Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $167.0 billion 8.5% |

| EMPLOYMENT | |

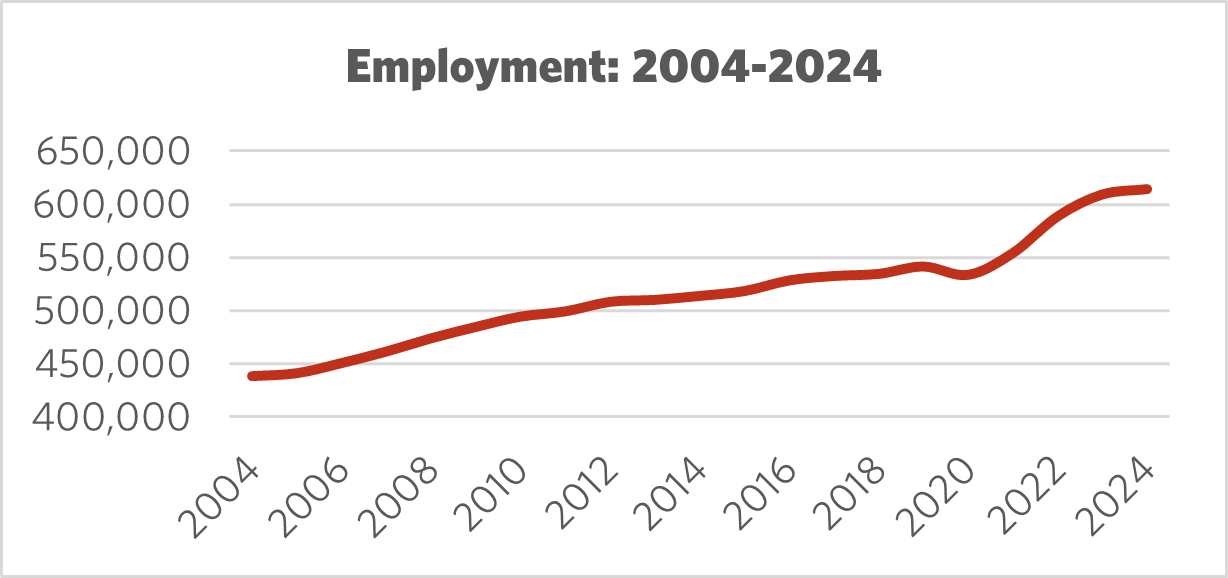

Total Employment 10-year change | 614,300 +19.5% |

| Percentage of part-time workers | 2.3% |

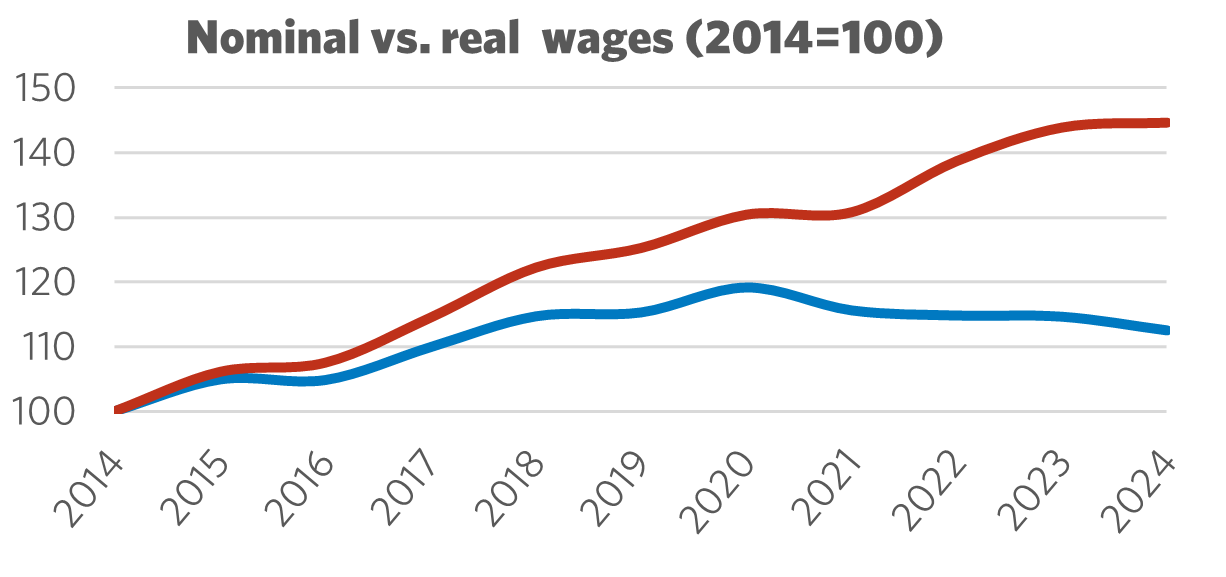

| Average hourly wage | $53.56/hr |

10-year real wage change | +12.5% |

| Average Work Hours/Week | 33.6 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 1,066kt 28.4% 0.17% |

