Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $20.9 billion 1.1% |

| TRADE | |

| Exports | $38.8 billion |

| Imports | $16.2 billion |

| Foreign Trade Balance | +$22.6 billion |

| EMPLOYMENT | |

Total Employment 10-year change | 163,100 -8.1% |

| Percentage of part-time workers | 4.6% |

| Average hourly wage | $41.18/hr |

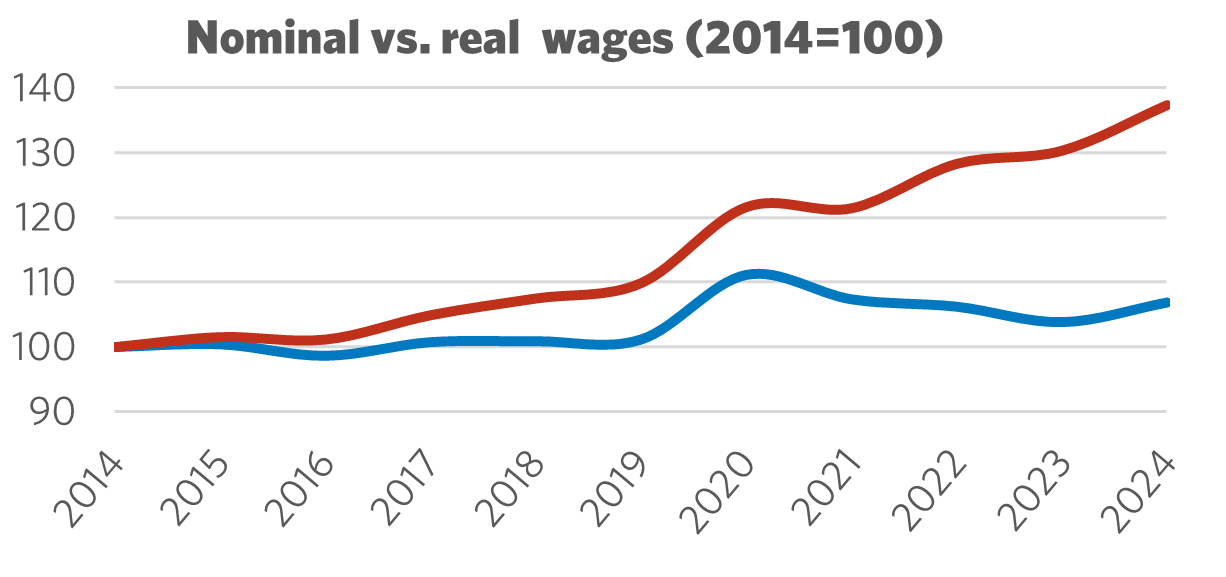

10-year real wage change | +6.9% |

| Average Work Hours/Week | 37.8 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 54,637kt -8.1% 8.65% |

| LABOUR | |

| Union Coverage Rate | 32.4% |

| Unifor Members in the Industry | 24,000 |

| Share of Total Unifor Membership | 7.5%

|

| Number of Unifor Bargaining Units | 271 |

Unifor in the Forestry Industry

With 24,000 members spread across 10 Canadian provinces, Unifor is Canada’s forestry union. Unifor’s members work in a variety of forestry, logging and firefighting occupations as well as wood product, bioenergy and pulp and paper manufacturing facilities.

The forestry sector makes up about 8% of Unifor’s total membership. Quebec has the highest concentration of forestry membership, accounting for about 50% of overall sectoral membership, compared to 18% in Ontario, 18% in Atlantic Canada, and 11% in British Columbia. Approximately 26% of sectoral membership work for the five largest employers, with the single largest employer—Domtar— accounting for just under 10% of members.

| Select Unifor Employers | Approx. # Members |

| Domtar | 2,300 |

| Kruger | 1,530 |

| JD Irving | 1,030 |

| Cascades | 780 |

| Atlantic Packaging | 540 |

Current Conditions

Canada’s forestry sector generates a gross domestic product (GDP) of $20.9 billion, representing 1.1% of the country’s total economic output.

With more than 163,000 workers, many of whom are based in rural communities, the forestry sector continues to be a critical creator of good, union jobs that support local economic development.

