Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $10.6 billion 0.53% |

| EMPLOYMENT | |

Total Employment 10-year change | 108,285 +8.6% |

| Percentage of part-time workers | 20.0% |

| Average hourly wage | $44.71/hr |

10-year real wage change | +7.1% |

| Average Work Hours/Week (2023) | 34.7 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 18,726 kt +7.4% 2.96% |

| LABOUR | |

| Union Coverage Rate | 56.0% |

| Unifor Members in the Industry | 17,000 |

| Share of Total Unifor Membership | 5.3% |

| Number of Unifor Bargaining Units | 41 |

Unifor in the Air Transport Industry

Unifor represents 17,000 workers in Canada’s air transport industry, from coast to coast to coast. Union members are involved in every facet of the industry, including air traffic navigation, customer service, janitorial services, and baggage handling. They direct flights, pilot aircraft, and serve as flight attendants. Additionally, they work as aircraft groomers, maintenance engineers, and ramp attendants, as well as managing airports and maintaining equipment. Unifor air transport members operate in both the northern and southernmost points of the country. In short, they are the driving force behind the industry.

Over 5% of Unifor’s membership is employed in the air transport sector, working across 41 bargaining units for 28 employers. The union coverage rate in the industry is 56%.

| SELECT UNIFOR EMPLOYER | APPROX. # MEMBERS |

| Air Canada | 6,500 |

| NAV Canada | 3,100 |

| WestJet | 1,750 |

| GTAA | 1,400 |

| Swissport | 1,300 |

Current Conditions

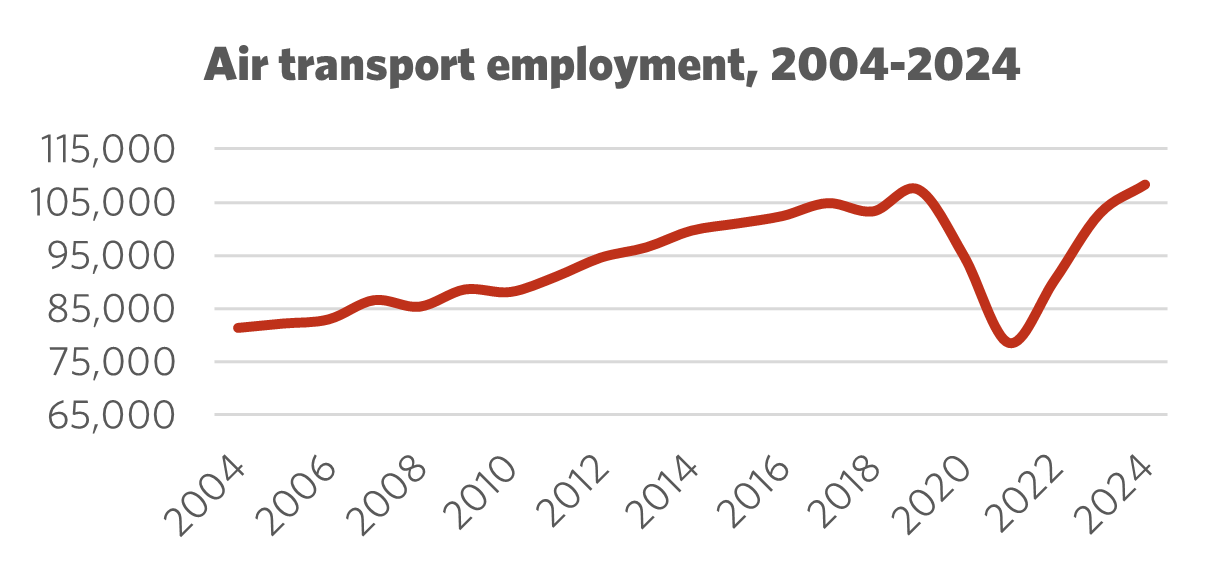

The air transportation sector has faced significant challenges over the past five years, including from COVID-19 pandemic lockdowns and travel restrictions, all resulting in major layoffs. But the sector has rebounded. By 2024, air passenger traffic, GDP generated by the industry, and employment levels had all recovered from the pandemic's losses. Air transportation is expected to grow substantially in the next decade, with Canada’s largest airports anticipating millions more flyers annually.

While this news is promising, the industry also faces headwinds. Trump’s trade war has notably influenced Canadians’ travel preferences, leading many to choose domestic and overseas destinations over trips to the United States. This shift has resulted in route changes that affect workers’ schedules and hours.

