Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $62.4 billion 3.2% |

| TRADE | |

| Exports | $144.7 billion |

| Imports | $244.6 billion |

| Export reliance | 73.8% |

| U.S. dependence | 60.3% |

| Foreign Trade Balance | -$99.9 billion |

| EMPLOYMENT | |

Total Employment 10-year change | 457,400 +7.1% |

| Percentage of part-time workers | 3.7% |

| Average hourly wage | $38.98/hr |

10-year real wage change | +2.5% |

| Average Work Hours/Week | 35.8 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 21,800kt -10.1% 3.45% |

| LABOUR | |

| Union Coverage Rate | 15.5% |

| Unifor Members in the Industry | 18,800 |

| Share of Total Unifor Membership | 5.9%

|

| Number of Unifor Bargaining Units | 272 |

Unifor in the General Manufacturing Industry

Unifor's 18,800 general manufacturing members represent close to 6% of the total union membership, distributed across 272 bargaining units. Major employers include Winpak, Ipex, Trench, Active Dynamic Group and Siemens Canada. By individual industry, general manufacturing members are predominantly in plastic and rubber manufacturing (20%), chemical manufacturing (17%), and electrical manufacturing (11%), which together account for just under half of all Unifor members in the sector. The remainder are in furniture manufacturing (9%), machinery manufacturing (7%), textile manufacturing (2%) and other or unclassified manufacturing workplaces (34%).

| Select Unifor Employers | Approx. # Members |

| Winpak Ltd. | 865 |

| Ipex Inc. | 435 |

| Trench Ltd. | 360 |

| Active Dynamic Group | 270 |

| Siemens Canada | 260 |

Current Conditions

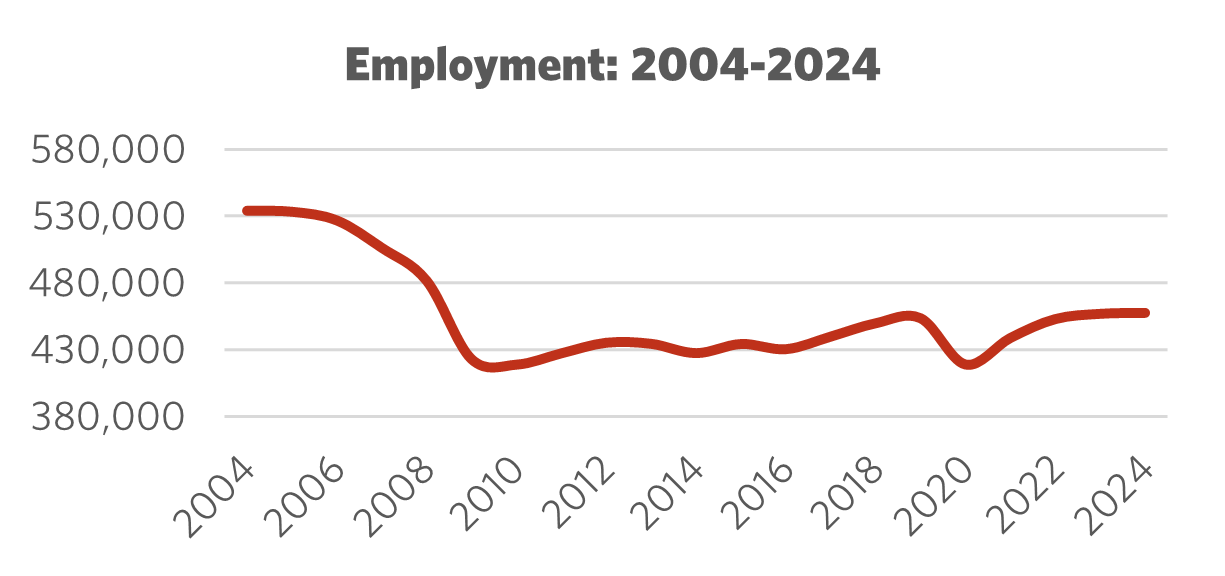

The Canadian manufacturing sector encompasses a diverse range of workplaces, many of which are captured in other detailed Unifor sector profiles. However, the general manufacturing sector in Unifor covers key industries such as textiles, chemicals, plastics, rubber, machinery, electrical equipment, furniture and others. Overall, this sector has faced significant challenges over the past two decades. Due to factors such as competition from foreign producers and trade imbalances, Canada lost nearly 130,000 general manufacturing jobs during the 2000s. This represented a substantial decline, as one in seven jobs in the industry disappeared during the 2004 to 2008 period alone.

After the 2008-9 financial crisis, Canadian manufacturing experienced a gradual recovery, which accelerated after 2016, only to see a substantial setback during the COVID-19 pandemic. Job levels in general manufacturing have since recovered to their pre-pandemic level, but employment gains in the post-pandemic period have been sluggish. Since 2014, however, employment in the industry has grown by a respectable 7%. Union coverage in general manufacturing sits at 15.5%, which is near the average rate for private sector industries, while part-time jobs comprise just 3.7% of all employment in the industry.

