Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $236.2 billion 12.0% |

| TRADE | |

| Exports | $9.5 billion |

| Imports | $10.1 billion |

| Export reliance | 0.4% |

| U.S. dependence | 0.2% |

| Foreign Trade Balance | -$0.6 billion |

| EMPLOYMENT | |

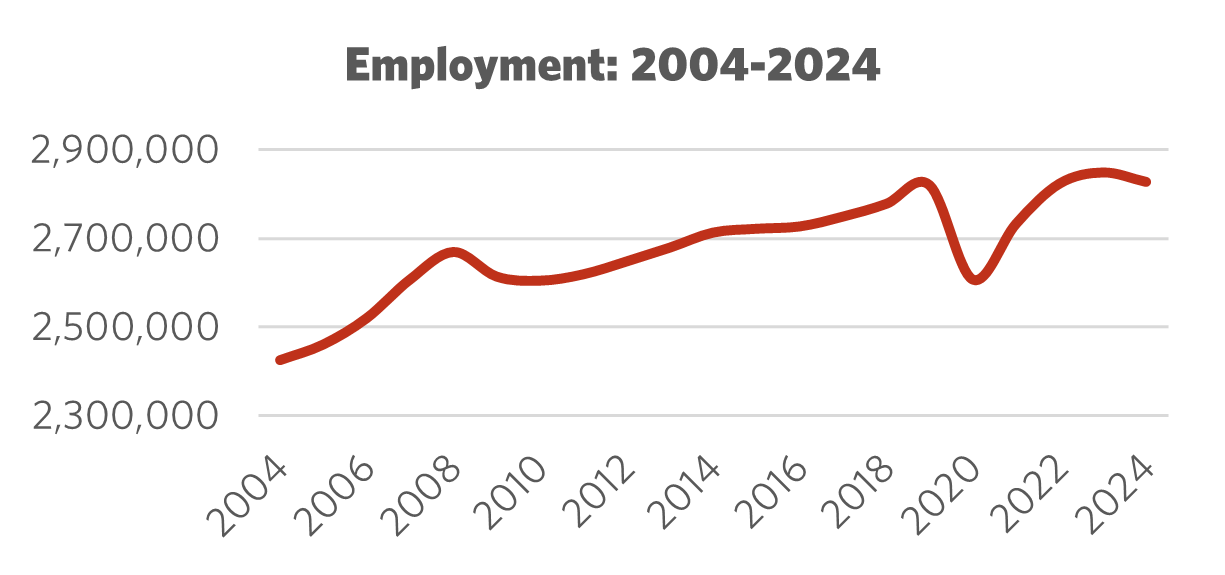

Total Employment 10-year change | 2,826,900 +4.2% |

| Percentage of part-time workers | 28.4% |

| Average hourly wage | $30.34/hr |

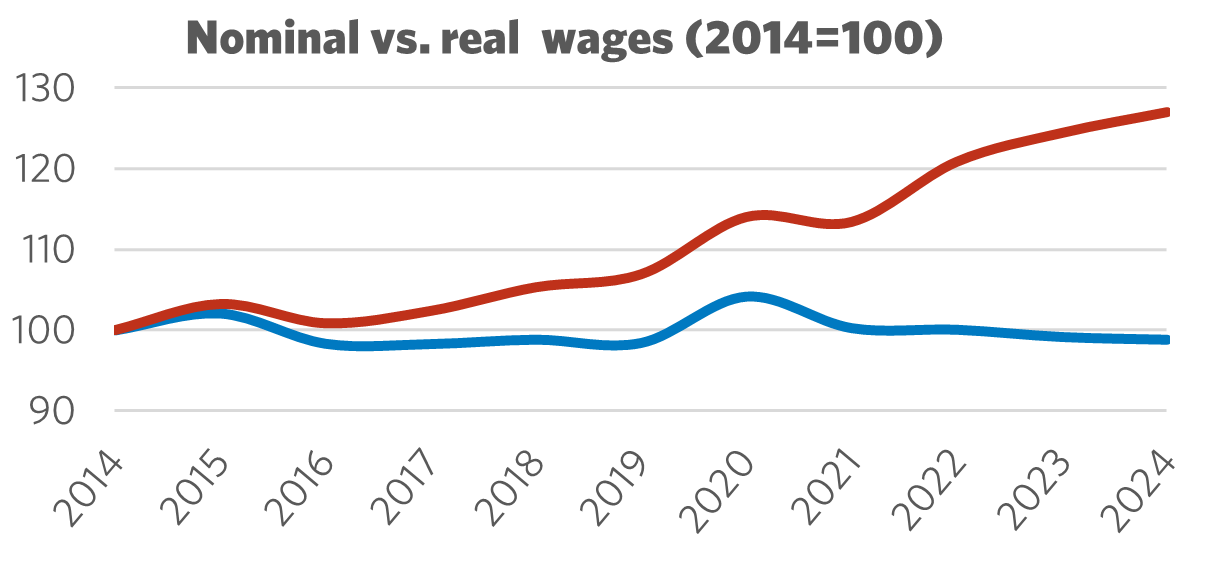

10-year real wage change | -1.2% |

| Average Work Hours/Week | 32.9 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 10,800kt -43.0% 1.7% |

| LABOUR | |

| Union Coverage Rate | 11.9% |

| Unifor Members in the Industry | 18,000 |

| Share of Total Unifor Membership | 5.6%

|

| Number of Unifor Bargaining Units | 50 |

Unifor in the Retail and Wholesale Industry

Approximately 6% of Unifor members work in the retail and wholesale sector (and associated warehousing sectors), corresponding to around 18,000 members. The union’s retail and wholesale membership spreads across more than 100 bargaining units and 8 Canadian provinces, although nearly 80% live and work in Ontario and a further 13% in Atlantic Canada.