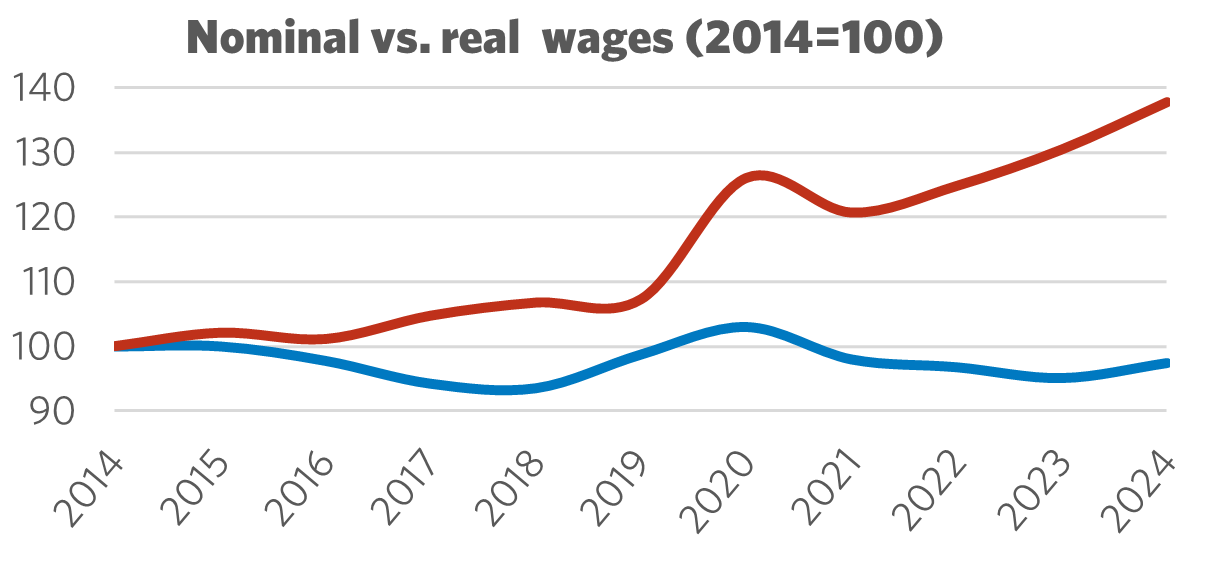

Moreover, the average wage for workers in the air transportation sector has not kept pace with inflation since 2019. Unifor members are experiencing increased harassment and frustration from customers, growing pressure from new technologies, and declining job quality due to an overreliance on overtime or erratic schedules.

Canada’s Air Passenger Protection Regulations are proving inadequate to address the poor treatment some passengers have faced from airlines, and there are not enough workers available to manage disruptions when they occur. Airline and airport employers have created a high-turnover environment that complicates the retention of new workers, putting additional pressure on existing staff who must work short-handed or spend time training new employees while also conducting their regular job.

In March 2025, the federal government clarified the rules governing airports to facilitate the privatization of services and facilities—a practice shown to diminish service quality and customer satisfaction. Meeting the upcoming demand in the industry will require a new approach.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Air Transport Industry

Preparing for anticipated increases in both foreign and domestic air travel requires the industry to address the ongoing chaos many travelers experience while transiting across Canada. Unifor’s Air Transportation Workers’ Charter of Rights and Freedoms outlines nine recommendations to enhance the industry’s ability to meet customer needs through exceptional service provided by respected and well-resourced aviation workers.

The industry must focus on attracting and retaining workers by ensuring that every job is a good job. This includes fair scheduling, competitive pay, and establishing a living wage as the minimum at every airport across the country. Workers should have a voice in any technological changes that affect them, and employers need to create harassment-free environments where passengers understand that inappropriate behavior has consequences. Fulfilling the Air Passenger Protection Regulations and providing a hassle-free travel experience requires more workers and improved job quality across all segments of the industry. However, the industry will not make these changes voluntarily; the federal government must take the lead and compel the industry and Canada’s airports to improve their practices.

The recent federal government statement clarifying rules for airport operations opens the door for further privatization and profit-driven practices. While the government aims to enhance service and build infrastructure, their approach is misguided. Research has shown that privatization undermines service quality and suppresses wages and working conditions. Unifor is committed to doing everything possible to prevent the further privatization of Canada’s airports.

Sector Development Recommendations

- Improve Job Quality: Government and Industry must take action to improve wages, implement fair scheduling practices, create harassment-free environments and more full-time jobs to attract and retain the workers the industry needs.

- Keep Airports Public: Airports need to carefully consider the risks of privatization. Unifor has consistently called on airport authorities to stop any activity to further privatize airport operations and has urged the federal government to reverse course on any such initiatives.

- End Contract Flipping: contract-flipping continues to be a widespread practice in the industry, reducing job security and increasing precarity, particularly for the industry’s most vulnerable workers.