Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $129.8 billion 6.6% |

| TRADE | |

| Exports | $189.6 billion |

| Imports | $47.2 billion |

| Foreign Trade Balance | +$142.4 billion |

| EMPLOYMENT | |

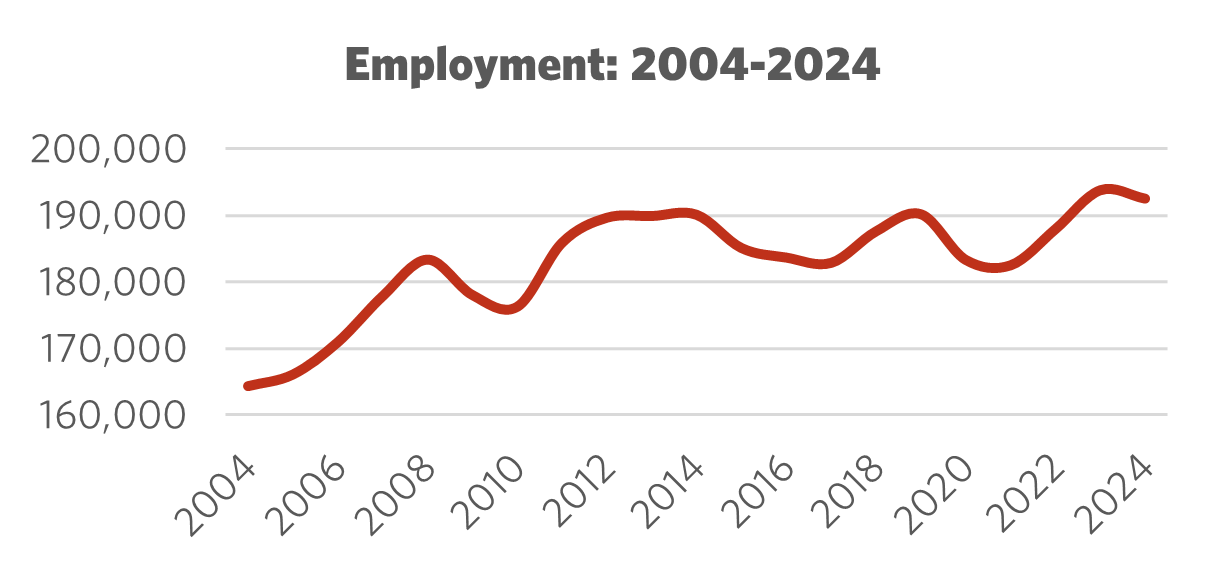

Total Employment 10-year change | 192,500 +1.3% |

| Percentage of part-time workers | 1.4% |

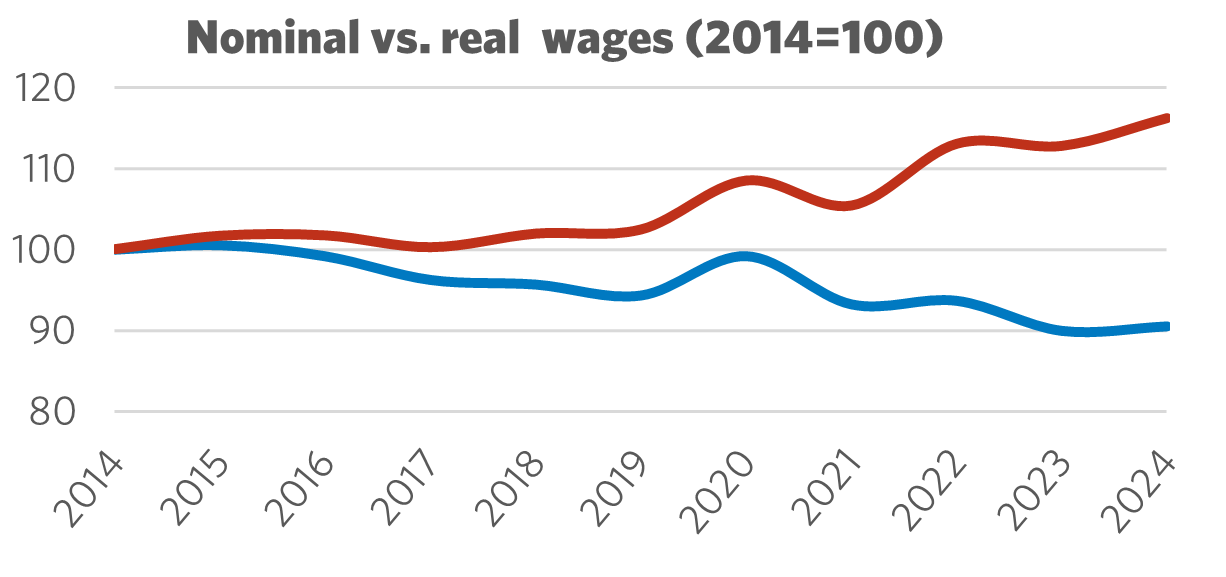

| Average hourly wage | $66.38/hr |

10-year real wage change | -9.5% |

| Average Work Hours/Week | 37.6 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) Change since 2012 Share of Canadian industry total | 276,122kt -12.5% 43.7% |

