Share

We’ve all been hearing a lot about the size of Canada’s federal deficit lately.

Last month National Bank reported that Canada’s deficit has grown larger than any other country in the G-20.

That same month CBC ran the headline “Keep Calm and Borrow On” citing Finance Minister Chrystia Freeland’s recent speeches about the government’s plan to support people through the COVID-19 crisis and wait to set a fiscal anchor until a later date.

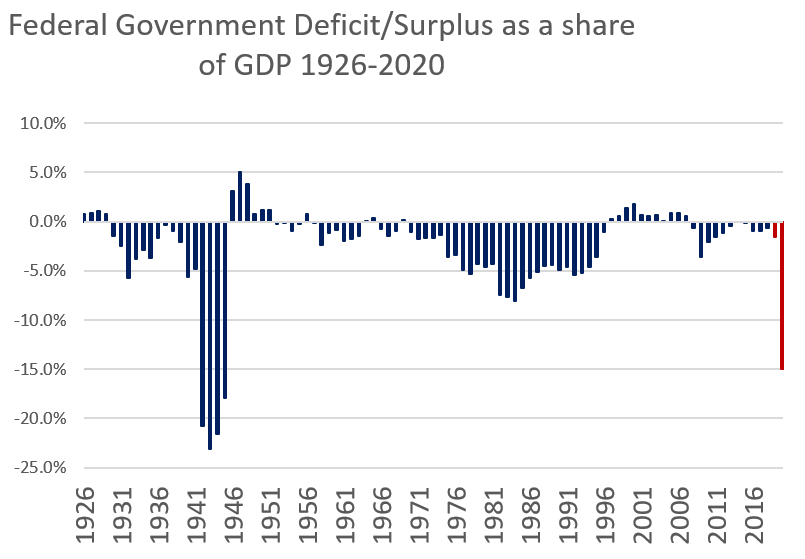

All of the talk about unprecedented government spending got me curious about whether or not the claim is true—has the federal government ever gone into a larger deficit than they have this year? Turns out the answer is yes.

The chart below illustrates the point. For the four years surrounding World War II, the federal deficit reached between 18 and 23% of GDP.

Source: Author’s calculations with data from Historical Statistics of Canada, Federal Government Finance Series; Department of Finance Fiscal Reference Tables; Parliamentary Budget Office.

So far, the Parliamentary Budget Office is predicting this year’s deficit to measure around 15% of GDP, smaller than in World War II. Instead of collapsing in the years that followed the war, the Canadian economy and the people working and living in it thrived.

We are experiencing a moment that requires extraordinary effort from all of us, government included. History teaches us that we need not fear a deficit during unprecedented crises. The COVID-19 economic measures—CRB, CERB, CEWS, LEEFF, CEBA, Safe Restart Funding, long-awaited and forthcoming industry support packages, tax waivers, tax deferrals, loan guarantees, business rent subsidies, lay-off extensions and more—have all played a vital role in sustaining individuals and businesses while protecting public health and preventing even further economic collapse.

Even once the fiscal year is over and the size of the deficit is officially measured, big questions will remain.

In its October 2020 Monetary Policy Report, The Bank of Canada predicts Canadian economy is unlikely to recover to the level of GDP measured in 2019 before 2022. Even then, several industries will have seen structural changes.

Thousands of workers will have permanently lost their jobs and will have (or need to) transition to new employment. Some industries will bounce back quickly (some are even creating more output and jobs than they were at the beginning of the year) while others will remain depressed for years to come. Industries such as air travel and tourism may be changed forever.

In the medium term, government should focus on reducing the relative size of the debt compared to GDP by growing the economy. In the type of economic environment we are in now where monetary policy can do very little to further boost economic activity, how should government step in? By spending money on public programs and public infrastructure.

In June, Unifor released our plan for a Fair, Inclusive and Resilient Economic Recovery. That plan recommends government continue to run large deficits in the near future in order to build an improved foundation for economic growth moving forward.

We are in a long game right now, not a short one. Pull back too quickly and we end up in a drawn out crisis. Pull back a little late and we end up with stronger public infrastructure and more, higher quality jobs and a slightly higher debt-to-GDP ratio.

If you are worried about the size of government spending right now or have questions, visit our recently released myth-busting guide to talking about debt and deficit.

Using the word unprecedented to describe all we’ve experienced in 2020 often feels like an understatement. However, when it comes to federal government spending, it turns out unprecedented is an overstatement.