Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $36.9 billion 1.9% |

| EMPLOYMENT | |

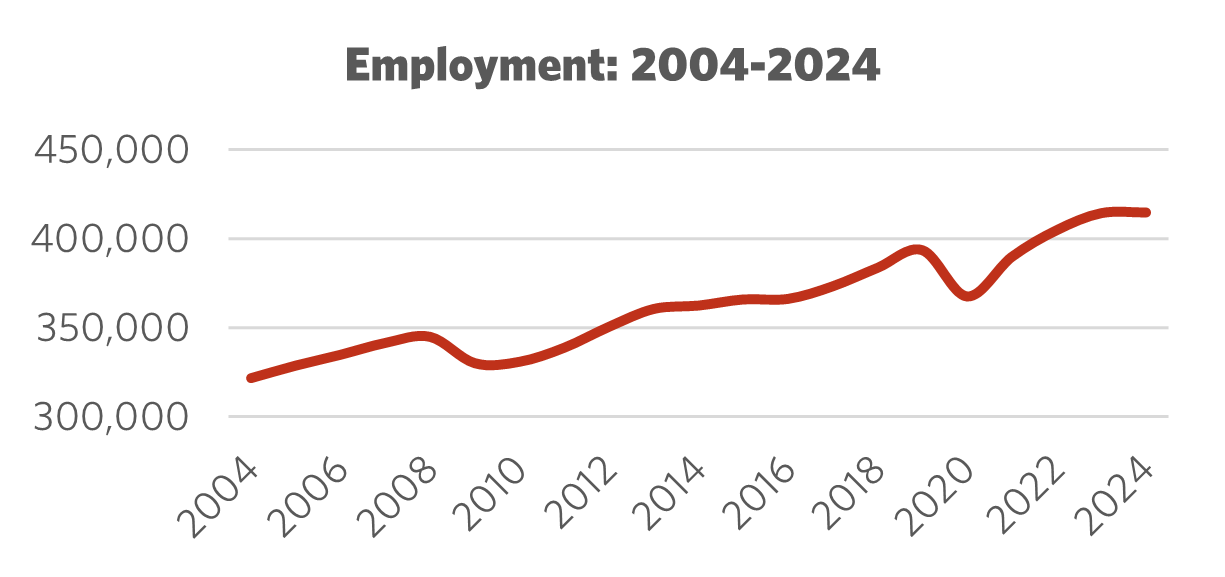

Total Employment 10-year change | 414,800 +14.4% |

| Percentage of part-time workers | 14.6% |

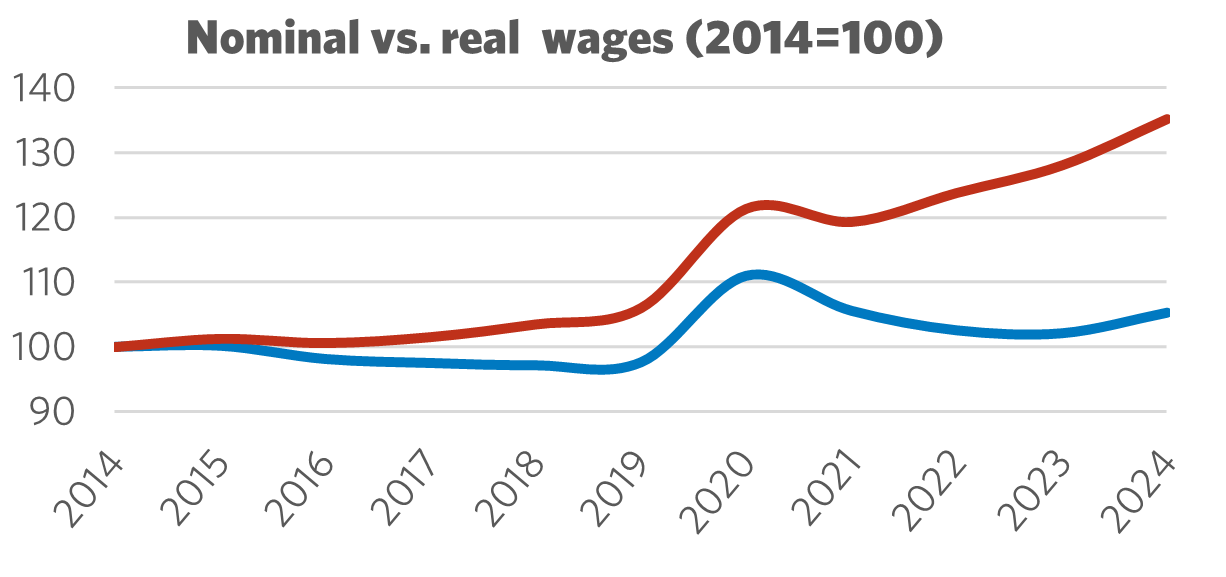

| Average hourly wage | $34.54/hr |

10-year real wage change | +5.2% |

| Average Work Hours/Week | 35.9 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 26,100kt -10.0% 4.1% |

| LABOUR | |

| Union Coverage Rate | 28.2% |

| Unifor Members in the Industry | 21,000 |

| Share of Total Unifor Membership | 6.6%

|

| Number of Unifor Bargaining Units | 154 |

Unifor in the Road Transport Industry

Unifor's road transport sector encompasses trucking, logistics services, taxi and transit operators, maintenance personnel, school bus drivers, the armoured car sector, and courier drivers. Unifor represents 21,000 members in this sector, spread across 154 bargaining units, accounting for 7% of the union's total membership. Members in the road transport sector work as directly employed drivers, owner-operators, and skilled tradespeople, including mechanics, technicians, and electricians. Additionally, they hold positions as guards, customer service representatives, and logistics support personnel, including clerical workers and cleaners.

