Advocating for a Strong, Sustainable Canadian Auto Industry

Submission to Government of Canada consultations on potential policy responses to unfair Chinese trade practices in electric vehicles “EV Consultation”

Introduction

Unifor is Canada’s largest union in the private sector, representing 320,000 workers in all major industries. Unifor is also Canada’s autoworkers union, representing more than 40,000 workers in heavy and light-duty vehicle and powertrain assembly, as well as automotive component parts manufacturing, distribution as well as engineering, clerical and security operations. Thousands more Unifor members work in vehicle dealerships and vehicle servicing businesses throughout the country. Unifor was formed in 2013, following the merger of the Canadian Auto Workers union (CAW) and the Communications, Energy and Paperworkers union of Canada (CEP).

Unifor welcomes this government consultation on potential policy responses to unfair Chinese trade practices. In coming years, and according to forecasts, China’s domestic EV production capacity and exports will increase rapidly. Chinese firms are set to expand sales and production in jurisdictions around the world, as part of an intentional, government-backed growth strategy. According to analysts, the question of EV sales by Chinese-owned firms in North America “isn’t an if. It’s a when.”

This submission urges the Canadian government to use its trade policy capacities and enable domestic auto sector and supply chain growth that aligns with the principles of a sustainable, localized and high-standard economic development strategy. The recommendations presented herein aim to address the imbalances inherent in Canada-China trade relations, to further Canada’s own industrial development ambitions, grow good, union jobs and realize the full economic benefit of a thriving automotive base. It is not intended to circumvent China’s own domestic development strategy.

However, in this submission we acknowledge and respond to practices that Unifor believes violate the tenets of fair trade and human rights. Competitive trade advantages obtained through improper and (in certain cases) illicit practices in China cannot be overlooked nor tolerated. There is a balance to be struck by recognizing and respecting a nation’s right to self-determination and economic agency, while drawing a line on actions intended to undermine the same rights of other nations and, especially, deny fundamental rights of working people.

Summary of Recommendations

Unifor recommends the federal government:

- Impose a federal surtax (100% above the MFN rate) on all new energy passenger and commercial vehicles (e.g. BEV, PHEV, FCEV, SHEV) imported from China as listed within the July 2 consultation paper, as well as a surtax on lithium-ion battery cells and related battery components, under authority of Section 53 of the Customs Tariff.

- Extend the Section 53 surtax to match the tariff rates imposed by the United States on equivalent new energy vehicle battery products (25% above the MFN rate), including under HS codes 8507.90.40, 8507.60.0010 and 8507.60.0020 as well as for various critical minerals (25% above the MFN rate), such as graphite, and others listed in the U.S. proposed modification of Section 301 tariffs released in May 2024.

- Extend the Section 53 surtax to strategic EV and battery-related components (25% above the MFN rate) of importance to Canada, including electric motors and driveunit components (including magnets, sensors and actuators), as well as key battery cell components, including cathode active material, anodes, separators, and electrolytes.

- Establish that the surtax shall be in effect for a period of at least one-year and subject to re-evaluation no later than August 1, 2025.

- Establish a monitoring and analysis committee, involving industry experts, to assess impacts on trade flows, transshipments, import surges and market prices in new energy vehicles from China and Chinese automakers resulting from the myriad actions taken by Canada and other nations.

- Require future vehicle product program investments made by automakers, that receive public funding, whether through special programs, financial instruments, or tax credits must be electrified vehicle programs or include electrified variants of internal combustion engine program or a multi-energy program architecture.

- Pursue policies that expand domestic vehicle production by leveraging government-funded purchases of vehicles, including by assigning local content and final assembly requirements to major public vehicle fleet and transit procurements, where possible.

- Reverse its decision to phase out the Incentives for Zero Emission Vehicles (iZEV) and Incentives for Medium- and Heavy Duty Zero Emission Vehicles (iMHZEV) programs.

- Extend the duration of the programs until at least March 31, 2030, and March 31, 2031, respectively. Or, in the case of the iZEV program, until light duty passenger ZEVs represent 50% of new car registrations.

- Increase the maximum rebate of the iZEV program by an additional $5,000, on condition the vehicles meet North American content requirements under CUSMA.

- Disqualify any vehicle from the iZEV and iMHDZEV programs that is subject to a surtax under Section 53 of the Customs Tariff.

- Utilize the tools afforded under the Investment Canada Act to continue monitoring foreign direct investment in the Canadian automotive and EV supply chain.

- Update federal Guidelines on the National Security Review of Investments – Annex A (Sensitive Technology Areas), to explicitly include connected and automated vehicle (CAV) systems.

- Monitor outcomes of the US ICTS supply chain review.

- Issue guidance to CBSA and ESDC Labour Program officials, regarding the evidentiary proof required to invoke prohibitions on goods produced with forced labour under the Customs Tariff. The directive must enable CBSA to confront goods suspected of forced labour, issue Withhold Release Orders and require importers and/or suppliers to demonstrate compliance with Canadian law.

- Bolster resources to CBSA to better equip officers with necessary training, tools and staff support to enforce Canada’s effort to ban entry of goods produced with forced labour and coordinate effectively with the United States and Mexico.