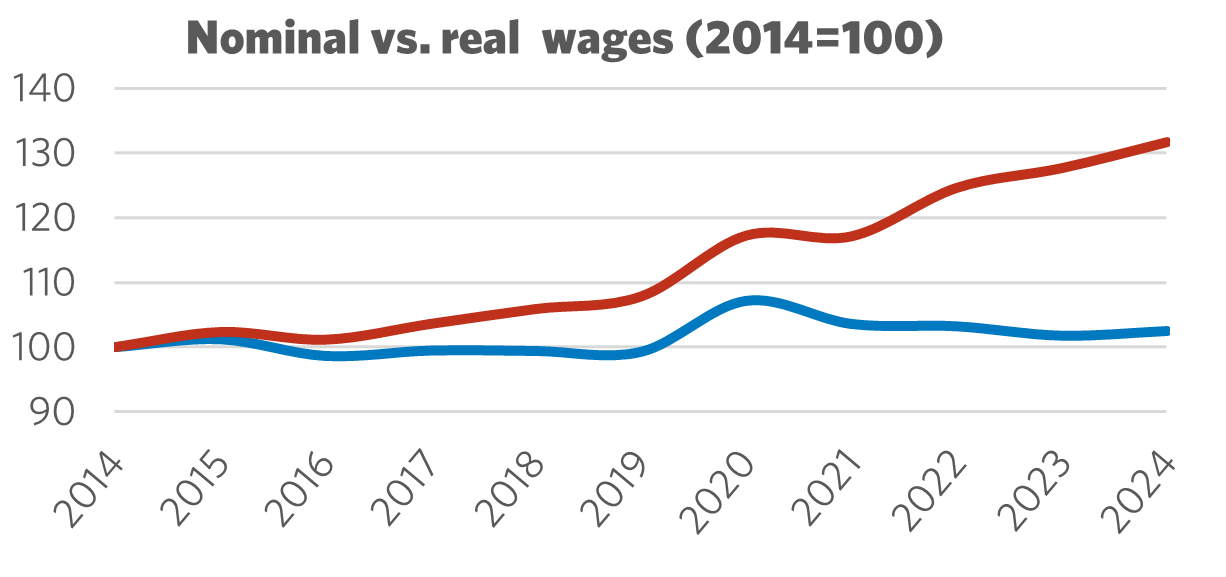

Nominal wages in general manufacturing were relatively stagnant from 2014 to 2019, with real wage growth slightly negative over this period of time as inflation outpaced wage gains in the industry. After 2019, however, wages began to increase sharply, although the past few years of historically high inflation has kept real wage gains relatively modest. Over the past ten years, the average real wage increase in the industry sits at 2.5%. On the environmental front, general manufacturing has substantially reduced its greenhouse gas emissions, which fell by more than 10% from 2012 to 2022. Its share of total industry emissions in 2022 was 3.5%, which is relatively proportional to its 3.2% share of Canada’s gross domestic product (GDP) in 2024, which amounted to $62.4 billion in economic output.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the General Manufacturing Industry

The general manufacturing sector has yet to regain all of the jobs lost during the difficult decade of the 2000s, but recent trends suggest that its component industries have been on a general economic upswing. However, with recent trade tensions between the United States and Canada, the sector is also particularly vulnerable to external shocks from the punitive tariffs of the Trump administration. The sector as a whole exported nearly 74% of total manufacturing shipments in 2024, while 60% of all shipments were exported to the U.S., underscoring just how vulnerable the sector is to the imposition of tariffs.

A negative trade balance of $100 billion in 2024 also signals tremendous opportunity to increase Canada’s autonomy and self-sufficiency when it comes to general manufacturing, which governments at both the provincial and federal levels have signalled greater interest in fostering. Such nation-building projects, however, must focus on a whole-of-supply chain approach to the revitalization of manufacturing in Canada, ensuring that intermediary and end products produced by the sector are linked to domestic raw materials and suppliers wherever possible. Establishing a coherent, and forward-facing industrial strategy for Canadian manufacturing is essential.

These industries are also highly dependent on the skilled trades, which governments at all levels must do more to support through enhanced training and apprenticeship programs. Impending demographic pressures on the skilled trades via an aging workforce and lower rates of apprenticeships among youth are critical issues that government must seek to rectify through greater promotion of the trades at a young age. Apprenticeship quotas should also become a standard condition of employers receiving government loans or grants. Finally, to ensure that the trades are an attractive and viable means to earn a robust income, governments should prioritize grants and loans for unionized workplaces and/or facilities that pay the prevailing regional wage.

Sector Development Recommendations

- Negotiate a permanent end to U.S. tariffs. Recent U.S.-Canada trade tensions have created paralyzing uncertainty for a sector that exported nearly 74% of its shipments in 2024, with 60% of all shipments going to the U.S.

- A significant trade deficit of $100 billion in 2024 highlights the need for Canada to enhance its manufacturing autonomy and self-sufficiency.

- A comprehensive industrial strategy approach to the revitalization of manufacturing should focus on linking domestic raw materials and suppliers throughout the supply chain.

- To address workforce challenges, governments must support skilled trades through improved training and apprenticeship programs, promote trades to youth, and tie apprenticeship quotas to government funding for employers.