Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $42.8 billion 2.2% |

| EMPLOYMENT | |

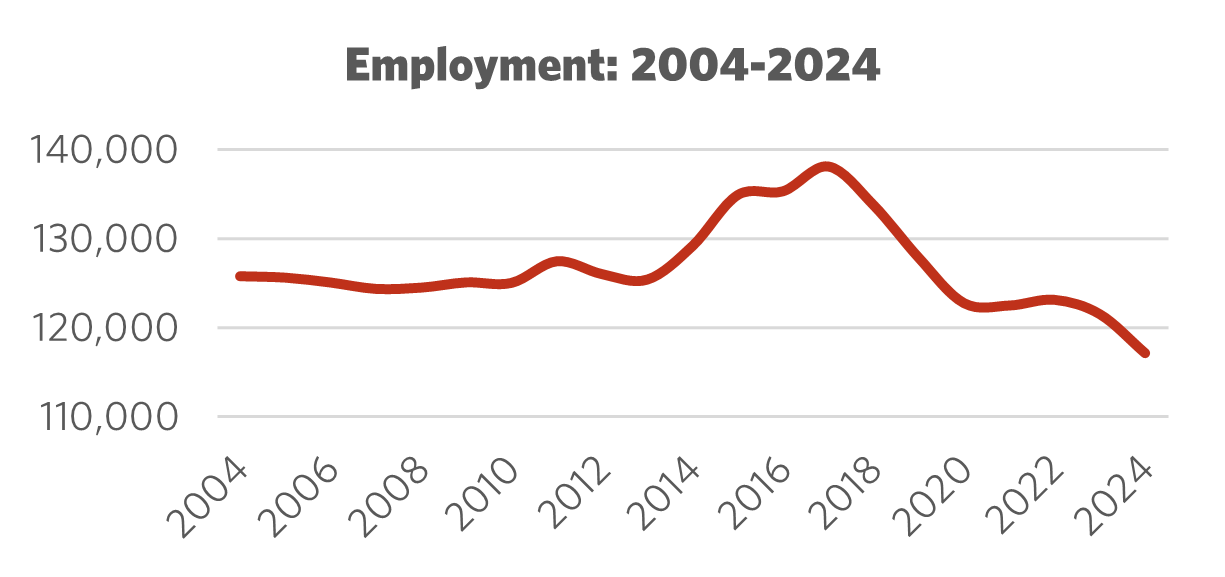

Total Employment 10-year change | 117,100 -9.3% |

| Percentage of part-time workers | 3.9% |

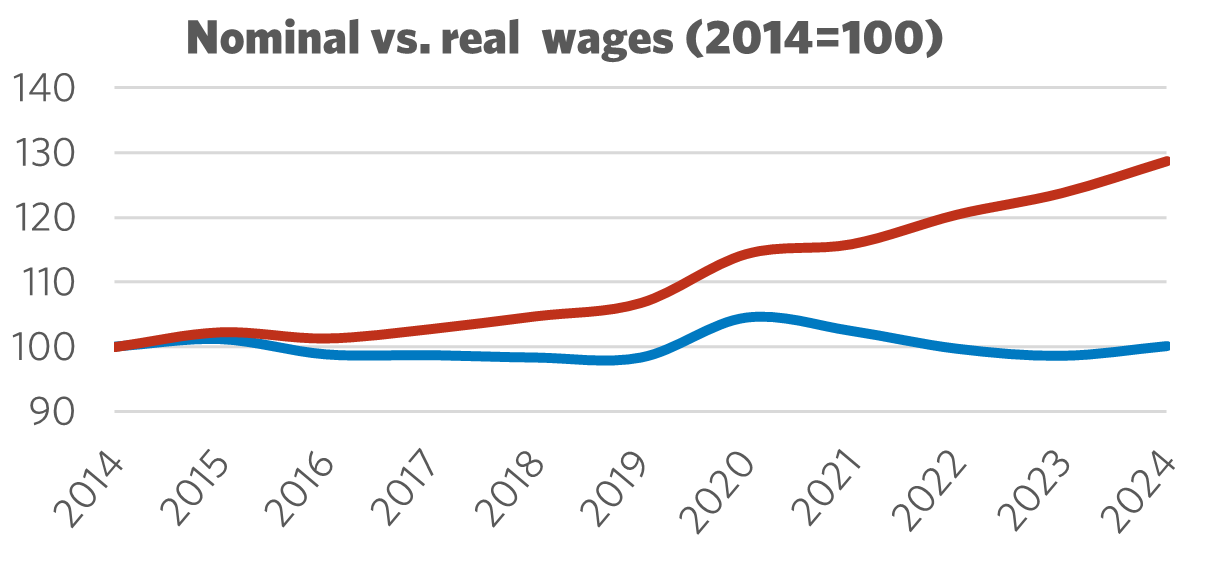

| Average hourly wage | $44.45/hr |

10-year real wage change | +0.1% |

| Average Work Hours/Week | 34.8 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 624kt -18.5% 0.1% |

