Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $6.1 billion 0.31% |

| TRADE | |

| Exports | $51.9 billion |

| Imports | $84.9 billion |

| Export reliance | 94.5% |

| U.S. dependence | 90.7% |

| Foreign Trade Balance | -$33.0 billion |

| EMPLOYMENT | |

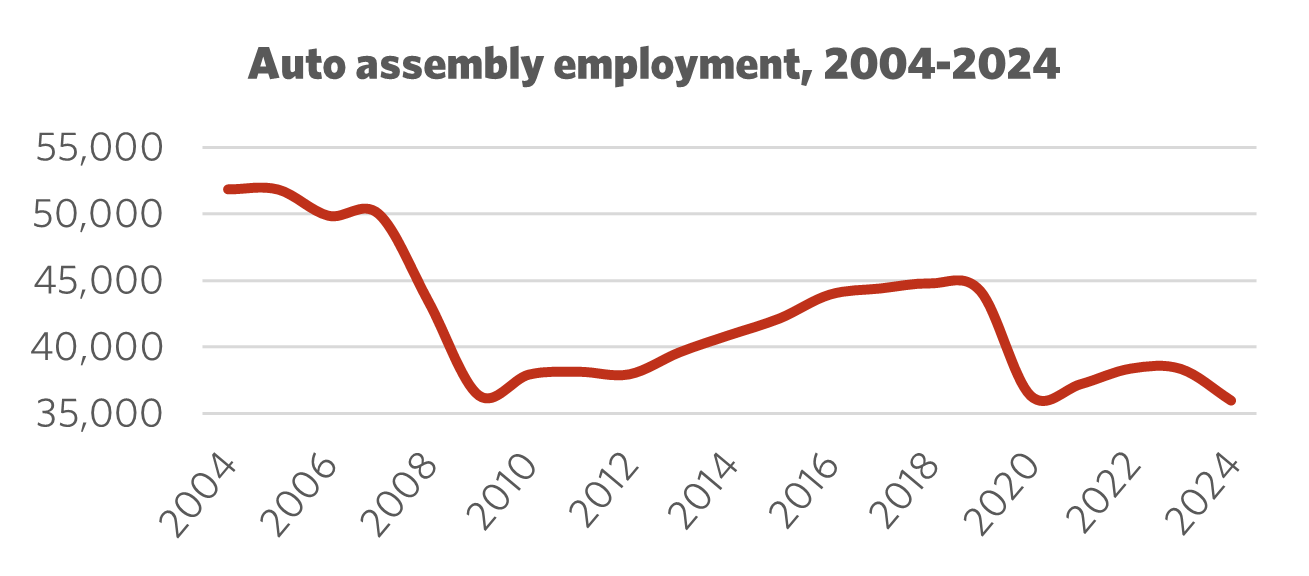

Total Employment 10-year change | 35,933 -12.1% |

| Percentage of part-time workers | 2.2% |

| Average hourly wage | $44.65/hr |

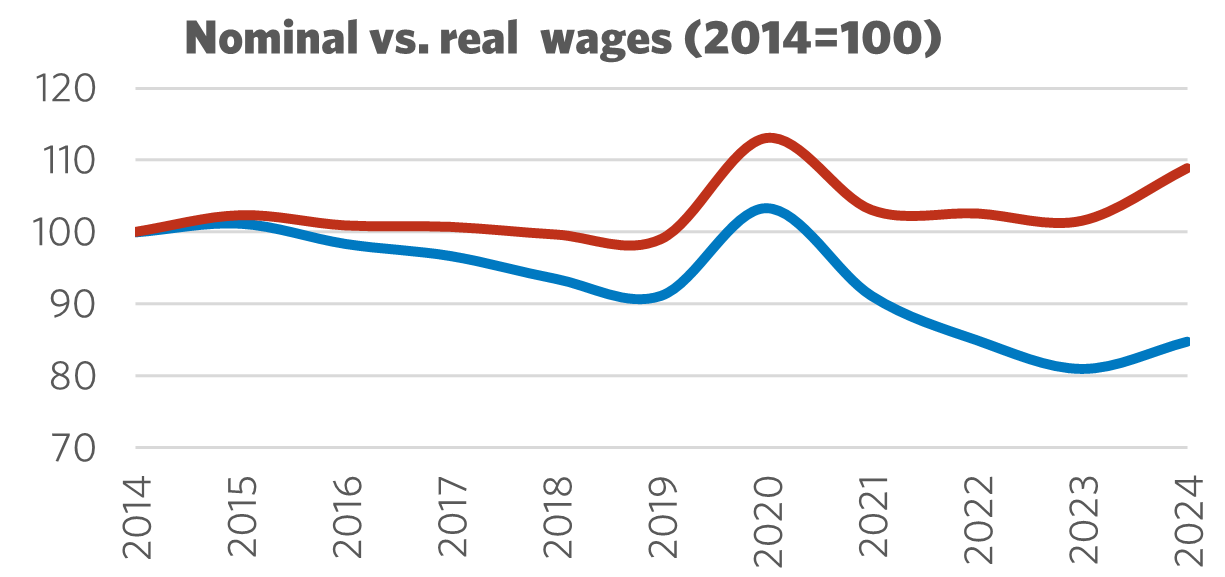

10-year real wage change | -15.3% |

| Average Work Hours/Week | 37.4 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 624kt -5.9% 0.1% |

| LABOUR | |

| Union Coverage Rate | 29.1% |

| Unifor Members in the Industry | 20,000 |

| Share of Total Unifor Membership | 6.3% |

| Number of Unifor Bargaining Units | 22 |

Unifor in the Auto Assembly Industry

Unifor is Canada’s predominant autoworkers union, with more than 18,000 members working in auto assembly and powertrain operations (i.e., engines and drivetrain components). Recently, Unifor reached a new agreement with battery cell-maker NextStar Energy, a joint venture between LG and Stellantis – the first agreement of its kind in Canadian history. The auto assembly sector makes up 6% of overall union membership, mostly located in Ontario.