Advocating for a Strong, Sustainable Canadian Auto Industry

Unifor advocates for a strong and sustainable domestic auto industry, underpinned by good, union jobs. Reducing Canada’s transportation carbon footprint is necessary as the country strives to meet its Paris climate commitments and its “net zero” greenhouse-gas emissions goals by 2050. However, the transition to a net zero economy must correspond with economic growth, job security and prosperity for working people – goals best achieved through comprehensive and ambitious industrial strategies.

Through its contract negotiations with the Detroit 3 automakers, Unifor has secured transformational investments at Canadian auto factories in recent years, including billions of dollars in new electric vehicle programs. These program investments, supported by funding from both federal and provincial governments, is catalyzing the redevelopment of Canada’s vehicle supply chain, from minerals to battery materials to finished vehicles. This new investment, spurred by electrification, followed decades of factory disinvestment and offshoring resulting in plant closures and the loss of tens of thousands of jobs.

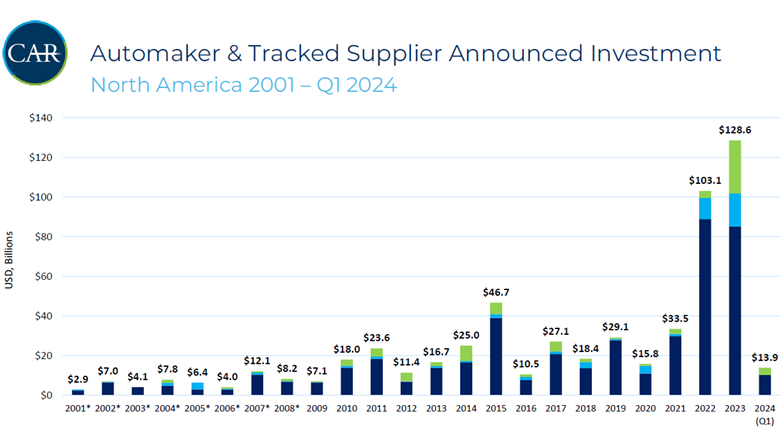

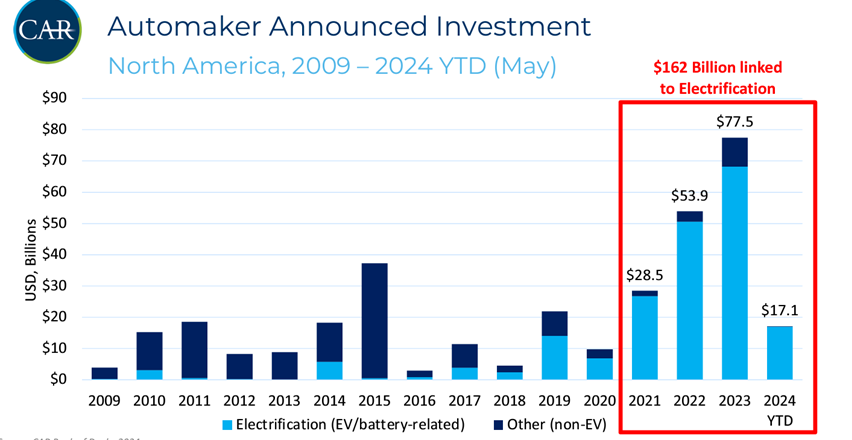

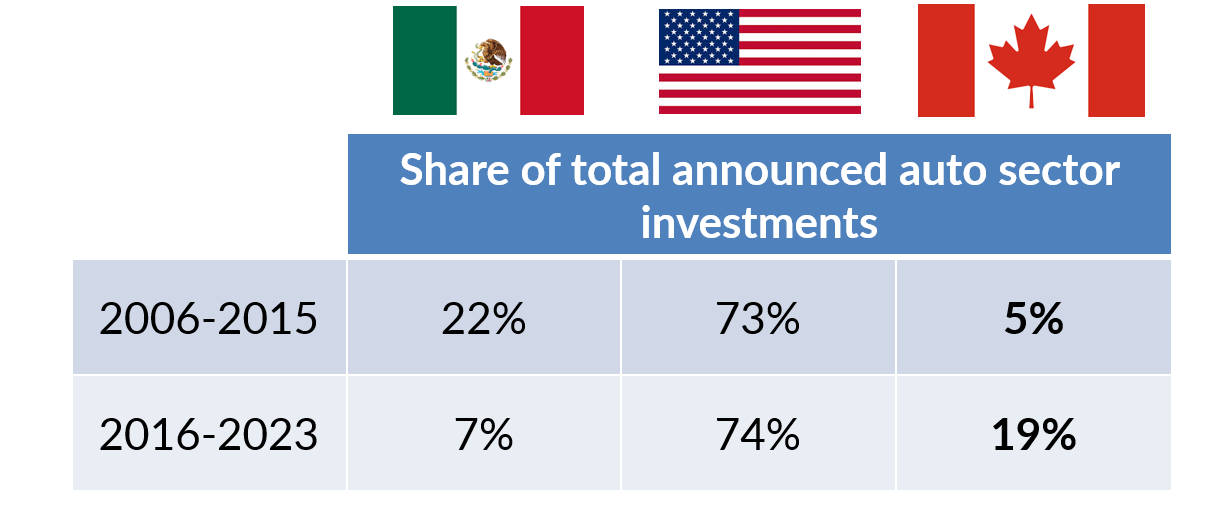

In under four years, Canada secured nearly $50 billion in major auto and EV battery supply chain investments, including nine large “greenfield” factories in Canada (see Annex 1), the first since 2005. Based on recent public statements, these nine investments are expected to create at least 12,000 new, direct jobs in Canada. After consecutive years of declining output, forecasters now expect annual Canadian passenger vehicle production to expand in the coming years by 37% to approximately 1.8 units by 2031 . This reflects Canada’s success in landing a growing share of new vehicle program investments within North American, most of which are tied to electrification (see Annex 2). Headline investment totals fail to account for the associated, substantial ‘spin-off’ investments across component part suppliers, nor do they to reflect the full economic impact of upstream supply chain investments and the induced economic effects spurred by above-average union wages, health benefits and high productivity.

