Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $9.8 billion 0.5% |

| EMPLOYMENT | |

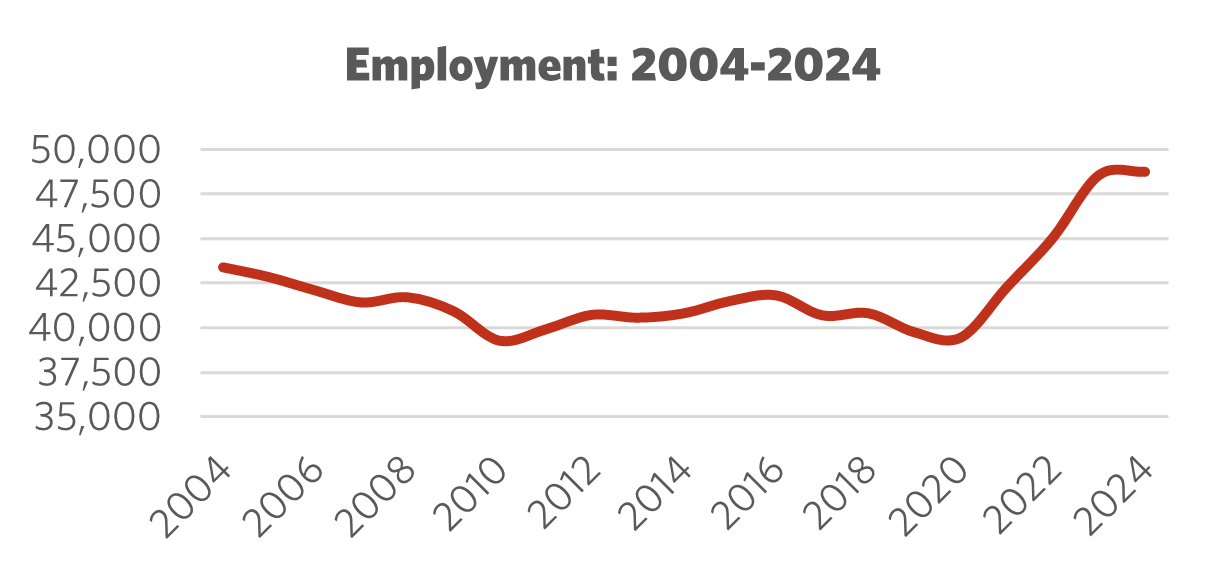

Total Employment 10-year change | 48,750 19.5% |

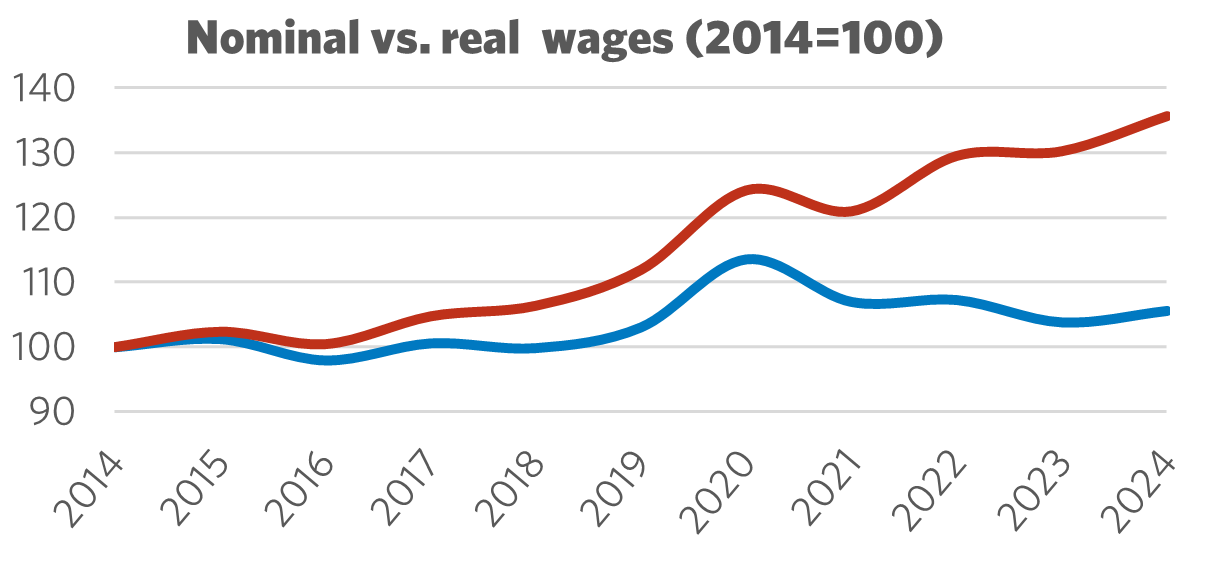

| Average hourly wage | $44.95/hr |

10-year real wage change | +3.8% |

| Average Work Hours/Week | 38.1 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 5,530kt -3.1% 0.8% |