| LABOUR | |

| Union Coverage Rate | 8.7% |

| Unifor Members in the Industry | 1,500 |

| Share of Total Unifor Membership | 0.5% |

| Number of Unifor Bargaining Units | 17 |

Unifor in the Financial Services Industry

Unifor represents 1,500 members in the financial services sector, spread out across five Canadian provinces. Most of Unifor’s members are concentrated in life and health insurance services. Green Shield Canada and American Income Life are the two largest employers, collectively representing over 70% of Unifor’s members in this sector. The remaining third of the union’s membership is active in credit unions across Ontario, British Columbia, Quebec, and Nova Scotia.

| Select Unifor Employers | Approx. # Members |

| Green Shield Canada | 670 |

| American Income Life Insurance Company | 225 |

| First Ontario Credit Union | 90 |

| East Coast Credit Union | 50 |

Current Conditions

Canada’s financial services sector generates $167 billion in gross domestic product (GDP) and is a significant contributor to the country's economy, accounting for 8.5% of total economic output.

The Canadian financial services sector is currently navigating a complex landscape characterized by increased resilience, technological advancements, and evolving economic conditions. While the sector has shown strength, particularly in the banking industry, it also faces significant challenges.

Canadian banks, credit unions and other lending institutions have a comparatively strong reputation for prudent lending and stress-testing their portfolios. However, high household debt makes the economy — and by extension, the financial sector — more vulnerable to economic shocks such as recessions and widespread layoffs. If a significant number of households struggle to service their debt, it could lead to increased defaults across various loan products, including mortgages, lines of credit, and credit cards.

Furthermore, a significant proportion of Canadian mortgages will face renewals in the coming years at higher rates than when they were initially taken out. Even with recent rate cuts, these renewals will still represent a substantial increase in payments for many households. This could lead to increased mortgage delinquencies and defaults, directly impacting bank balance sheets and requiring higher provisions for credit losses.

Insurance providers are also under considerable pressure. Economic headwinds, such as high inflation and severe weather events due to climate change, have driven up the cost of claims, which in turn result in higher premium costs. These increases hurt bottom lines, as clients often scale back on the range of insurance products they purchase in response to increasing prices. To mitigate such losses, employers in this sector are contracting out work, restructuring work systems, and adopting new technologies to maximize efficiency. To that end, companies in this sector have embraced artificial intelligence (AI); for example, chatbots and virtual assistants are being used to handle routine form processing and customer inquiries. This poses a significant threat to job security in this industry.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Financial Services Industry

The financial services sector has historically low unionization rates in Canada. Where unions are present, workers typically enjoy better pay and benefits, more predictable schedules, improved work-life balance, and greater job security compared to their non-unionized counterparts. The turmoil and uncertainty many workers in the sector are facing may prompt others to consider joining a union, helping to increase overall density rates in the sector and increase workers collective bargaining power.

With AI comes new risks. Employers in the sector need to understand ethical considerations, potential biases in AI systems, and implement robust cybersecurity practices to protect sensitive financial data and health information.

U.S. trade aggression toward Canada also creates significant uncertainty. President Trump has falsely claimed that Canada prohibits entry of U.S. lenders into its market, despite the presence of at least 16 U.S.-headquartered bank subsidiaries operating north of the border as of 2025. Regardless of the facts, a Trump-led campaign against alleged unfair treatment of American financial service providers may manifest in other ways, including new pressures to deregulate the industry. Canada must strengthen its resolve when dealing with pressures from the U.S. and business community to undermine existing sound regulatory practices.

Sector Development Recommendations

- Protect jobs against the growing use of AI, as employers look to save costs by using new technology to process basic claims and loans, and handle routine customer inquiries.

- Advance union organizing efforts in the private financial sector. Organizing remains challenging due to the fragmentation of workplaces, the diverse roles within the sector, and potential employer resistance.

- Resist employer efforts to contract out work, especially as businesses in the Canadian financial services sector navigate a complex and dynamic environment involving economic, technological and regulatory challenges.