The potential for growth in the auto sector, and Canadian leadership in the EV space, is palpable, but there are headwinds. Incubating a market for the production and mass adoption of electrified or other zero emissions vehicles (ZEVs), requires a multi-faceted and collaborative approach across government and among stakeholders. It requires strategic investments in energy and transportation infrastructure, consumer incentives, income and training support as well as leveraging supply chain growth opportunities. It also requires proactive and protective measures to address unfair trade practices that threaten to undermine Canada’s progress. For decades, automakers have exploited poorly monitored international supply chains, both within North America and globally, to lower production and labour costs and drive profits.

Canada has taken steps to address unfair trade practices in recent years. The renegotiation of the North American Free Trade Agreement (NAFTA), for instance, resulted in novel trade provisions attempting to expand North American content in vehicles, including components built in high-wage factories. The new agreement also includes a Facility-Specific Rapid Response Labour Mechanism (RRLM) to protect the fundamental rights of workers and enforce Mexico’s promised labour reforms. Mexico’s failure to uphold labour rights since the inception of NAFTA in 1994, while automakers enjoyed tariff-free market access, created severe trade imbalances that harmed Mexican workers and put Canadian workers at a distinct competitive disadvantage. While labour concerns in Mexico persist, efforts to stamp out trade distortions have helped bolster Canada’s domestic auto sector and fair-trade priorities within North America. In 2020, Canada legislated a ban on imported goods produced with forced labour and, in 2024, established a reporting program to identify steps taken by corporations to root out forced labour and child labour from supply chains. In 2023, Canada also identified a ‘Reciprocity-Based Approach’ to guide future trade-impacted policies, such as procurement, to level the playing field with trade partners by imposing comparable market access and national treatment measures for goods and services.

Today, China presents the most immediate threat to the development of Canada’s homegrown ZEV supply chain and auto sector redevelopment ambitions. China’s stated goal of establishing a global, automotive superpower (bolstered by its domestic automakers) collides with Canada’s own industrial development strategy, commitments to fair and inclusive trade and requisite high labour standards in the automotive supply chain.

Chinese automakers’ rapid ascent, and unfair advantage

China’s homegrown automakers have rapidly ascended to overtake Japan as the world’s largest vehicle exporter, according to recent reports . BYD, one of China’s lead vehicle producers, has transformed itself from a smartphone battery supplier to the world’s biggest battery electric vehicle producer, in 20 years. BYD is one of many increasingly sophisticated China-based automakers that have benefitted from China’s state-directed industrial policy, known as China Manufacturing 2025 (CM2025) or “Made in China 2025”, which sought “self-reliance” across 10 homegrown industrial sectors, including in New Energy Vehicles (NEVs) and energy equipment (such as solar panels and lithium-ion batteries).

The sheer size of the Chinese economy (enabling firms to take advantage of economies of scale) coupled with ambitious and stated-directed production targets will have consequences on global supply of EVs, despite China’s declared goal of self-sufficiency. CM2025, for instance, requires local Chinese producers to supply 70% of all basic domestic components and materials for lithium-ion batteries, solar panels and EVs. Not only has China exceeded that target, it now produces 80% of global photovoltaic panel supply, according to the International Energy Agency, which is double China’s domestic demand, and expected to rise to 95% within years. China’s oversupply and market dominance for lithium-ion batteries has contributed to a collapse in global battery prices that threatens the viability of global firms, with Chinese officials urging manufacturers to halt new factory production.

The market dominance exhibited over CM2025-targeted goods, such as solar panels and lithium-ion batteries, is reflective of China’s condition of “structural overcapacity.” China’s domestic policy tends to over-emphasize supply-side economic supports instead of demand-side incentives. This approach is partly responsible for Chinese oversupply of steel and aluminum goods in recent years. Canadian autoworkers are wary of similar outcomes from what is largely an uncontrolled and mismanaged production strategy for EVs.

Secondly, to meet its CM2025 growth and production targets, China deployed a range of state resources and economic policies unavailable to Canada (in any comparable way) and, arguably, not compliant with WTO rules. These policies enabled both a rapid expansion of industrial capacity for EVs as well as a continued cost-containment strategy through wage suppression. Both should raise significant trade concerns for Canada . For example:

- China has for many years required foreign investors, including automakers, to transfer advanced technological expertise to Chinese state-owned firms in exchange for market access. Such arrangements explicitly violate China’s terms of accession to the WTO, but nevertheless persist in different and various forms. This partly explains the prevalence of 50% joint ventures between domestic Chinese firms and foreign-based automakers, like General Motors and Volkswagen (joint ventures with China’s state-owned SAIC Motor Corporation) as well as Ford Motor Company (joint venture with China’s state-owned Changan Auto). Historically, vehicles produced through a joint venture must be sold under a local brand nameplate, instead of existing nameplates of the foreign automaker.

