Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $50.7 billion 2.6% |

| EMPLOYMENT | |

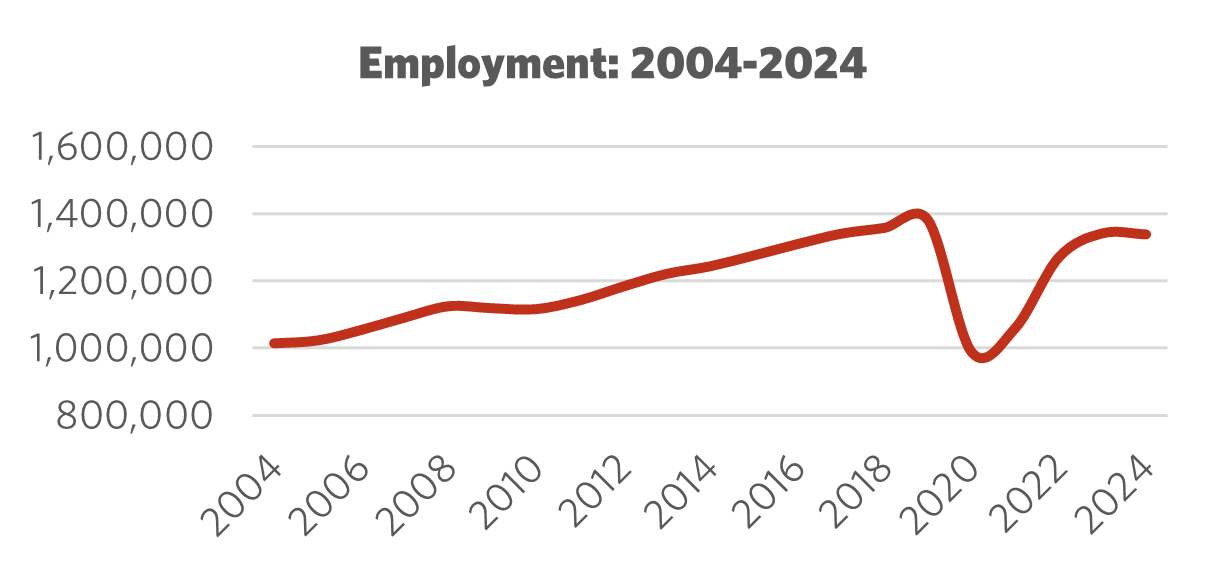

Total Employment 10-year change | 1,338,100 +7.6% |

| Percentage of part-time workers | 44.7% |

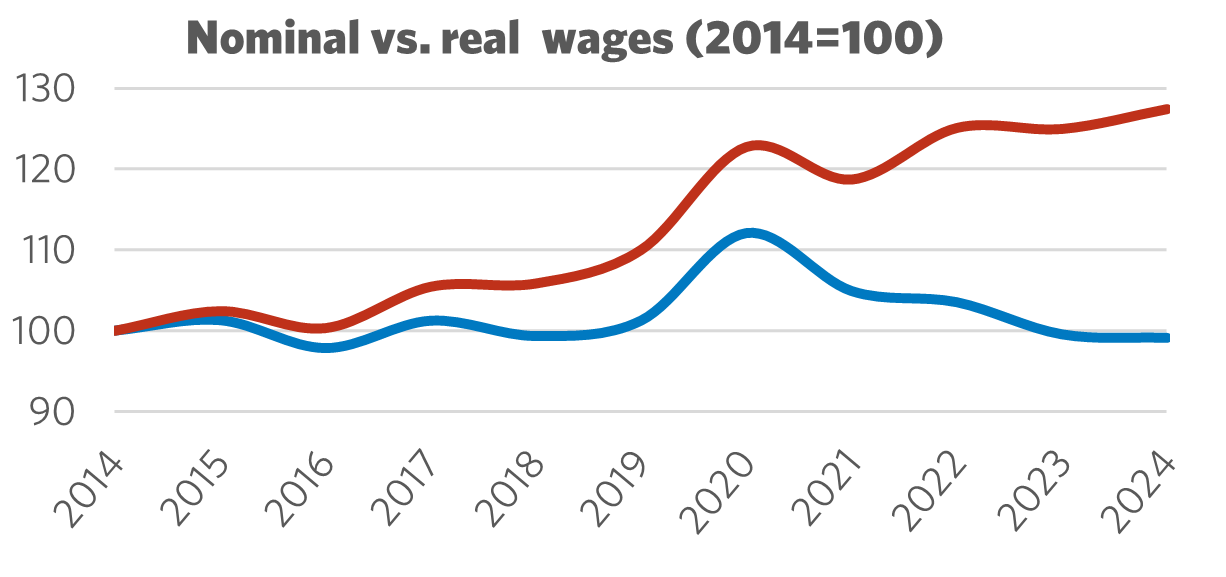

| Average hourly wage | $25.22/hr |

10-year real wage change | -0.9% |

| Average Work Hours/Week | 29.7 |

| ENVIRONMENT | |

Greenhouse Gas Emissions (2022) 10-year change Share of Canadian industry total | 1,970kt +18.7% 0.3% |

| LABOUR | |

| Union Coverage Rate | 6.9% |

| Unifor Members in the Industry | 18,500 |

| Share of Total Unifor Membership | 5.8%

|

| Number of Unifor Bargaining Units | 151 |

Unifor in the Hospitality and Gaming Industry

With 18,500 members from coast to coast, Unifor is the union of choice for hospitality and gaming workers in Canada. Within the sector, Unifor’s membership is divided into three segments: approximately 7,200 in accommodation (including hotels, motels, and resorts), 3,300 in restaurants and food services, and more than 8,000 in gaming (including casinos, racetracks, and other gaming services). Unifor’s gaming membership is concentrated in Ontario, British Columbia, and Manitoba, while hospitality members are located across the country, with the highest numbers in British Columbia and Ontario. The hospitality and gaming sector makes up about 7% of Unifor’s total membership.

More than half of Unifor hotel members work for two major chains: Fairmont and Marriott. With almost 2,500 members in 11 hotels and resorts from BC to Quebec, Fairmont is by far the largest single employer of Unifor members in the accommodation segment. With