Sector Facts and Figures

| Sector Facts and Figures | |

| OUTPUT | |

Sector GDP Share of Canadian GDP | $8.4 billion 0.42% |

| TRADE | |

| Exports | $21.6 billion |

| Imports | $21.1 billion |

| Export reliance | 69.1% |

| U.S. dependence | 43.9% |

| Foreign Trade Balance | $0.44 billion |

| EMPLOYMENT | |

Total Employment 10-year change | 47,400 +2.0% |

| Percentage of part-time workers | 2.7% |

| Average hourly wage | $47.19/hr |

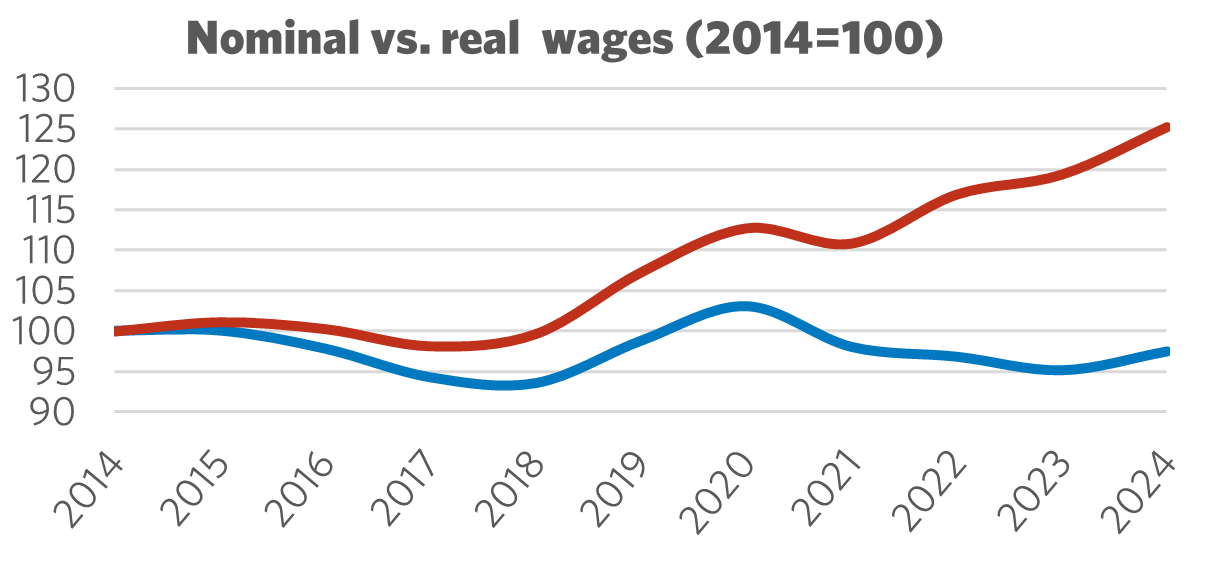

10-year real wage change | -2.5% |

| Average Work Hours/Week | 36.4 |

Unifor in the Aerospace Industry

Unifor’s 11,000 aerospace members design, build, and maintain commercial, military, and space aircraft in more than two dozen workplaces across the country.

From coast to coast, Unifor members in this sector are highly skilled and rigorously trained. They work as aerospace engineers, aircraft maintenance engineers, and aircraft assemblers. These professionals carefully construct complex precision parts, overhaul commercial and military aircraft, and design and manufacture simulators for pilot training, robotics for space exploration, and satellites for Earth monitoring and communications.

Unifor has 28 bargaining units at 25 employers, representing 3% of Unifor's overall membership. Union coverage in the industry is nearly 30%.

| SELECT UNIFOR EMPLOYER | APPROX. # MEMBERS |

| Bombardier Canada | 3,600 |

| Pratt & Whitney Canada | 2,300 |

| Boeing | 1,100 |

| C.A.E. | 580 |

| Cascade Aerospace | 450 |

Current Conditions

Canada’s aerospace industry is poised for growth, but this growth will largely depend on decisions made by federal and provincial governments to invest in Canadian-based companies, expand the aerospace workforce, and procure Canadian-made aerospace products and innovations.

