Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $1.6 billion 0.1% |

| EMPLOYMENT | |

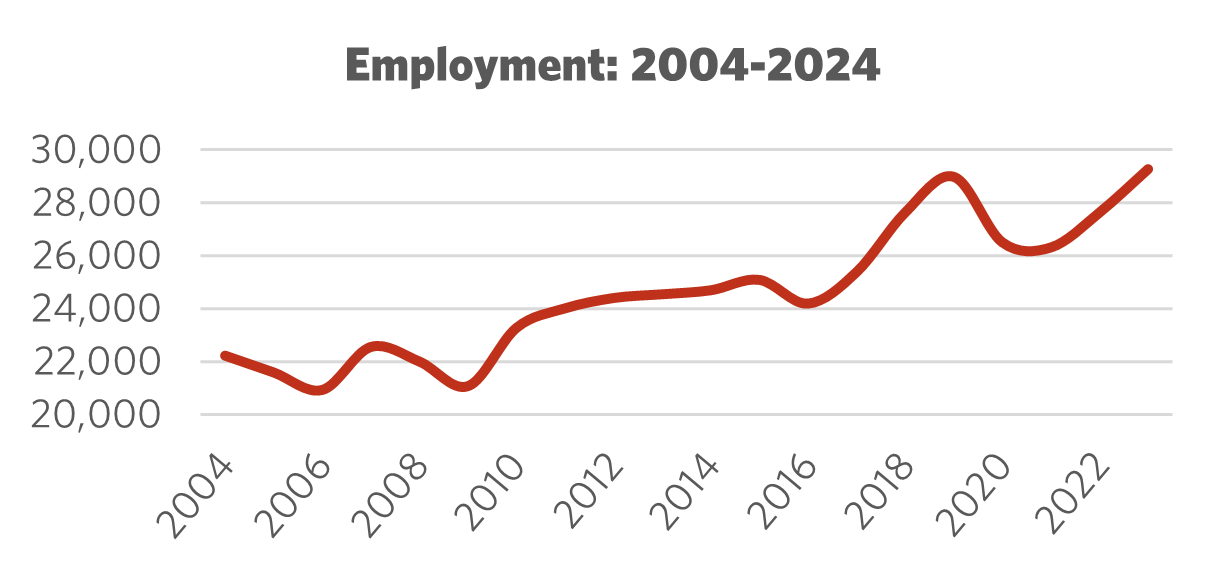

Total Employment (2023) 10-year change | 29,300 +19.3% |

| Percentage of part-time workers | 6.4% |

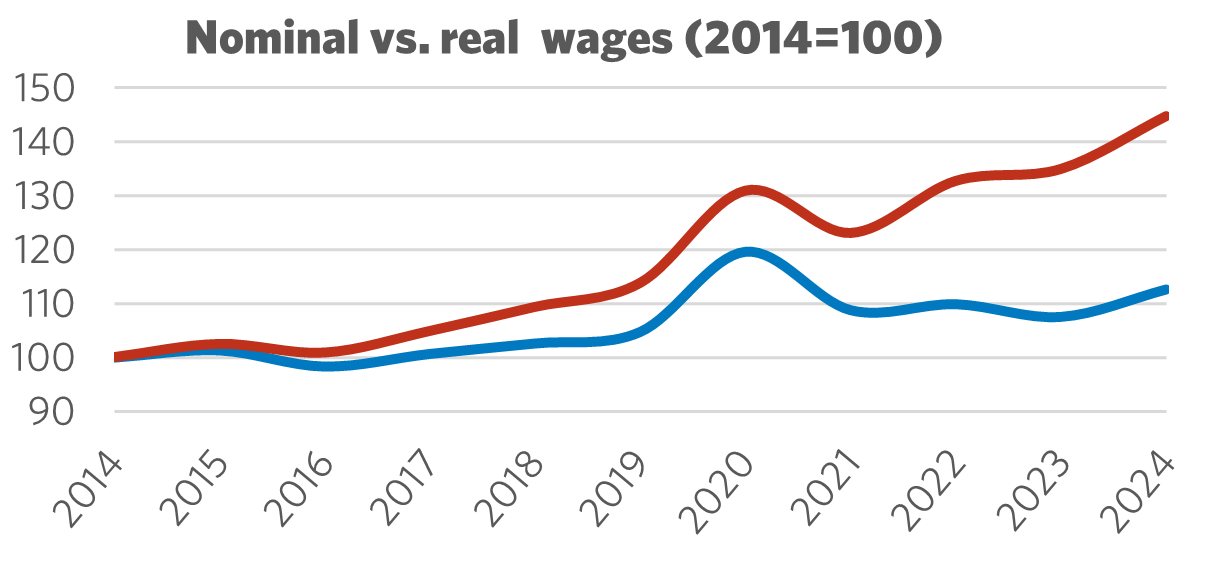

| Average hourly wage | $45.09/hr |

10-year real wage change | +12.7% |

| Average Work Hours/Week (2023) | 36.5 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 2,160kt -58.0% 0.3% |

| LABOUR | |

| Union Coverage Rate | 65.7% |

| Unifor Members in the Industry | 2,000 |

| Share of Total Unifor Membership | 0.6%

|

| Number of Unifor Bargaining Units | 26 |

Unifor in the Marine Transport Industry

Unifor represents 8% of marine transportation workers in Canada.