In Ontario, Unifor members are also employed by Ontario Northland, Canada’s provincially owned rail service serving Northern Ontario. This rail service has recently resumed operations after years of being mothballed, addressing the needs of communities and industries in the North that could not be fully met by roads alone.

Unifor members work as owner-operators for CNTL, one of the largest rail freight trucking services in Canada. Additionally, Unifor represents workers across a network of port and inland services, unloading automobiles from ships for transport by rail and then by truck, known as auto ports.

| Select Unifor Employers | Approx. # Members |

| Coast Mount Bus Company | 5,200 |

| DHL Express | 2,100 |

| First Student | 1,180 |

| Brink's | 1,140 |

| BC Transit | 725 |

Current Conditions

The road transport industry contributed $36.9 billion to Canada’s gross domestic product (GDP) in 2024, which accounted for just under 2% of all economic output. The industry employs around 415,000 workers and handles 70% of Canada's domestic freight transport. In 2023, road transport facilitated 52% of imports and 40% of exports, with 31% of all U.S.-Canada trade passing through just five road crossings: the Ambassador Bridge in Windsor, Fort Erie/Niagara Falls, Sarnia, Emerson, and Lacolle.

The logistics and courier industry has experienced significant downward pressure on wages due to competition from casualized delivery services and a shift to digital platforms. Beyond wage competition, the industry faces challenges such as a lack of public and private investment in road transport infrastructure, insufficient access to clean and accessible washrooms, healthy food options, and safe, secure parking and rest stops.

Workers in the industry also contend with increasing levels of surveillance, automation, and deskilling brought on by the push to implement artificial intelligence and other digital tools in vehicles. AI systems provide management with easier ways to monitor and discipline workers.

The unregulated and untested application of new technologies undermines the work environment, particularly in the logistics and armoured car industries. The focus in these sectors remains on automating as much of the service as possible while expecting workers to perform flawlessly under increasing pressure.

Union coverage in the road transport industry was around 28% in 2024; however, union density varies significantly among different sub-sectors. Wage growth was stagnant in the years leading up to the COVID-19 pandemic, with real wages (adjusted for inflation) declining year-over-year. Wage growth has since accelerated, but historic levels of inflation have continued to subdue real wage growth in the industry, with real wages increasing by 5.2% over the past decade.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Road Transport Industry

The road transport industry will be heavily impacted by the U.S.-led tariff war. However, new procurement in these areas as well as economic activity generated by large nation-building projects present significant opportunities to expand Canadian production of transit and logistics vehicles, as well as electric charging infrastructure.

Investing in made-in-Canada electric delivery vehicles and charging infrastructure would enhance the Canadian logistics transport industry's capacity. Coupled with an expansion of charging station infrastructure and utility-owned programs that build weather-tested charging stations, this initiative will expedite the transition to low-emission vehicles across the sector.

Casualization has become a significant concern for operators and drivers, as companies adjust their tactics to avoid unionization. In many cases, salaried drivers have been replaced by misclassified dependent contractors operating as owner-operators or casual labourers.

Labour protections and unions are crucial for ensuring supply chain security and resilience. Implementing wage floors and sectoral bargaining similar to those in British Columbia's port trucking sector can help reduce wage suppression and casualization. Free and fair collective bargaining supports the working conditions and wages necessary to attract highly skilled labour to these sectors and retain economic resources in Canada.

Transport surveillance technology is primarily designed and developed by companies based in China or the U.S. The data from these surveillance and AI systems is often stored in foreign data centers. Legislation addressing privacy, surveillance, and AI should be adapted to ensure that data collected on Canadians complies with domestic storage regulations. Research programs supporting the regulation of AI and surveillance services should align more closely with European standards. Such alignment could promote the development of safer and more sustainable data services in logistics and safety.

Emissions standards for cross-border trucking have relied on American research programs, and a focus on harmonization has driven investment. Changes to American emissions standards will impact heavy truck and trailer regulations. Consequently, Canadian government industrial research arms will need to compensate for the loss of American regulatory research programs within their Department of Transportation. Additionally, research investments have always been necessary to address the unique Canadian environment and geography.

Sector Development Recommendations

- Unions must continue resisting efforts to privatize and further de-regulate rail transportation services. This only serves to erode working conditions and increase risks to worker and public safety.

- Significant investment is needed to revitalize Canada’s national passenger rail service. This includes expanding service across the country, twinning tracks, prioritizing passenger services on tracks, enhancing service frequency, and modernizing equipment.

- Automation and surveillance technologies continue to be implemented with little regulation or federal industrial research, negatively affecting employment and safety.