Approximately half of all auto assembly workers in Canada fall under a Unifor collective agreement, which remains among the ‘gold standard’ labour contracts in Canada. Toyota and Honda, Canada’s non-unionized automakers, generally follow the wage and benefit provisions negotiated between Unifor and the Detroit 3.

Apart from production and skilled trades jobs, Unifor members also work in parts distribution centres, offices, engineering and testing, transportation and security.

| SELECT UNIFOR EMPLOYER | APPROX. # MEMBERS |

| Stellantis | 8,100 |

| Ford Motor Company | 5,000 |

| General Motors | 4,850 |

| NextStar Energy (battery cells) | 450 |

Current Conditions

Canadian autoworkers have been riding the highs and lows of an industry in transition and caught in the crosshairs of a needless trade war with the United States. Catalyzed by historic product investments secured in Unifor’s 2020 contract negotiations with the ‘Detroit 3’ automakers (Ford, General Motors and Stellantis – formerly Chrysler), the Canadian industry was on the upswing following decades of production decline, job loss and southbound capital flows.

Between 2020 and 2024, Canada secured more than $50 billion in automotive investment – primarily in the burgeoning electric vehicle (EV) supply chain – along with tens of thousands of new auto sector jobs, including the first-ever battery ‘gigafactories’ in Ontario and Quebec. As the pace of EV sales slowed, governments chose to wind down vehicle purchasing incentives and failed to deliver on necessary infrastructure (e.g., charging stations) to assuage concerns of wary consumers. With demand shifting, profit-hungry North American automakers recalibrated plans for EVs, leaning back into gas-powered vehicle programs instead. Product planning adjustments are nothing new to the auto industry, but the volatility it creates for workers in a period of major technological transitions is especially painful. Unifor addressed income security concerns in 2023 bargaining, delivering strong collective agreements with exceptional wage, benefit and pension gains, along with tailored transition supports, that raised the bar for workers everywhere.

Amid this industrial shift, Donald Trump’s election in 2024 upended any positive momentum. Trump’s aggressive tariff and anti-EV policies threaten to undo Biden-era clean tech investments, downgrade auto sales forecasts, and threaten permanent and lasting damage to the North American industry. All the while, fast-growing EV automakers – notably in China – ready themselves to dominate global sales and production.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Auto Assembly Industry

Donald Trump’s upending of the North American auto industry – at the first signs of resurgence in decades – is undoubtedly self-sabotaging. Not only was the auto industry benefitting from major new investments, but unionized autoworkers also made historic gains at the bargaining table in Canada, the U.S. and Mexico. In 2023, Unifor bargained wage settlements that were the highest on record, undoing many of the worker concessions mandated through corporate restructuring during the Great Recession.

Trump’s effort to steal away Canadian auto jobs by imposing stiff tariffs is both cynical and dangerous. There is no denying the half-century of deep integration between the Canadian and U.S. auto industries, ever since the 1965 Auto Pact. Undoing this through tariffs is proving a punishing exercise, hurting workers on both sides of the border. Building a strong, dynamic and forward-looking North American auto industry that delivers good, unionized jobs and protects them against damaging ‘free trade’ deals requires strategic planning – not machine-gun tariffs. Canada must do everything in its power to protect its domestic industry, while navigating an erratic Trump presidency. Companies that move production out of the country, for instance, must face consequences. Canada must leverage its market power, along with investment dollars, to secure and grow its auto manufacturing footprint. If an automaker wants to sell here, they must also build here.

Federal and provincial governments, in consultation with trade unions and industry, must collaborate on a coherent industrial strategy that focuses on building out a complete supply chain for future vehicles, from critical minerals to assembly. Developing the necessary skills, research and innovation at every node of the supply chain must be Canada’s comparative advantage, buffering against an advancing Chinese global automotive superpower.

Sector Development Recommendations

- Negotiate a permanent end to U.S. tariffs.

- Establish a comprehensive national auto sector industrial strategy, informed by Unifor and civil society stakeholders.

- Provide necessary public investments to protect and secure strategic product programs, including vehicle assembly mandates and component parts.

- Undertake a feasibility study for the establishment of an all-Canadian automaker.

- Grow good jobs in the auto sector by simplifying union certification rules in all jurisdictions, supporting inclusive hiring practices and promoting workforce diversity.

- Ensure that fair and balanced trade policy aligns with sector development goals.

- Support consumer adoption and government fleet purchases of Canadian-made vehicles through incentive programs, infrastructure upgrades and awareness-raising efforts.