| LABOUR | |

| Union Coverage Rate | 39.8% |

| Unifor Members in the Industry | 15,000 |

| Share of Total Unifor Membership | 4.7% |

| Number of Unifor Bargaining Units | 137 |

Unifor in the Energy Industry

Unifor is Canada’s premier energy union, with 15,000 members working in oil and gas extraction, natural gas distribution, renewable fuels, pipelines, electric utilities, nuclear power, and petroleum refineries. More than half of Unifor’s energy sector members work in the Prairie region (Alberta, Saskatchewan and Manitoba) while just over a quarter work in Ontario. British Columbia, Quebec, Nova Scotia and Newfoundland together account for approximately one-fifth of Unifor’s energy sector membership.

The average union coverage rate for the energy sector overall is close to 40%, although this average is skewed by a union coverage rate within the utility sector of 70% where Unifor represents workers at SaskPower, Manitoba Hydro, Transalta, CANDU Ltd., and EnWave. In oil and gas production, the union coverage rate is closer to 20%, although Unifor represents approximately 70% of these union workers.

| SELECT UNIFOR EMPLOYER | APPROX. # MEMBERS |

| Suncor Energy | 4,000 |

| Enbridge | 1,400 |

| SaskEnergy/TransGas | 900 |

| SaskPower | 615 |

| Co-op Refinery | 700 |

Current Conditions

Canada’s energy sector employs 192,500 workers contributing 6.6% to total gross domestic product (GDP), making Canada the sixth-largest energy producer. Exports at nearly $190 billion in energy were sent to 123 nations in 2024, representing approximately 4% of the world’s energy output.

Canadian energy generation includes oil, natural gas, hydroelectricity, coal, nuclear power, renewable electricity, and biofuels. Fossil fuels constitute the largest share of Canada’s energy production at 77%, followed by nuclear energy at 8%. Canada exports almost all of its energy to the US: 97% of oil, 99% of natural gas, and 100% of its electricity, while acting as a subsidy to the U.S. market as Canadian energy is discounted relative to American domestic oil and gas prices.

Canada is the second-largest exporter of uranium globally, contributing 15% of global uranium production while also producing 3% of global nuclear power. Domestic uranium production, valued at $1.1 billion, comes from Saskatchewan mines, with 80% allocated for export. Canada’s own CANDU reactor designs operate at 19 reactor units domestically, with an additional 9 units deployed overseas. Unifor’s presence in nuclear energy includes engineers, uranium miners, and manufacturers of precision components for fuel and reactors.

Unifor has responded to the U.S. tariff threat by calling on both the government and employers to increase investment in "Made in Canada" value-added energy products, assert Canadian sovereignty over energy sector research and regulations, and limit procurement of nuclear energy expansion to Canadian-owned and developed CANDU technology. The impacts of the tariffs and American subsidies for their own production is a reduction in the competitiveness of biofuel production in Canada. Canadian regulations on emissions and supports for investment in renewable fuels are not keeping up with the large shifts in economic and environmental policy around the world, putting parts of Canada's energy supply chain at risk.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Energy Industry

Canada must ensure that the transportation of energy, energy products, and electricity to and from value-added production centers – including refineries, chemical plants, plastics manufacturers, mid-stream utilization facilities, and storage sites – is sustainable, secure, and safe. To achieve this, the government should collaborate with unions, industry stakeholders, and research institutes to establish a comprehensive industrial strategy for the energy sector.

Canada should assert regulatory sovereignty over energy and energy products that serve as inputs for downstream domestic production. Procurement practices must promote the maintenance and growth of Canadian industrial production, supply chains, and the procurement of nuclear power and isotopes to enhance Canada’s energy security and maximize economic benefits. Governments can apply Canadian content rules to help incubate future-facing industries, such as domestic biofuels, to spur downstream energy production and employment growth.

The ongoing development and implementation of regulations on emissions, particularly methane, will be essential. Addressing emissions as potential risks to Canadian production and exports is crucial, as they can act as non-tariff barriers to trade. An effective industrial strategy must also include investment in research focused on sustainable production. Funding for Canada’s national research institutes is necessary to support emissions reduction across the energy and energy products sector.

Sector Development Recommendations

- Reduce Canada’s over-reliance on imported production inputs in the oil, gas, sustainable biofuel, and electricity sectors.

- To address the national security vulnerabilities associated with energy transport via pipelines, rail, and trucks that travel through the United States, the Canadian government should invest in developing domestic transport options for energy products.

- Diversifying inter-provincial transport infrastructure is essential to overcome the distance and geographical barriers to energy movement between the East, West, and North. Energy security includes connecting Canadian energy products to domestic industrial programs and communities.