- China is not a party to the WTO’s Government Procurement Agreement (GPA). Accordingly, Chinese governments limit foreign supplier access to public procurement markets. China may employ local procurement preferences – without limitation – in support of industrial policy objectives. Canada has severely curtailed its own ability to direct public procurements in the same way, both as party to the GPA and numerous bilateral trade agreements. China State Council guidelines released in 2015 mandated local government-funded organizations to ensure NEVs comprise 30% of fleet vehicles (including transit busses) and that these are sourced from Chinese suppliers. Failure to meet these state-directed mandates would risk a reduction in state operating subsidies.

- The Chinese government provided significant financial support to its domestic NEV industry since 2009. According to the Center for Strategic International Studies, more than $230 billion USD was delivered to the sector in the form of rebates, tax exemptions, infrastructure spending, research and development as well as procurement. This fails to capture the full extent of government-funded supports as it excludes various local and municipal state programs and it excludes supports provided to producers along other nodes of the NEV supply chain (e.g. chemical processors, battery manufacturers, mining operations, etc.).

- State supports provided by China to domestic electric bus manufacturers, according to reports, virtually offset the full cost of bus production. This contributed to rapid development of passenger transit vehicles, an expansion of manufacturing capacity and market saturation of vehicles.

- According to the European Union Chamber of Commerce in China, the launch of CM2025 also instigated an “unprecedented wave” of targeted outbound Chinese investment into Europe and elsewhere between 2015 and 2016. This reflects the evolution of China’s “going out” investment policy that, according to the U.S. State Department, began with targeted foreign investments by Chinese SOEs but that now includes state and private enterprises. Today, private and state-backed Chinese automakers are making public their intentions to expand production capacity for vehicles and components parts all throughout the world, including in North America. According to the Coalition for a Prosperous America, this includes 29 new Chinese-owned factories established in Mexico since 2022.

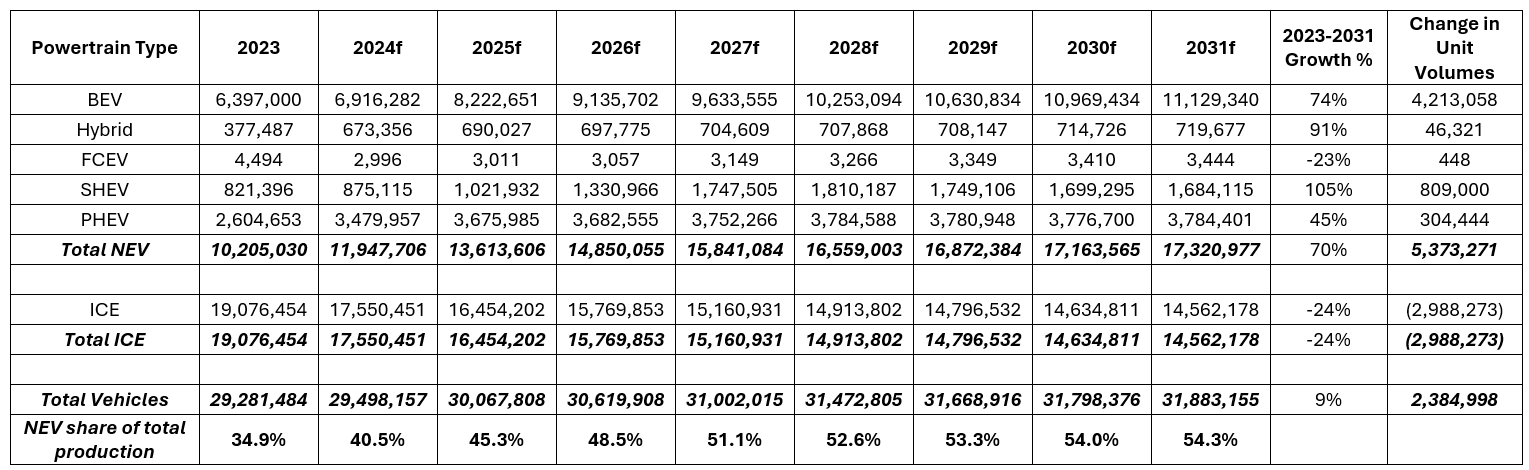

The CM2025 strategy is, by most measures, a total success for China – particularly in its ambitious to expand and dominate EV production. The pace in output growth is breathtaking. In 2019, China produced 1 million new energy passenger cars (including EVs, hybrids and fuel cell vehicles). Today, five years later, production has grown to approximately 4.9 million. By 2031, China is forecasted to produce over 7 million new energy passenger cars – a 600% rise in production. Across all vehicle segments, including cars, trucks and buses, China’s EV output is expected to hit 17 million vehicles in 2031, 5.3 million more than what was produced in 2023 (see Annex 3). And while “self-sufficiency” continues to be China’s watchword, it is hardly plausible that this accelerating pace of EV output will only serve a now slowing domestic market. BYD, for instance, announced this year it is expanding its internal fleet of container ships to bolster EV export sales.

China’s other unfair advantage: weak labour and environmental standards

China and Chinese-based automakers present another challenge to Canada’s auto industry: the social dumping of goods into the domestic market.