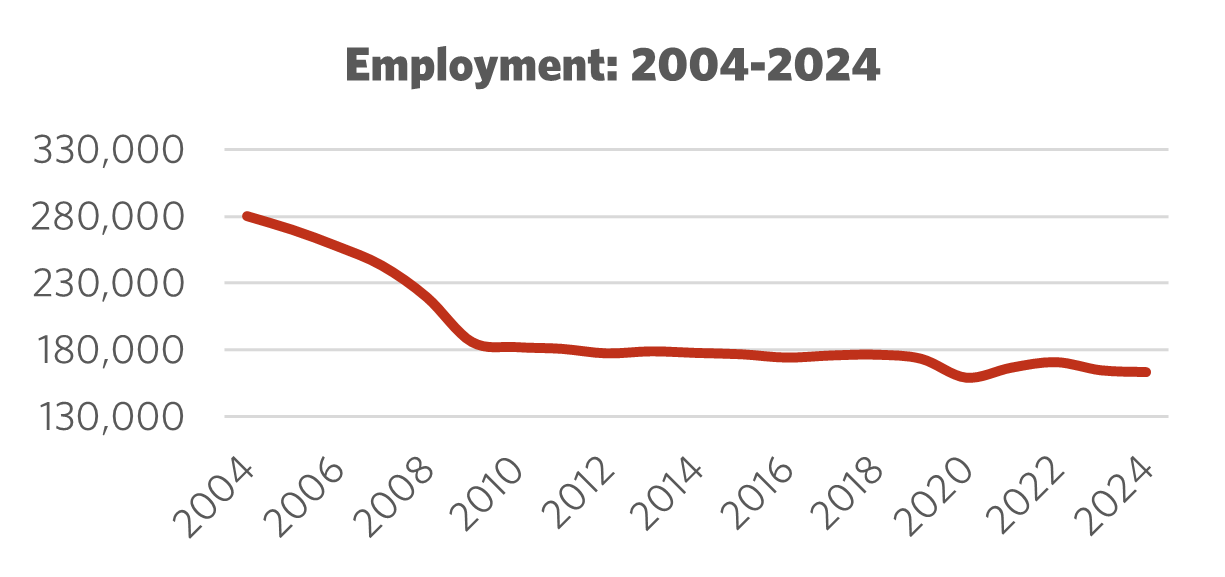

The story of Canada’s forestry sector continues to be one of difficult transition. Even before the global economic crisis in 2008, the industry had entered a period of wrenching decline and transformation, but the meltdown on Wall Street spelled further disaster for the forestry sector. The industry suffered multiple bankruptcies, closures and a wholesale restructuring of the corporate landscape.

Canada’s forestry sector continues to experience a perfect storm of repeated and intersecting crises, and a combination of economic, environmental, and global challenges continues to destabilize the broader sector.

The softwood lumber dispute and the persistent threat of U.S. tariffs have intensified a trade war that will cause disastrous repercussions across the forestry sector. Every season, wildfires pose a serious threat to Canada’s forests, forestry operations, and communities that depend on the industry. Important conservation measures, including species and habitat protection efforts, continue to complicate long-term planning for the sector. Volatile prices are still making companies think twice about investments, and new European regulations could negatively impact the ability of Canadian forest products to be sold in that market and around the world.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Forestry Industry

Over the past decades, Canadians have become increasingly aware of the related issues of climate change and the increasing frequency of climate-related natural disasters, habitat loss and the need for conservation, alongside the call for reconciliation and justice for Indigenous people across the country. Canada’s forestry industry exists at the nexus of these important issues, and the next decade will be full of challenges and opportunities for positive transformation.

Canada will have to build a path forward for the sector based on the idea of a sustainable “working” forest, founded on a commitment to reconciliation with Indigenous people, and guided by science-based principles of sustainability and habitat protection. Unifor will continue to fight for improved sustainability standards here at home, and around the world, and advocate for stronger public investment to support higher value-added production, the transition to new markets and green innovation.

The ongoing Canada-U.S. trade war has underscored the need to build new trading partnerships around the world, and to increase domestic demand for Canadian forestry products. Unifor has proposed an ambitious national homebuilding strategy, building on the existing Canada’s Housing Plan, which will connect Canada’s forests with the housing crisis. This national homebuilding plan will require federal, provincial and municipal governments to coordinate with forestry and housing stakeholders.

Looking ahead, there is reason to be optimistic about Canada’s forest sector. New and promising opportunities lay ahead in addition to Unifor’s proposed national homebuilding plan, including increased biofuel activity from forest residue and wood chips, modernizing building codes to integrate and mandate the use of wood, and more focus on second and third transformation of higher-value engineered wood products.

Sector Development Recommendations

- To protect the forestry industry, Canada must impose retaliatory tariffs to push against the U.S.-caused trade war, in addition to negotiating a new and fair softwood lumber agreement with the United States.

- Governments at all levels must support efforts to develop a national homebuilding strategy, building on the existing Canada’s Housing Plan, which will require federal, provincial and municipal governments to coordinate with forestry and housing stakeholders, and will connect Canada’s forests with the housing crisis.

- The forestry industry requires stronger public investment to support higher value-added production, transition to new markets and the pursuit green innovation.

- A National Forestry Council should be established to foster sustained dialogue among all stakeholders, and to develop a comprehensive federal forestry strategy.

- Reconciliation with Indigenous communities must be prioritized and while working in partnership to promote forestry sector development.

- The forestry sector needs increased sustainability at home while pursuing stronger standards around the world, with an emphasis on the viability of a sustainable “working” forest.