The majority of members work on passenger ferries, the largest being Marine Atlantic. An additional 535 members, represented under 6 collective agreements, work for the St. Lawrence Seaway Management Corp., which maintains and manages operations along the St. Lawrence River.

The union also represents nearly 300 communications officers working for the Canadian Coast Guard and 200 cargo shippers at Algoma Central.

| Select Unifor Employers | Approx. # Members |

| Marine Atlantic | 900 |

| St. Lawrence Seaway | 535 |

| Coast Guard Marine Communication | 280 |

| Algoma Central Corporation | 200 |

Current Conditions

Canada’s ports, harbors, and terminals are the main gateways for international trade, the fishing and seafood industry, energy transport, food and goods distribution, travel, and tourism, ensuring that coastal communities remain connected.

Marine transportation is regulated by Transport Canada and includes 563 port facilities, 883 fishing harbors, and 127 recreational harbors. The Canadian Port Authorities independently manage 17 ports on behalf of the federal government, while 35 are managed directly by Transport Canada. Canada’s commercial registered fleet (1,000 tonnes and above) comprises 727 vessels, totaling 3.7 million gross tonnes of capacity, including 1,440 barges. Canadian ferry services transport 53 million passengers and 21 million vehicles between coastal communities each year.

In 2024, the St. Lawrence Seaway moved $20 billion worth of goods through 15 locks, generating an estimated $12.3 billion in economic activity for Canada. The commodity with the highest volume shipped through the Seaway is grain, valued at $4.87 billion.

Canada has over 16% of the world’s coastal area, making marine travel the primary means of connecting bulk shipping from Canada to the global market. The marine sector is essential for domestic trade between coastal communities, along the Seaway, and in connecting Northern communities.

Recruitment remains the main challenge facing the marine sector, affecting skilled trades jobs and Coast Guard Marine Communications. Unifor members at the Seaway continue to deal with management efforts to contract out and automate work, which led to a strike in 2023.

Ferry services face challenges due to aging ships, resulting in frequent downtime and limited capacity along transport corridors. Significant delays in sector renewal and investment in infrastructure upgrades and expansion—caused by underfunding and privatization—are ongoing concerns for supply chain resilience.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Marine Transport Industry

Canada's ports, the Seaway, and the coastal ferry system must continue to expand to support international and inter-provincial trade. The marine transport of goods and energy products over the vast distances to the East, West, and North is essential for supporting Canadian production.

A Seaway cargo ship can transport the equivalent of 301 rail cars or 963 trucks, serving as part of the solution for domestic transport of energy products in the absence of pipeline capacity.

Canada's ferries facilitate the movement of people and goods as an extension of the Trans-Canada Highway, such as the route between Newfoundland and the mainland. Ferry services between the maritime provinces and Newfoundland and Labrador have been granted special constitutional status since 1949. Marine Atlantic carried over 20% of passenger transport (360,000 passengers across 1,750 crossings) and 92,000 commercial vehicles carrying goods, chemicals, and fuel to and from Newfoundland in 2023, using its four dual-use vehicle roll-on, roll-off ferries.

Canada should invest in port and yard capacity for the production, maintenance, and fueling of maritime vessels, including ferries, tugs, cargo ships, icebreakers, and coastal security vessels. Ensuring made-in-Canada options will support sovereignty, security, and supply chain resilience.

Sector Development Recommendations

- Investment is needed in the training and recruitment of Coast Guard communications personnel and skilled trades across the marine transport sector. Labour shortages and high turnover rates are significant concerns for the industry.

- Canada’s aging ferries pose a substantial risk to the coastal marine transport sector. Canadian shipbuilding capacity is limited and currently unavailable for ferry renewal, leading to our dependence on shipbuilding facilities elsewhere in the world.

- Canada’s shipping corridor must receive investment to increase capacity and meet the growing demands for East-West transport of bulk goods to export markets.

- Northern marine transport infrastructure needs to be expanded through government investment, including the development of an industrial strategy to address new and changing marine fuel and communication requirements.