One of China’s distinct competitive advantages is a strictly regulated collective bargaining and labour relations system. Through its single trade union system, China denies workers the right to freedom of association – a violation of one of the International Labour Organization’s core labour conventions. Workers in China are barred from alternative structures of trade union representation external to the All-China Federation of Trade Unions (ACFTU) – a state sanctioned entity. Under the country’s Trade Union Law and Labour Contract Law, the establishment of any trade union organization is subject to approval through ACFTU channels. In 1982, China removed the right to strike from its constitution, although there are numerous examples of workers self-organizing pickets and protests for better wages and working conditions, outside of formal state structures. Workers’ rights violations are sparsely documented in China, however the International Trade Union Confederation (ITUC) has compiled a series of troubling news stories documenting state prosecutions of trade union and human rights activists, including arrests, detentions and physical violence dating back to 2009.

An impotent and state-controlled trade union apparatus in China disenfranchises workers and undermines the tenets of industrial democracy. It also denies workers the ability to collectively present a countervailing power, which is necessary for the redistribution of income and other benefits derived from economic growth and productivity. In fact, the ACFTU – like most repressive state institutions – acts as a wage suppressor, unduly limiting the benefits to workers that should be derived from economic progress, thereby artificially lowering the costs of production. China Labour Bulletin, a workers’ advocacy organization that monitors trade union activity and human rights in China, provides a damning critique of the ACFTU complicity in wage suppression tactics, and in relation to China’s low-road industrial strategy:

The failure of the ACFTU to stand with its members has meant that, after four decades of economic reform, the majority of China’s workers have yet to benefit from the country’s so-called “economic miracle,” while a small group of Party and business leaders has become obscenely wealthy. Moreover, this extreme wealth inequality has worsened over the last five years as China’s fast-paced economy slows down and an ever-increasing number of workers are consigned to low-paid, precarious employment with little or no welfare benefits. Even Premier Li Keqiang admitted in a press conference at the end of the 2020 National People’s Congress that, based on official statistics, 600 million people in China still had an average income of less than 1,000 yuan. In 2022, the official claim is that the number of people in flexible employment has reached 200 million.

Compounding China’s restrictive, wage-suppressing collective bargaining system and the denial of fundamental rights to freedom or association are horrific claims of forced labour, most notably in the Xinjiang Uyghur Autonomous Region (XUAR). In 2022, the United Nations High Commissioner charged China with committing crimes against humanity toward the Uyghur and Turkic Muslim communities in the region. Charges against China include arbitrary detention, torture, mass surveillance, cultural and religious persecution as well as forced labour both inside and outside of the region, involving government-backed forced labour transfers.

The implications of forced labour in China raise major concerns within the global automotive industry. Human Rights Watch (HRW), in an explosive study released in February 2024, documents the interconnection between Xinjiang’s aluminum industry and the Chinese auto supply chain. Xinjing is one of the largest aluminum producing regions in the world, representing 9% of total global supply. Aluminum is an important material in the production of vehicle components (including casted parts, frames and EV battery-related components) manufactured in China and around the world. The concern is a high risk of goods produced with forced labour are circulating through the global auto supply chain, and not just in vehicles made in China or by Chinese automakers, but all automakers including those based in North America.

As HRW documents, it is virtually impossible to trace the origins of aluminum used in fabricated goods back to its initial raw material state – creating challenges in identifying specific, tradeable goods produced with forced labour. This includes an array of electric vehicle components, such as battery foils, trays, conductors, enclosure frames and alloy wheels, among others. In fact, auto industry demand for aluminum is expected to double between 2019 to 2050, exacerbating this problem if unchecked. Under the UN Guiding Principles on Business and Human Rights, automakers have a responsibility to identify and prevent forced labour in their supply chains. Based on the HRW report, automakers operating in China lack both urgency and interest in this matter, whether by claiming non-culpability due to their Chinese joint venture arrangements (e.g. Volkswagen, General Motors) or, simply, by ignoring HRW requests for comment entirely (e.g. BYD, Toyota).

The prevalence of forced labour in automotive goods taints the entire global supply chain. The failure to address this intolerable action, both in the aluminum sector and potentially elsewhere (labour transfers are hardly well documented), only further advantages China as it continues to establish itself as a low-cost automotive supplier to the world. Canada either accepts the risks associated with inaction, and is complicit in these crimes, or will take meaningful steps to address it.

Lastly, automakers continue to benefit from high carbon intensity inputs and cheap, dirty energy embedded in Chinese production process. Most vehicle emissions (approximately 80%) occur in its ‘use-mode’ – the burning of gasoline while the vehicle operates. On the production end, most emissions are generated in the upstream segments, including raw material processing, transformation and transportation. Despite historic investments in clean energy infrastructure, 90% of China’s emissions come from the energy sector, and 60% of power is derived from coal. Coal, in fact, plays an outsized role in powering China’s aluminum sector, which emits “23% more CO2 equivalent than the global average.”

While commendable, Canada’s efforts to reduce domestic greenhouse gas emissions, accelerate ZEV adoption and invest in future-facing automotive supply chain technologies, comes at a steep cost when considering the role of China in the global equation. In the absence of offsets, border adjustments or other measures to rebalance the unfair (and in some cases illegal) flow of low-cost, carbon-intensive automotive goods across the border, Canada’s auto sector industrial strategy will be profoundly undermined.

Canada’s potential policy responses

The Government of Canada recognizes many of the above-mentioned concerns in its consultation paper released on July 2, 2024. The consultation paper presented a series of potential policy responses and actions federal officials are considering.