almost 1,500 members in 10 hotels, Unifor has a significant footprint with Marriott, one of the largest hotel companies in the world. Within the restaurant and food services segment, large employers include Compass, with 640 members working in different locations, and catering services at the University of Manitoba, where Unifor represents 380 members. Within the gaming segment – Unifor’s largest segment in the sector, with a smaller number of large workplaces and more ownership concentration – the three largest employers account for almost 80% of total membership. The largest Unifor-represented employers include Casino Rama, Caesars Windsor, Great Canadian Gaming, Gateway Casinos & Entertainment, and Manitoba Liquor & Lotteries. In Ontario, casinos are expanding to become resort-style operations with on-site hotels, and this will increase union membership and reinforce the need to integrate the gaming, accommodation, and restaurant & food service segments.

| Select Unifor Employers | Approx. # Members |

| Casino Rama | 1,600 |

| Caesar’s Windsor | 1,500 |

| Fairmont | 2,300 |

| Marriott | 1,500 |

| Compass | 640 |

| UManitoba catering services | 380 |

Current Conditions

The hospitality and gaming sector was among the hardest hit during the COVID-19 pandemic. During periods of quarantine, many workers were laid off as employers scaled back operations or temporarily closed altogether. Although it has been several years since the last period of quarantine, to curtail labour costs, many employers in the sector have brought back fewer staff than they had in place prior to the pandemic, resulting in workload issues for those employed in the sector.