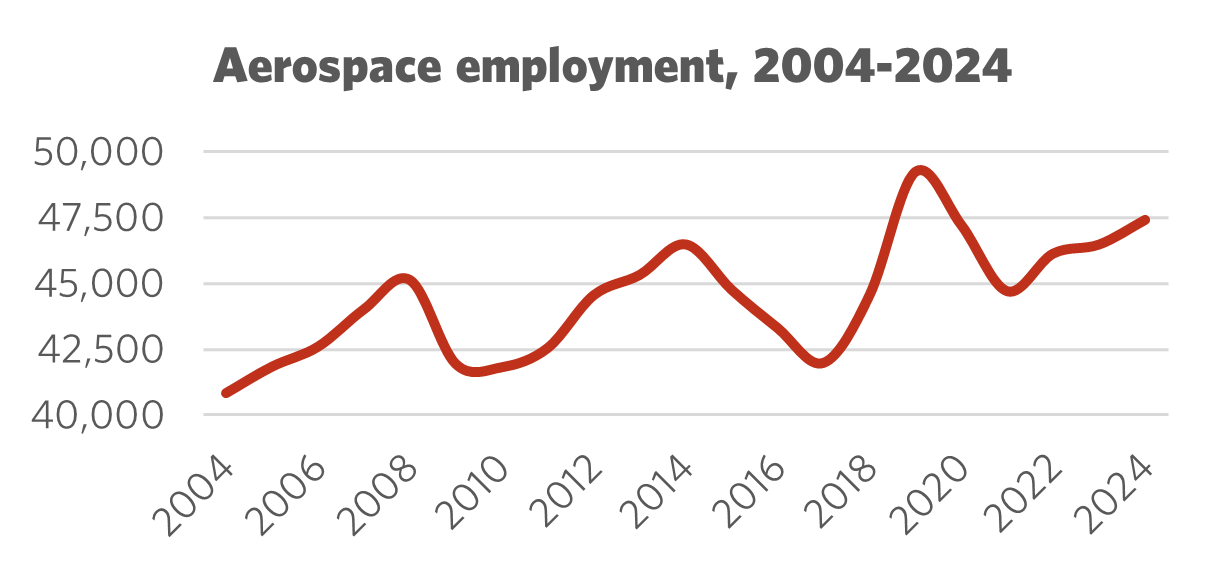

After a significant decline during the height of the COVID-19 pandemic, economic activity—including GDP, employment, and exports—has begun to recover. However, even three years later, the industry has not returned to its pre-pandemic peak. In 2024, the GDP generated by aerospace products and parts manufacturing was $8.4 billion—an increase from the 2020 low of $7.5 billion, but still well below the 2019 pre-pandemic level of $10.1 billion. Employment levels in 2024 were also nearly 2024 their 2019 figure. On a positive note, expenditures on research and development have rebounded.

The aerospace industry offers substantial economic benefits that must be nurtured and guided by public policy to ensure that these benefits reach the Canadian public. Some of the most compelling advantages include quality jobs, homegrown innovation, and strong export potential.

However, U.S. tariffs could further weaken Canada’s aerospace industry. While certain U.S. tariffs may exempt CUSMA-compliant products, tariffs have still dampened investment in the sector, as has the national security study on commercial jets, engines and parts.

At the same time, Canadian and European governments are engaging in important discussions about building the products and services needed to protect their sovereignty. Canada joining Europe’s defense procurement network could yield sizeable economic benefits for the domestic aerospace industry. Canada, along with its NATO partners, are committed to bolster defense spending over the coming decade, to levels unseen since the Second World War. This includes investments in research, development and production in the aerospace sector. The Canadian aerospace industry is uniquely positioned to meet this challenge.

Figure 1: Employment 2004 - 2024

Figure 2: Nominal vs. Real Wages (2014 = 100)

Moving Forward: Developing the Aerospace Industry

Globally, demand for civil, search and rescue, firefighting, and defense aircraft is growing rapidly. The space industry, which includes satellites in low-Earth orbit and space exploration technology, is expected to see significant growth in the next decade. Research and development (R&D) focused on new technologies to reduce emissions and address the next generation of aerospace challenges is already underway.

Canada has all the necessary ingredients to grow its aerospace industry to meet global demand, but these resources must be harnessed and intentionally directed. Unifor’s comprehensive Aerospace Policy, Building for the Next Generation: A Workers’ Strategy for Canada’s Aerospace Industry, identifies four pillars that government, industry, and labour must collaborate on to expand the industry, create good jobs, and foster economic development while protecting Canada’s sovereignty.

Canada must develop an industrial strategy for the sector led by a multi-stakeholder development council. This council should create a comprehensive plan to retain the current workforce while attracting the next generation of workers to the industry. Key activities should include flexible funding with longer timelines for educational institutions, improvements to wages and working conditions, and meaningful dialogue about technological change.

Government must also utilize Canadian procurement solutions to strengthen the industry and invest in the aerospace ecosystem through targeted funding and strategic partnerships, while establishing a diverse, scalable and flexible funding program. This will empower Canadian companies to meet government demand and ensure economic benefits are delivered to Canada’s workers.

Sector Development Recommendations

- Negotiate a permanent end to U.S. tariffs.

- Formulate a national aerospace industrial strategy, led by a multi-sector aerospace development council.

- Implement Made-in-Canada government procurement policies, ensuring more Canadian content and innovation.

- Develop a two-pronged approach to workforce development and retention, by improving job quality to retain current workers and a plan to attract the next generation of talent.