Below is Unifor’s response to these items, followed by a series of additional policy responses that union encourages the federal government to consider.

- Impose a Surtax under Section 53 of the Customs Tariff

Unifor recommends:

- A federal surtax (100% above the MFN rate) on all new energy passenger and commercial vehicles (e.g. BEV, PHEV, FCEV, SHEV) imported from China as listed within the July 2 consultation paper, as well as a surtax on lithium-ion battery cells and related battery components, under authority of Section 53 of the Customs Tariff.

- That Canada’s Section 53 surtax matches the tariff rates imposed by the United States on equivalent new energy vehicle battery products (25% above the MFN rate), including under HS codes 8507.90.40, 8507.60.0010 and 8507.60.0020 as well as for various critical minerals (25% above the MFN rate), such as graphite, and others listed in the U.S. proposed modification of Section 301 tariffs released in May 2024.

- Extending the Section 53 surtax to strategic EV and battery-related components (25% above the MFN rate) of importance to Canada, including electric motors and driveunit components (including magnets, sensors and actuators), as well as key battery cell components, including cathode active material, anodes, separators, and electrolytes.

- The surtax shall be in effect for a period of at least one-year and subject to re-evaluation no later than August 1, 2025.

- Finance Canada establish a monitoring and analysis committee, involving industry experts, to assess impacts on trade flows, transshipments, import surges and market prices in new energy vehicles from China and Chinese automakers resulting from the myriad actions taken by Canada and other nations.

- That all future vehicle product program investments made by automakers, that receive public funding, whether through special programs, financial instruments, or tax credits must be electrified vehicle programs or include electrified variants of internal combustion engine programs or multi-energy program architecture.

- Pursue policies that expand domestic production by leveraging government-funded purchases of vehicles, including by assigning local content and final assembly requirements to major public vehicle fleet and transit procurements, where possible.

Reasons:

Invoking Section 53 is entirely warranted and justified in this case. The culmination of actions undertaken by China to incubate and direct an export-led development of its electric vehicle and components sector will have an adverse effect on Canadian workers. For example, Unifor represents workers in 13 major Canadian auto assembly plants involving light-duty passenger vehicles, powertrain as well as commercial-heavy truck and passenger bus assembly (see Annex 4). Eight of these facilities are producing, or scheduled to produce, electrified vehicles. Canadian-built EVs vary in segments and class, including small, affordable compact utility vehicles to larger, heavy-duty electric trucks and commercial vans. Slowing demand for EVs in North America has resulted in product program delays at many Canadian facilities, including at Unifor-represented facilities, creating uncertainty for workers. Recently, and in response to extensive production delays at Ford Motor Company’s Oakville Assembly plant, the union negotiated a mitigation plan to shorten the expected down-weeks, pivoting on previous electrification plans. Canadian autoworkers are reorienting themselves to the building of new EV products, whether they be finished vehicles, batteries or component parts. Allowing for the continued and unrestricted importation of EVs, enabling new low-cost entrants into the market, could further delay EV transitions at Canadian facilities and, in fact, may entirely curtail planned EV transformations at Canadian plants.

Just as China closely guarded its EV industry against foreign competitors, within a calculated and heavily-funded industrial strategy, Canada can – and must – do the same. Using this opportunity to address structural inequities that afford unfair trade advantages to Chinese-based automakers is long overdue. The consequences of inaction are severe and threatens to undermine Canada’s development of an advanced, future-facing automotive supply chain, in an integrated North American market, that is built on the premise of fair trade, high standards, good jobs and clean energy inputs. China offers none of those things.

Automaking nations have already taken action to address this threat and to level an unfair playing field. Most notable is the United States’ decision to consider special, incremental Section 301 tariffs on Chinese vehicle imports to 100% (resulting in inbound tariffs on light duty electric vehicles of 102.5%). Included in this response are U.S. proposals to extend tariffs on other EV-related goods, including lithium-ion battery components under HS codes 8507.90.40, 8507.60.0010 and 8507.60.0020). Additional actions have been taken by Brazil, set to impose 35% tariffs on Chinese EVs by 2026, and the European Commission, who will impose subsidy duties on individual Chinese importers (resulting in inbound tariffs of between 27.4% and 47.6%). The European trade remedy approach is notable for its compliance with WTO rules regarding countervailing and anti-dumping duty protections, but also occurs in a different economic context in which Chinese importers already make up a sizeable share of the new vehicle market, or about 20% of new car sales, and Chinese-based firms are actively producing (or have announced production) across Europe .

Imposing a Section 53 surtax on EVs and key inputs from China is reflective of the current state of Canada’s auto industry transition and intended to pre-empt economic injury to Canadian workers. Unifor sees both the U.S. and European Commission actions as means to rebalance unfair trade advantages corporations enjoy when producing and importing goods from China and the damage those imports inflict on jobs. These efforts aim to restrict (at least temporarily) unfair competition, enabling the necessary upgrading of Canadian and North American factory infrastructure, job skills, product programs and supplier arrangements in a fast-moving, technologically advanced supply chain. To accelerate Canada’s EV supply chain development, the federal government must pursue policies that expand domestic production, including by assigning local content and final assembly requirements to major public vehicle fleet and transit procurements, where possible.