In terms of union coverage and job quality, workers in the three segments – gaming, accommodation and food services – have vastly different experiences. In the gaming sector, approximately 30% of the overall workforce is unionized and their wages, benefits, and working conditions tend to be better than those of other workers in the broader sector. In the accommodation sector, approximately 17% of the workforce is unionized, although union density is significantly higher in urban centres and resort destinations. In this segment, job quality and working conditions vary widely, mostly depending on union status. At 3% union density, the restaurant & food service segment has the lowest union coverage rate and the lowest standards in terms of wages, benefits, and job quality.

Overall, the hospitality and gaming sector in Canada contributes $50.7 billion to the country's GDP, accounting for approximately 2.6% of total economic output, and employs more than 1.3 million people.

Figure 1: Employment 2004 – 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Hospitality and Gaming Industry

The hospitality and gaming sector faces numerous opportunities and challenges, ranging from sector-wide issues to segment-specific ones.

Online gaming (iGaming) poses a significant threat to casino workers. Online gaming operators, most of which are foreign-owned, are piggybacking on single-game sports betting sites, providing patrons with various online gaming options that previously only existed in traditional casinos. With aggressive marketing campaigns and relentless advertising, iGaming operators have diverted revenue and customers away from traditional brick-and-mortar casinos, threatening the job security of workers.

Technological change will affect all aspects of the sector, though each segment will feel the impacts differently. In the gaming segment, operators are experimenting with electronic table games to reduce labour costs. Artificial intelligence (AI) has the potential to displace workers in this sector, particularly in roles that are susceptible to automation. Furthermore, AI’s ability to optimize operations and personalize customer experiences can reduce the demand for human interaction in customer-facing roles. When negotiating in the sector, attention should be paid to bargaining language that mitigates against job loss due to AI initiatives being introduced in the workplace.

For the accommodation and restaurants segments, technological change includes increasing automation and labour-saving measures such as keyless check-in and device-driven self-ordering for guests. Request-only room refreshes, resulting in job cuts for hotel room attendants, is another labour-saving measure that is becoming more commonplace and must be addressed in bargaining.

In the gaming and food service segments, there is a shift away from full-service restaurants and cafeterias to more “grab-and-go” style service with fewer staff. Unionized workplaces have been more successful at resisting these efforts to de-staff the sector, and non-union workers are especially vulnerable.

For the accommodation segment, short-term rental (STR) platforms like Airbnb continue to pose a threat to the regulated hotel industry, while also undermining the long-term rental market for residents. The problem of grey market “ghost hotels,” where commercial operators buy up multiple units and offer them exclusively on STR platforms full-time, began primarily in urban centres but have over time expanded to resort towns and smaller cities/tourism destinations, which are beginning to experience the same negative impacts. These commercial STR operators compete unfairly with the regulated hotel industry, while also driving up rent and contributing to Canada’s housing crisis.

Unfortunately, the hospitality sector continues to be a purveyor of low-waged and generally low-quality jobs. Unifor has an opportunity to help create good jobs across the overall hospitality and gaming sector on three fronts: first, by organizing more workplaces, building union density and worker power; second, by increasing coordination across the country to bargain strong contracts that improve industry standards and working conditions; and third, by advocating for governments to improve labour laws and employment standards, including regarding wages, workload, scheduling, and a fairer process to join a union.

Sector Development Recommendations

- To protect workers in the gaming sector, unions should negotiate common expiration dates to build bargaining power (i.e., multiple sites, single-employer bargaining).

- Both government and labour should work to ensure that the trend of iGaming does not undermine employment, economic development, or government revenue streams.

- In the hospitality segment, contract standards and job quality need to be improved in terms of wages, benefits, workload, health & safety, and sub-contracting protections.

- The hospitality segment also requires continued efforts to negotiate sector-wide health and welfare benefit plans to smooth out the costs for smaller sites.

- Since technological change will continue to evolve and intensify across the entire sector, unions must use collective bargaining, labour law reform, training, and other means to mitigate employment impacts for workers.