| LABOUR | |

| Union Coverage Rate | 67.9% |

| Unifor Members in the Industry | 9,000 |

| Share of Total Unifor Membership | 2.8%

|

| Number of Unifor Bargaining Units | 37 |

Unifor in the Rail Transport Industry

Unifor represents over 9,000 workers in the rail sector, spread across 37 bargaining units, accounting for just under 3% of total Unifor membership. The union's rail members are distributed throughout the country’s extensive rail system, working in a variety of positions, including skilled trades such as mechanics, diesel mechanics, locomotive engineers, and electricians, as well as owner-operators, clerical staff, customer service representatives, hotel operations, and food services. Just over two-thirds of all workers in the sector are covered by a collective agreement, and approximately a quarter of all rail workers in Canada are Unifor members.

In Ontario, Unifor members are also employed by Ontario Northland, Canada’s provincially owned rail service serving Northern Ontario. This rail service has recently resumed operations after years of being mothballed, addressing the needs of communities and industries in the North that could not be fully met by roads alone.

Unifor members work as owner-operators for CNTL, one of the largest rail freight trucking services in Canada. Additionally, Unifor represents workers across a network of port and inland services, unloading automobiles from ships for transport by rail and then by truck, known as auto ports.

| Select Unifor Employers | Approx. # Members |

| Canadian National Rail | 4,400 |

| VIA Rail | 2,000 |

| Canadian Pacific Rail | 1,400 |

| Ontario Northland | 380 |

| CNTL | 250 |

Current Conditions

The rail sector in Canada is essential for transporting goods and people between provinces and into northern remote communities. For some areas, rail remains the only means for regular freight shipments and passenger travel.

VIA Rail, a publicly owned Crown corporation, operates the only inter-provincial passenger rail service in Canada. With 3,400 employees, the company carries 3.3 million passengers annually and serves over 400 communities. VIA Rail owns more than 70 locomotives, over 350 train cars, and 61 rail stations.

However, VIA Rail does not own the majority of the tracks it operates on or the signalling systems, requiring it to rent access from the private rail companies CPKC and CN. VIA Rail trains have no legislated priority on these tracks, which results in some of the most disrupted passenger rail services in the world.

Recently, the government announced the privatization of part of VIA Rail's operations under the Alto subsidiary. Alto is set to provide high-speed rail service between the Toronto and Quebec City corridor, with plans for fully privatized operations, maintenance, and service along this new route.

For freight travel, Canada has two major Class I railroad companies: CN (Canadian National Railway Company) and CPKC (Canadian Pacific Kansas City Limited). CPKC and CN own and operate the tracks and signalling across 75% of Canada's rail infrastructure. Both companies are based in Canada but also serve large areas in the USA, with CPKC having expanded operations into Mexico. Class II rail companies operate along 11,500 km of smaller short-line rail, moving freight alongside public commuter rail entities like GO Transit and West Coast Express. CN also directly owns a freight trucking subsidiary, CNTL, which connects rail-transported freight from rail yards to warehouses or port operations.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Rail Transport Industry

VIA Rail continues to face significant challenges in funding, operating without a legislative mandate. The recent procurement of new locomotives and cars has shifted to US-based rail manufacturers, resulting in service delays due to a mismatch between new technologies and the signaling systems used by Canadian rail companies.

For VIA Rail passengers, service delays have become the norm as trains share tracks with freight services. CN and CPKC own nearly 75% of all rail tracks in Canada, and over 90% of the tracks used by VIA Rail. Freight services continue to take priority over passenger services.

Rail is an essential component of intermodal and bulk transport services in Canada. It is often the only efficient way to transport consumable goods, grain, and ore over long distances between waterways and production centers. However, supply chains are increasingly strained by climate-related events, such as more frequent extreme heat, wildfires, floods, and windstorms. Major investments in upgrading rail infrastructure are necessary, along with advancements in technology to enhance current work processes and ensure the safety of workers and secure cargo.

Canada has become a low-regulation country where major rail companies operate with minimal oversight. The country relies heavily on the US Department of Transportation for much of its regulatory input. With recent significant cuts to that regulatory and research regime in the US, Canadians will no longer have access to important resources. Therefore, Canadian government investments in industrial research programs, regulatory enforcement, and testing of new technologies are becoming essential to fill the gap left by these US cuts. Additionally, research investments have always been necessary to address the unique Canadian environment and geography.

Sector Development Recommendations

- Unions must continue resisting efforts to privatize and further de-regulate rail transportation services. This only serves to erode working conditions and increase risks to worker and public safety.

- Significant investment is needed to revitalize Canada’s national passenger rail service. This includes expanding service across the country, twinning tracks, prioritizing passenger services on tracks, enhancing service frequency, and modernizing equipment.

- Automation and surveillance technologies continue to be implemented with little regulation or federal industrial research, negatively affecting employment and safety.