- Reconfigure ZEV Incentive Program Eligibility

Unifor recommends:

- Government reverse its decision to phase out the Incentives for Zero Emission Vehicles (iZEV) and Incentives for Medium- and Heavy Duty Zero Emission Vehicles (iMHZEV) programs.

- Extend the duration of the programs until at least March 31, 2030, and March 31, 2031, respectively. Or, in the case of the iZEV program, until light duty passenger ZEVs represent 50% of new car registrations.

- Increase the maximum rebate of the iZEV program by an additional $5,000, on condition the vehicles meet North American content requirements under CUSMA.

- Disqualify any vehicle from the iZEV and iMHDZEV programs that is subject to surtax under Section 53 of the Customs Tariff.

Reasons:

ZEV affordability remains a major barrier to customer adoption, along with concerns over charging infrastructure. The iZEV program provides a necessary incentive to spur new ZEV sales and expand Canada’s overall ZEV stock. The program has been, by many accounts, a success. According to Statistics Canada, EVs (including battery electric, hybrid and plug-in hybrid vehicles) made up 18.7% of new vehicle registrations in Canada in 2023, a significant increase from 2017 (new EV registrations totalled 2.1%). However, ZEV sales growth in North America has slowed in the past 12 months . Some suggest it is reflective of having exhausted the market for early EV adopters. Mass market adoption of EVs will require extended battery range and more extensive, diverse and accessible vehicle options. Suggesting that low-cost imports from China can help satisfy this next phase of EV market penetration is simply not satisfactory. The consequences of this approach, as stated above, are too high for autoworkers. Willfully ignoring the social costs of this approach stands against the principles of fair trade and human rights.

Extending the iZEV and iMHDZEV programs will help to address the affordability question, especially as new, more affordable EV options from North American suppliers are made available to customer in the coming years. Doubling the benefit, for a time-limited period, to encourage the purchase of vehicles built in Canada and North America aligns well with Canada’s industrial strategy, and current CUSMA content commitments. Phasing out the incentive programs once EV sales reach a critical threshold (e.g. 50%) is appropriate, as it reflects a durable consumer market and a diverse stock of EVs available to Canadian used and aftermarket consumers. Disqualifying any vehicle currently subject to Section 53 surtaxes from publicly funded purchasing incentives creates greater coherence in the policy overall.

- Monitor investment, cyber and data security issues

Unifor recommends:

- The federal government, and Minister of Industry, Science and Economic Development utilize the tools afforded under the Investment Canada Act to continue monitoring foreign direct investment in the Canadian automotive and EV supply chain.

- Government updates its Guidelines on the National Security Review of Investments – Annex A (Sensitive Technology Areas), to explicitly include connected and automated vehicle (CAV) systems.

- Government monitors the outcome of the US ICTS supply chain review.

Reasons:

China’s export-led development strategy in the automotive industry, as noted above, includes foreign direct investment and rising production capacity outside of the domestic market. This is especially notable regarding sensitive component parts like Connected and Automated Vehicle (CAV) system technologies that may pose national security risks.

Weak in-bound Most Favoured Nation tariff rates for vehicles and parts, particularly in the United States for light duty passenger vehicles, serves as a poor deterrent for automakers choosing to ignore North American content rules under CUSMA. Canada, like Mexico, can serve as a convenient ‘back-door’ to foreign firms looking to avoid tariffs, but also take advantage of weak preferential tariff treatment rules. Therefore, Canada must remain vigilant in its monitoring of foreign investments and measuring the net benefits to the domestic economy and preservation of national security.

The federal government may consider expanding the list of sensitive technology areas under its Guidelines on National Security Review of Investments to explicitly include reference to CAV systems – a critical, and vulnerable, software-enabled component in vehicles that creates new risks to personal and data privacy but also to public safety and the protection of Canadian infrastructure. Concerns that connected vehicles systems will establish links with EV charging and city traffic management networks, in addition to vehicle-enabled self-driving features, raises serious risks of espionage and sabotage. According to news reports, the national security implications of connected vehicles prompted China, itself, to impose restrictions on foreign vehicles by banning Tesla cars from certain government and military locations.

As noted in the consultation paper, it is imperative Canada monitor the results of an ongoing Department of Commerce security probe into Information and Communication Technology Systems (ICTS) integral to connected vehicles, including potential prohibitions on the importation and use of systems owned, controlled or subject to the jurisdiction of foreign entities.

- Implement additional measures to prohibit illicit goods imported to Canada

Unifor recommends:

- Government issue guidance to CBSA and ESDC Labour Program officials, regarding the evidentiary proof required to invoke prohibitions on goods produced with forced labour under the Customs Tariff. The directive must enable CBSA to confront goods suspected of forced labour, issue Withhold Release Orders and require importers and/or suppliers to demonstrate compliance with Canadian law.

- Government bolster resources to CBSA to better equip officers with necessary training, tools and staff support to enforce Canada’s effort to ban entry of goods produced with forced labour and coordinate effectively with the United States and Mexico.

Reasons:

Canada’s trade with China is heavily imbalanced on most goods, and particularly on vehicles and vehicle parts. These imbalances are compounded by the disparities in the economic and social conditions of work. China is, by all accounts, a low-wage jurisdiction. It’s labour laws repress trade union independence and industrial democracy. The fundamental right to freedom of association and the right to strike are not sanctioned under law. This creates the conditions of artificially suppressing wages and, thereby, lowering the costs of production. China is also complicit in some of the most severe international crimes against workers, including forced labour. These actions are indefensible, intolerable and contrary to the international standards Canada stands by.

