institutions face chronic funding shortfalls and staffing shortages, which ebb and flow based on shifting political priorities of governments in power.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Education Industry

The education sector is significantly impacted by government policy, both fiscal and social, at the federal and provincial levels. This sector is experiencing growth in employment, particularly as the country’s population continues to rise. Unfortunately, a high demand for workers is not being matched by an increase in worker pay and benefits. Over the past decade, average wages across the sector have declined by 4% when adjusted for inflation.

In most provinces, inadequate education funding has hindered schools and boards from addressing rising costs, increasing enrollment, and the need for additional student support.

Post-secondary institutions are grappling with revenue and funding challenges, worsened by recent federal measures to restrict international student study permits. This has led to a 35% reduction in international student enrollment in 2024 compared to 2023, with an additional 10% decline expected in 2025 and 2026. Ontario has been hit particularly hard, with the province accounting for half of all work permits issued to international students.

Universities and colleges with high international student enrollment have experienced significant revenue losses, compounded by reductions in government transfers in some jurisdictions. As a result, these institutions have made difficult decisions, including cutting programs, laying off staff, and reducing services. In some areas, governments are pressuring post-secondary institutions to restructure and seek more private funding. This shift has caused institutions to operate increasingly like corporations, prioritizing financial outcomes over supporting programs and facilities. Governments at all levels must boost investments in post-secondary education to reverse the trend of privatization, while ensuring affordability and enabling a workforce to better support students.

Sector Development Recommendations

- Wage retrenchment across the education and public sector must be reversed.

- After years of operating budget freezes or cuts, education and public services must be made a public policy priority at all levels of government.

- The federal government must reverse the aggressive cap on international student study permits and acknowledge the contributions that international students make to Canada’s society and economy during and after their studies.

- Governments must reverse the tide of privatization in the public sector, especially within post-secondary institutions.