| LABOUR | |

| Union Coverage Rate | 25.0% |

| Unifor Members in the Industry | 24,000 |

| Share of Total Unifor Membership | 7.5%

|

| Number of Unifor Bargaining Units | 157 |

Unifor in the Telecommunications Industry

Unifor is the leading union in the telecommunications sector, with approximately 24,000 members working at large and small employers across the country. Bargaining unit members include those working as technicians, customer service agents, office and clerical staff, and sales staff. Telecommunications is one of the union’s largest sectors and it is home to one of Unifor’s single largest employers, Bell Canada and its subsidiaries.

Three-quarters of sectoral membership works for Bell Canada or one of its subsidiaries including Bell Technical Solutions, Bell Aliant, Bell Western, Bell MTS, Expertech, Télébec, and NorthernTel. More than 10% of the membership works for SaskTel, and the remavining members work for a variety of private (sometimes publicly-traded) companies. Regionally, Ontario and Quebec make up two-thirds of sectoral membership, with the rest of the union’s members working throughout B.C., the Prairies and the Atlantic region.

| Select Unifor Employers | Approx. # Members |

| Bell Canada | 19,200 |

| SaskTel | 3,000 |

| Progistix | 265 |

| Wirecomm | 200 |

| Zayo Canada | 200 |

Current Conditions

The telecommunications industry has helped shape Canada’s economic and social landscape for nearly two centuries and continues to make substantial contributions to the economy, supporting hundreds of thousands of jobs and driving infrastructure investment. The industry is constantly evolving, with new technologies and applications that have genuine impacts on the everyday lives of Canadians and telecommunications workers. Regulatory developments, competition, service demands, economic conditions, security, and environmental concerns are among the many factors shaping the industry.

The COVID-19 pandemic demonstrated the critical importance of telecommunications infrastructure in keeping people connected and further entrenched society’s reliance on connectivity and digital services. Broadband internet and mobile wireless service are now considered essential services in order for Canadians to fully participate in society.

The Telecommunications Act governs telecommunications services and affirms the Canadian Radio-television and Telecommunications Commission (CRTC)’s power to regulate the sector. The federal and provincial governments have also played a role in supporting infrastructure development and service provision. However, the industry has been driven by largely unfettered competition between a few large companies and many small service providers, with light regulation from the CRTC.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Telecommunications Industry

With rapid changes in the industry through new technology, consumer demands, and other economic and societal factors, the telecommunications industry will look very different a decade from now. As the industry evolves, workers in Canada must not be left behind and the interest of everyday people who rely on these basic services must be protected. In order to meet these challenges, developing a unified industrial strategy that is supported by all levels of government and the industry is essential.

The U.S.-provoked trade war has illustrated the importance of domestic resiliency for any industry. Canada should tighten up foreign ownership rules and more tightly regulate the industry so that domestic capacity and Canadian workers are protected.

In recent years, the federal government (often partnering with provincial and local governments) has supported the expansion of terrestrial broadband internet infrastructure – especially in rural, remote and Indigenous communities. These investments should continue while exploring the possibilities for expanded public ownership of basic infrastructure and services, increased involvement from Indigenous communities in establishing their own infrastructure, and leveraging public infrastructure and technologies to expand services.

Meanwhile, telco companies have been transforming their operations beyond core network functions. In some cases, telecommunications companies are investing in related technological aspects like cloud computing, cybersecurity and artificial intelligence. Bell Canada, for example, suggests that the company is transforming from a “telco” to a “techco.” Laws and regulations need to catch up with the rapidly changing technology and industry. This includes a comprehensive legal framework for AI that protects fundamental rights, ensuring that jobs in Canada are protected from offshoring or technological transitions in the workplace, and ensuring that investments in foundational telecommunications infrastructure continue.

Sector Development Recommendations

- To support both the industry and connectivity for marginalized communities, the CRTC and federal government should continue to invest in terrestrial broadband infrastructure to improve access for rural and remote communities and partnering with Indigenous communities to establish locally-owned service providers and infrastructure.

- The federal government should establish a framework and mechanism for acquiring infrastructure assets from companies looking to divest, while also leveraging public infrastructure to expand services in targeted areas.

- The federal government and CRTC should establish funding criteria for approved projects that would create good local jobs and prevent offshoring and contracting out of project operations.

- The federal government should strengthen foreign ownership rules, including restricting the expansion of services in Canada and acquisition of basic telecommunications infrastructure by foreign entities.

- The Ministry of Artificial Intelligence and Digital Innovation must involve the voices of workers and unions in developing a comprehensive legal framework for AI and digital innovation.