Canada has tools at its disposal to remedy these most egregious trade violations. Amendments to the Customs Tariff in 2020 enabled government officials to ban imported goods made in whole, or in part, with forced labour. This includes bans on aluminum products that, over recent years, have likely found their way into automotive parts and cars from the XUAR, made and sold in Canada. However, an absence of sufficient guidance and resources to assist in the effective implementation and utilization of this new law renders the ban meaningless. Such actions would not just apply to illicit goods from China, but those in other parts of the world.

The interaction between the Canada Border Services Agency (CBSA) and the Labour Program of Employment and Social Development Canada (ESDC) must be more clearly defined when assessing and confronting forced labour goods. Further, the federal government must issue clear guidance on the evidentiary standard for suspected forced labour goods that customs officials must follow. It is simply implausible, in most cases, to expect definitive evidence of forced labour in goods to be presented to customs officials responsible for enforcement. Therefore, it is important to enforce such laws, Canada follow the approach taken by US customs officials – enabling them with Withhold Release Orders (WROs) whereby goods suspected of forced labour (utilizing a reasonable evidentiary standard) may be withheld from entry, thereby putting the onus on importers and/or suppliers to confirm and validate otherwise. This reverse onus provision is essential in improving enforcement of Canadian law. Government must also allocate greater resources to both CBSA and ESDC to expand investigative and enforcement capacity, including special training.

Conclusion

Unifor recognizes the future of global automobility must coincide with efforts to reach net zero. This is the NorthStar guiding Canada’s automotive industrial strategy, one that is ambitious, intentional and comprehensive. The auto industry, and autoworkers, will play a vital role in a clean economy transformation, one that is only possible through government leadership and direction-setting from working people. Reaping the full benefits of a thriving automotive supply chain involves building the vehicles, manufacturing the components, processing the materials, mining and recycling the metals and developing critical technologies here at home.

China presents a direct threat to Canada’s ambitions. China has deployed policy tools to enable the growth of its domestic market that creates an imbalanced trading relationship. Worse, China is in breach of fundamental human and labour rights, creating an unfair competitive cost advantage and low-road industrial strategy that hurts workers. Evidence, past and present, suggests China’s tendency toward “structural overcapacity” and its desire to build a superpower automotive industry, will have negative consequences for Canadian workers and the North American auto industry – in the process of its own transition to EVs. Canada must use the policy tools at its disposal to level the playing field, and further its auto industrial strategy through complementary trade and labour policies, securing its objectives of economic growth, job security and prosperity for working people, along the path to net zero.

-Annex 1-

Major Greenfield Manufacturing and Processing Facilities Announced for Canada within the Auto-EV Supply Chain, since 2022

| Firm | Product | Location | Forecasted Direct Employment |

| NextStar | Battery cells and modules | Windsor, Ontario | 2,500 |

| PowerCo | Battery cells | St. Thomas, Ontario | 3,000 |

| Northvolt | Battery cells and cathode material | McMasterville, Quebec | 4,000 |

| Honda | Battery cells | Alliston, Ontario | 1,000 |

| Ultium CAM | Cathode material | Bécancour, Quebec | 200 (Phase 1) |

| EcoPro CAM | Cathode material | Bécancour, Quebec | 345 |

| Umicore | Cathode material | Loyalist Township, Ontario | 1,000 |

| Asahi Kasei | Separators | Port Colborne, Ontario | tbd |

| Honda CAM | Cathode material | tbd | tbd |

-Annex 2-

North American Automotive Investment in Electrification, Canada’s Share

Source: Center for Automotive Research; Unifor Research

Source: Center for Automotive Research

Source: Center for Automotive Research; Unifor Research

-Annex 3-

China Vehicle Production Forecast (2023-2031)

Source: AFS

-Annex 4-

Overview of Unifor Assembly and Powertrain Facility EV Product Programs (updated July, 2024)

| Facility | OEM | Current Production Status | Architecture Type | Confirmed EV Products (forecasted) |

| Ingersoll Assembly | GM/BrightDrop | Active | EV | ZEVO 600 ZEVO 425 |

| Oakville Assembly | Ford Motor Company | Idle/Retooling | ICE and EV | (Electrified Super Duty) |

| Windsor Assembly | Stellantis | Active/Retooling | ICE and EV | Pacifica PHEV (Charger EV) |

| Brampton Assembly | Stellantis | Idle/Retooling | ICE and EV | (Jeep Compass EV) |

| St. Catharines Propulsion | GM | Active/Retooling | ICE and EV | (Electric Drive-Units) |

| Windsor Engine | Ford Motor Company | Active | ICE | n/a |

| Essex Engine | Ford Motor Company | Active | ICE | n/a |

| Oshawa Assembly | GM | Active | ICE | n/a |

| Winnipeg Assembly | New Flyer | Active | ICE, EV and Hydrogen | Xcelsior Fuel Cell Xcelsior Hybrid Xcelsior EV |

| St. Eustache and Saint-François-du-Lac Assembly | Volvo/Nova Bus | Active | ICE, EV and Hydrogen | LFS HEV LFS Arctic Hybrid LFSe LFSe+ |

| Sainte-Claire Assembly | Volvo/Prevost | Active | ICE | n/a |

| Ste. Therese Assembly | Paccar | Active | ICE | n/a |