This sector has below average levels of unionization, with 88% of retail workers in Canada having no collective bargaining coverage. Although low unionization presents challenges, it also presents enormous organizing opportunities. A wave of new Unifor organizing, including at Wal-Mart and Amazon warehouses, signals a hopeful trend.

The five largest employers in this sector employ 80% of Unifor members, namely Metro (including Food Basics), Loblaws (including Dominion Stores, Valu Mart, Y.I.G., Real Canadian Wholesale Club, No Frills and Shoppers Drug Mart), Sobeys (including FreshCo), Wal-Mart (Mississauga Distribution Centre) and Birch Hill Equity Partners (Rexall Pharma Plus). The remaining 20% work in a wide array of retail, wholesale and warehousing establishments.

| Select Unifor Employers | Approx. # Members |

| Metro | 7,000 |

| Loblaw | 5,300 |

| Sobeys | 1,000 |

| Wal-Mart | 900 |

| Rexall | 350 |

Current Conditions

Canada’s retail industry is considered a bellwether of the broader economy. When retail sales rise and consumers are confident enough to spend money, analysts predict the economy must be strong. Conversely, when retail sales fall, economic storm-clouds are on the horizon. This, of course, is an over-simplified assessment. Canada’s retail and wholesale industry is large, diverse and dynamic – generating more than $800 billion in sales in 2024. It comprises many different sub-sectors (from car sales to comic books), each with unique characteristics. With more than 2.8 million workers, it is also among Canada’s largest single employment sectors.

Despite its significant contributions to Canada’s economic success (retail represents 12% of Canada’s Gross Domestic Product), the retail sector is notorious for highly precarious jobs. Retail workers earn below average wages and are more likely to work in part-time jobs, with few benefits and erratic schedules. Flexible work arrangements are attractive for some, but not all, and employers have grown accustomed to a ready pool of transient workers to keep costs down. Despite possessing a range of important but often undervalued skills, including customer sales, time management, conflict resolution and product knowledge, retail is widely considered a stepping-stone industry – a temporary employment waystation, on the road to something better. This mischaracterization of retail work diminishes its value, creates barriers to unionization (with less than 12% of workers covered by a collective agreement) and dampens career expectations.

The COVID-19 pandemic thrust retail workers into the spotlight. Selflessly, retail and wholesale workers in essential sectors (including grocery stores and pharmacies) put their health at risk to serve others. Despite recent and notable wage and benefit breakthroughs for unionized workers, including those in Unifor-represented supermarkets, employment conditions are still lagging. Investments in automation and advancements in online retailing are displacing workers and forcing traditional retailers (like Hudson’s Bay Company) into bankruptcy.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Retail and Wholesale Industry

Efforts to foster a more successful, responsive and durable retail and wholesale sector in Canada must intersect with policies to improve working conditions, raise wages and create more stable jobs. There is no reason to believe that part-time, low wage work must define the retail and wholesale sector. Advanced economies, like Sweden, are proof these service jobs can be good, career-oriented jobs, with high levels of unionization and workplace benefits. In 2023, Unifor negotiated a landmark collective agreement with Metro supermarkets providing an immediate and unheard-of $2/hour pay increase for full-time and senior part-time workers, which was patterned across the unionized segment of the retail sector. Positive change for workers in this sector is achievable when workers organize, prioritize their demands and are willing to fight for them.

The retail landscape is rapidly changing through technology and corporate restructuring; it is imperative that governments play an active role in managing this shift. Retail workers need job guarantees in the face of technological advancements and opportunities for employer-funded upskilling. At the very least, retail workers need better access to income supports. This includes expanded eligibility to Employment Insurance (EI), as well as stronger wage and severance protections in the event of corporate bankruptcy.

Governments must also work with unions to improve employment standards in the retail sector. This includes legislating minimum work hour guarantees, paid sick days, tackling deep-seated age and gender-based pay disparities, as well as access to workplace benefits and pensions. Streamlining the process for retail and wholesale workers to join a union will also go a long way to raise standards in this sector.

Sector Development Recommendations

- Identify opportunities to coordinate collective bargaining within targeted sectors, and set strong pattern agreements to raise work standards, led by Local Union leadership.

- Campaign for stronger, fairer minimum wages, eliminate substandard “student” wages and negotiate wage-enhancement provisions, including those that guard workers’ wages against the rising cost of living.

- Legislate equal treatment provisions for full-time and part-time workers, including on hourly pay rates and access to benefits.

- Require employers to engage in good faith, collaborative and transparent dialogue with employers on advancing new technologies.

- Continue to push back against the rise of precarious, temporary and involuntary part-time work that provides fewer benefits and less job security, and negotiate more full-time jobs.

- Identify inequities in pay, benefits and job opportunities, based on gender and race, and develop strategies to break down barriers to workplace equity.

- Focus on mental health and implementing rigorous safety standards and accountability with employers who put profits before worker safety.